By Ryan Watkins

Translated by TechFlow

The Crypto Economy’s Pivotal Transformation: From Speculation to Sustainable Value

The year is 2026, and the crypto economy stands at the precipice of its most profound transformation in eight years. We are witnessing a remarkable “soft landing” from the speculative excesses of 2021, giving way to a new era where valuations are increasingly anchored in tangible cash flow and real-world utility.

The painful journey of the past four years, often described through the lens of the “Red Queen Effect,” has forged a more resilient and mature ecosystem. With the easing of U.S. regulatory uncertainty and a burgeoning wave of enterprise-level adoption, digital assets are shedding their cyclical, speculative nature to embrace long-term, secular growth.

Amidst a global crisis of trust and pervasive currency debasement, this is more than just an industry recovery; it signifies the rise of a parallel financial system. For Web3 investors, this moment represents not merely a re-evaluation of beliefs, but an underestimated, cross-cycle entry opportunity into a fundamentally reshaped landscape.

Key Insights into Crypto’s New Dawn:

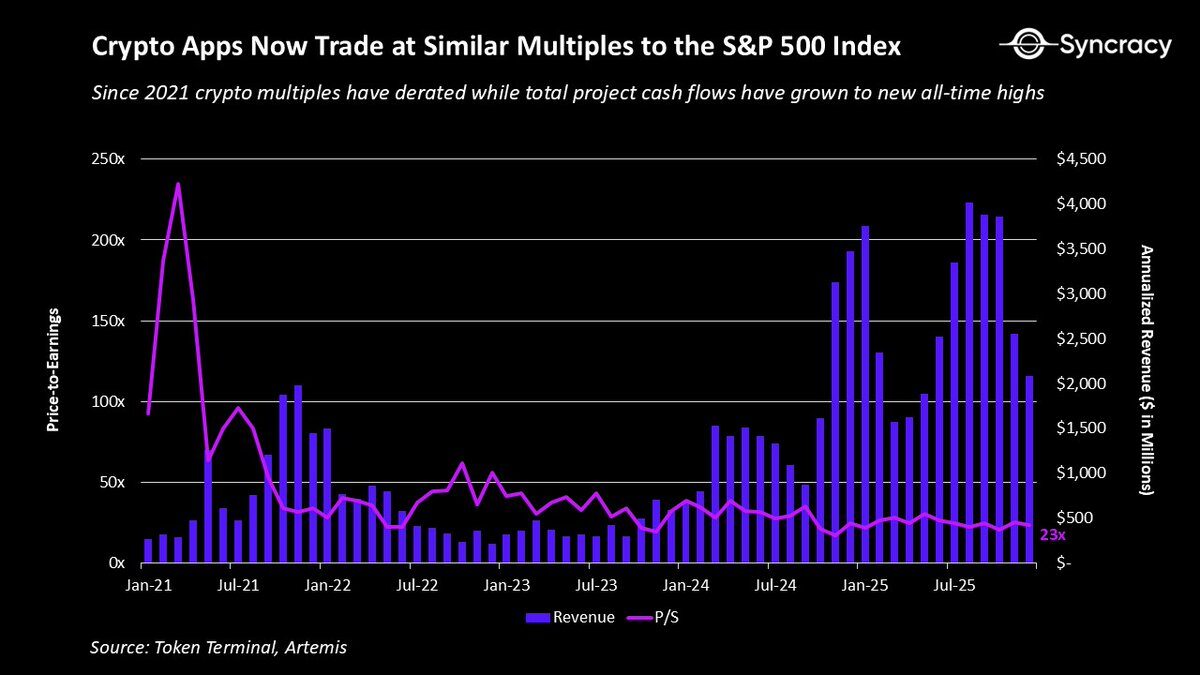

- The asset class significantly over-indexed on expectations in 2021; valuations have since undergone a rational correction, with quality assets now priced more reasonably.

- A more favorable U.S. regulatory environment is finally addressing critical issues of token alignment and value capture, enhancing the investment appeal of digital assets.

- The crypto economy’s growth trajectory is shifting from cyclical volatility to sustained, long-term secular trends, demonstrating valuable use cases extending far beyond Bitcoin.

- Leading blockchains are solidifying their status as the foundational standard for both burgeoning startups and established enterprises, becoming vibrant hubs for some of the world’s fastest-growing businesses.

- Following a grueling four-year altcoin bear market, market sentiment has bottomed out, leaving multi-year opportunities in top-tier projects fundamentally mispriced, with few analysts modeling for exponential growth.

- While premier projects are poised to thrive in this next era of the crypto economy, increased pressure to deliver and intensifying competition from traditional enterprises will inevitably weed out weaker participants.

