Bitcoin’s Rollercoaster: Navigating US Uncertainty and the Looming Short Squeeze

The cryptocurrency market was recently gripped by widespread panic as Bitcoin (BTC) plummeted below the $100,000 mark. A consensus quickly emerged among media outlets and financial analysts: the primary catalyst was the ongoing US government shutdown. This domestic political turmoil rippled across financial sectors, impacting not only the crypto space but also the broader US stock market. In response, President Trump voiced his urgency for a swift resolution, prompting internal Republican discussions aimed at ending the impasse, with speculation suggesting a resolution could be sought within the week. Amidst this backdrop of uncertainty, a glimmer of positive news emerged yesterday with the release of the “small non-farm” employment data, which indicated a healthier-than-anticipated private sector job market. This unexpected positive economic indicator played a crucial role in fueling yesterday’s modest market rebound.

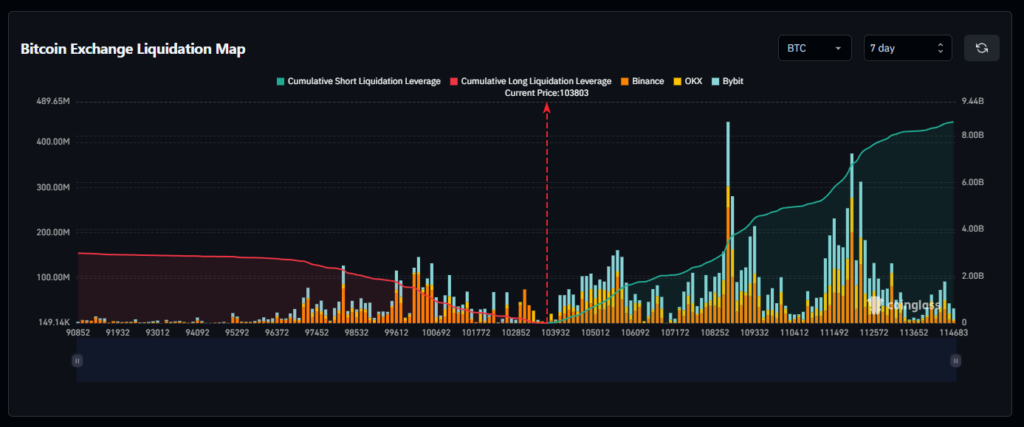

Deep Dive into the Liquidation Landscape: A Brewing Short Squeeze?

Turning our attention to the liquidation map provides a fascinating insight into current market sentiment. Given the extremely low liquidity on the 1-day chart – a direct consequence of widespread liquidations deterring new positions – we extended our analysis to cover the past week’s trading activity. The data clearly reveals a significant accumulation of short positions. This aggressive bearish sentiment is understandable, reflecting recent market trends and prevailing anxieties. However, this high concentration of shorts presents a compelling scenario: should BTC manage to ascend to $108,600, it could trigger the liquidation of nearly $3 billion in short positions. This staggering potential for a short squeeze highlights the market’s fragile balance. Concurrently, we observe a noticeable reduction in long positions, suggesting a cautious approach from bullish investors. Therefore, any positive developments from the US could ignite a far more substantial market rally than currently anticipated.

Navigating the Treacherous Waters of US Policy and Regulatory Hurdles

Despite the potential for a rebound, the path forward remains fraught with significant uncertainties stemming from the US. While progress towards resolving the government shutdown appears to be underway, the precise timeline and the ultimate form of its resolution are still unknown. Adding another layer of complexity, the US Supreme Court’s deliberation on the legality of President Trump’s tariff policies has introduced new variables. A ruling against the tariffs’ legality could compel Trump to seek alternative avenues for implementing trade duties, further unsettling global markets. Furthermore, the performance of both Bitcoin (BTC) and Ethereum (ETH) spot Exchange Traded Funds (ETFs) has been less than stellar, dampening investor enthusiasm. While the current market phase might be characterized as an oversold rebound, investors are strongly advised to remain vigilant and strategically adjust their positions based on evolving developments in the US political and regulatory landscape.

Disclaimer: This article is intended solely to provide market information. All content and views expressed herein are for reference purposes only and do not constitute investment advice. They do not necessarily reflect the views or positions of BlockTempo. Investors are solely responsible for their own decisions and transactions. The author and BlockTempo shall not be held liable for any direct or indirect losses incurred by investors as a result of their transactions.