- There is no force more powerful than an idea whose time has come, and the crypto economy has never felt more unstoppable.

In my eight years within this industry, the crypto economy is undergoing the most significant transformation I have ever witnessed. Institutions are steadily accumulating positions, while pioneering cypherpunks are diversifying their wealth. Enterprises are laying the groundwork for S-curve growth, even as disillusioned native developers exit the scene. Governments are actively steering global financial transformation onto blockchain rails, while short-term traders remain fixated on chart lines. Emerging markets are celebrating financial democratization, contrasting with U.S. cynics who dismiss it as merely a casino game.

Recently, much has been written comparing today’s crypto economy to historical periods. Optimists draw parallels to the post-dot-com bubble era, suggesting the industry’s speculative phase has passed, and long-term winners like Google and Amazon will emerge to climb their S-curves. Pessimists liken it to certain emerging markets of the 2010s, implying that weak investor protection and a scarcity of long-term capital could lead to underperforming asset prices, even as the underlying industry flourishes.

Both perspectives hold merit. After all, history, alongside experience, remains an investor’s most reliable guide. However, analogies offer limited insight. We must also understand the crypto economy within its unique macroeconomic and technological context. The market is not a monolith; it comprises diverse narratives and participants, interconnected yet distinct.

Here is my assessment of where we’ve been and where we’re headed.

The Red Queen’s Cycle: Running to Stay in Place

“Now, here, you see, it takes all the running you can do, to keep in the same place. If you want to get somewhere else, you must run at least twice as fast as that!”

— Lewis Carroll

In many respects, expectations are the sole determinant in financial markets. Exceed expectations, and prices rise; fall short, and they decline. Over time, expectations oscillate like a pendulum, often inversely correlated with future returns.

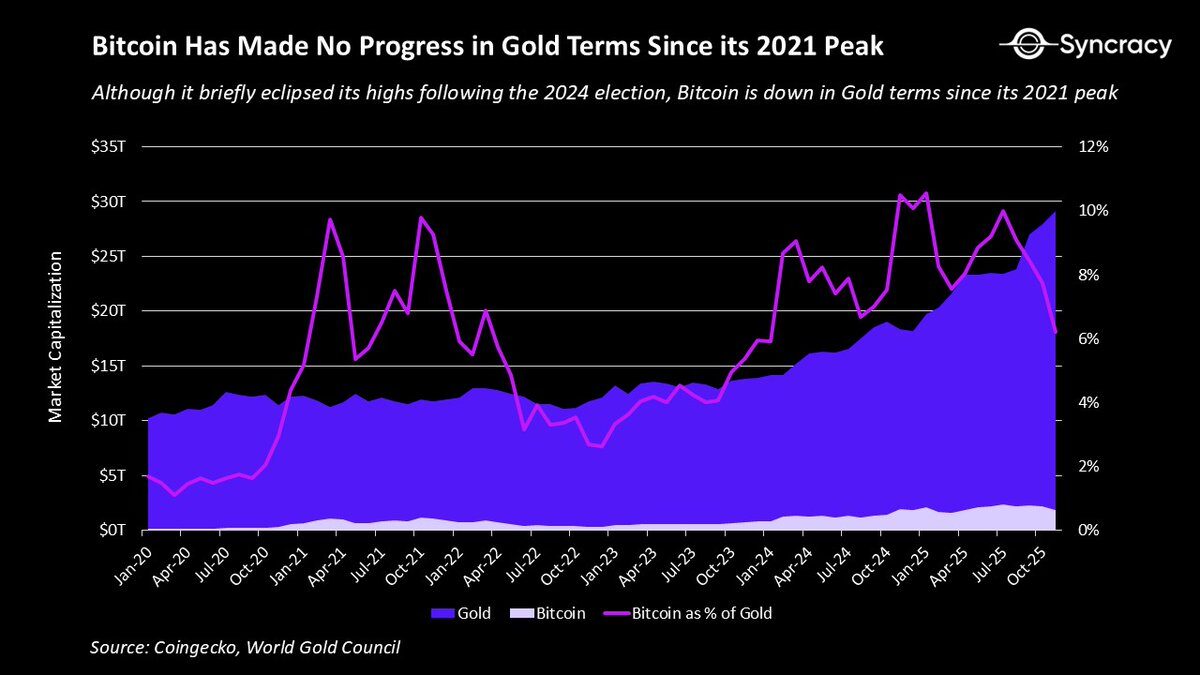

In 2021, the crypto economy overshot expectations to a degree most still struggle to comprehend. Some excesses were blatant: DeFi blue-chips trading at 500x price-to-sales multiples, or eight smart contract platforms valued over $100 billion. Not to mention the metaverse and NFT frenzy. Yet, the most sobering reflection of this overheating is the Bitcoin/Gold ratio.

Despite significant advancements, Bitcoin’s price against gold has not surpassed its 2021 peak and, in fact, remains lower. Who would have anticipated that, in what Trump dubbed the global crypto capital, following the most successful ETF launch in history, and amidst systemic U.S. dollar debasement, Bitcoin’s success as digital gold would be less pronounced than four years ago?

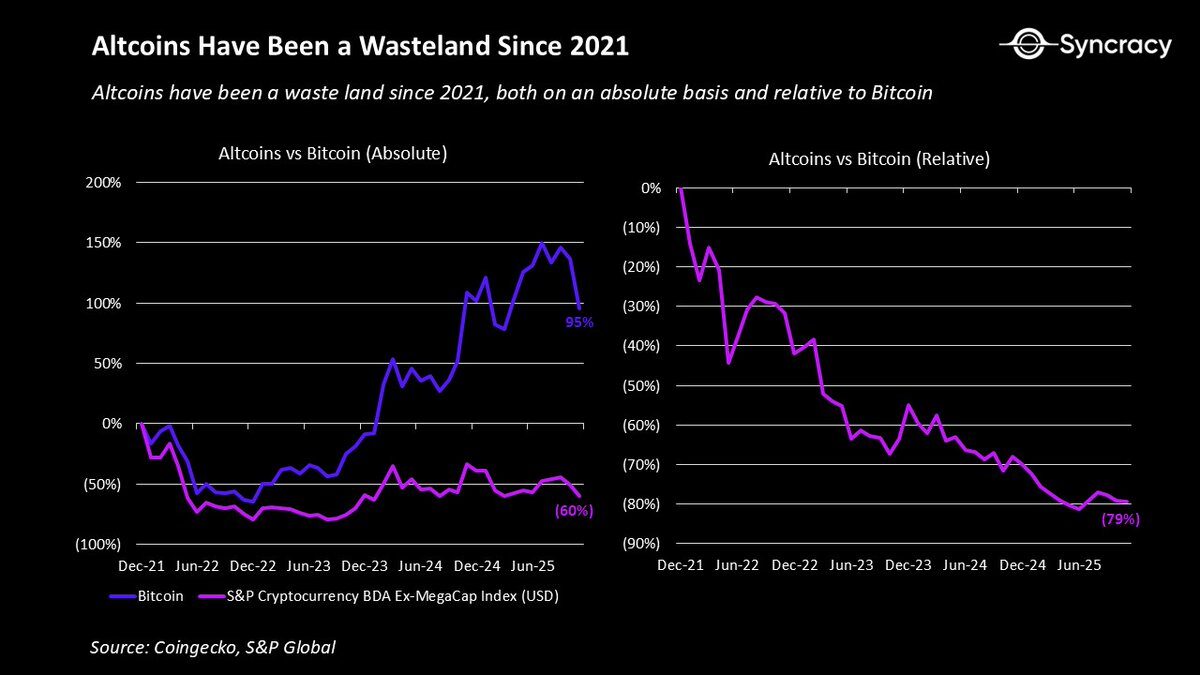

For other assets, the situation was far grimmer. Most projects entered this cycle burdened by a host of structural issues that exacerbated the challenge of managing extreme expectations:

- Most projects’ revenue streams were cyclical, contingent on perpetually rising asset prices.

- Regulatory uncertainty severely hampered institutional and enterprise participation.

- Dual ownership structures led to a fundamental misalignment of interests between equity insiders and public market token investors.

- A lack of clear disclosure standards created information asymmetry between project teams and their communities.

- The absence of a shared valuation framework resulted in excessive volatility and a lack of fundamental price floors.

This confluence of issues led to a sustained “bleeding” for most tokens, with only a handful even approaching their 2021 highs. The psychological toll was immense, as few experiences are more disheartening than continuous effort yielding no reward.

This disappointment was particularly acute for speculators and opportunists who viewed crypto as the path of least resistance to wealth. Over time, this struggle has ignited widespread burnout across the industry.

Crucially, this has been a healthy development. Mediocre efforts should not, as they once did, consistently generate extraordinary returns. The pre-2022 era, where “vaporware” could create immense fortunes, was clearly unsustainable.

The silver lining in all this is that the aforementioned problems are now widely understood, and prices have adjusted to reflect these new expectations. Today, beyond Bitcoin, few crypto-native individuals are willing to discuss any long-term fundamental thesis. After four years of painful correction, the asset class now possesses the necessary ingredients to surprise the market once again.

The Enlightened Crypto Economy: Building for Real Value

As noted, the crypto economy entered this cycle with numerous structural vulnerabilities. The good news is that these issues are now universally recognized, and many are steadily becoming relics of the past.

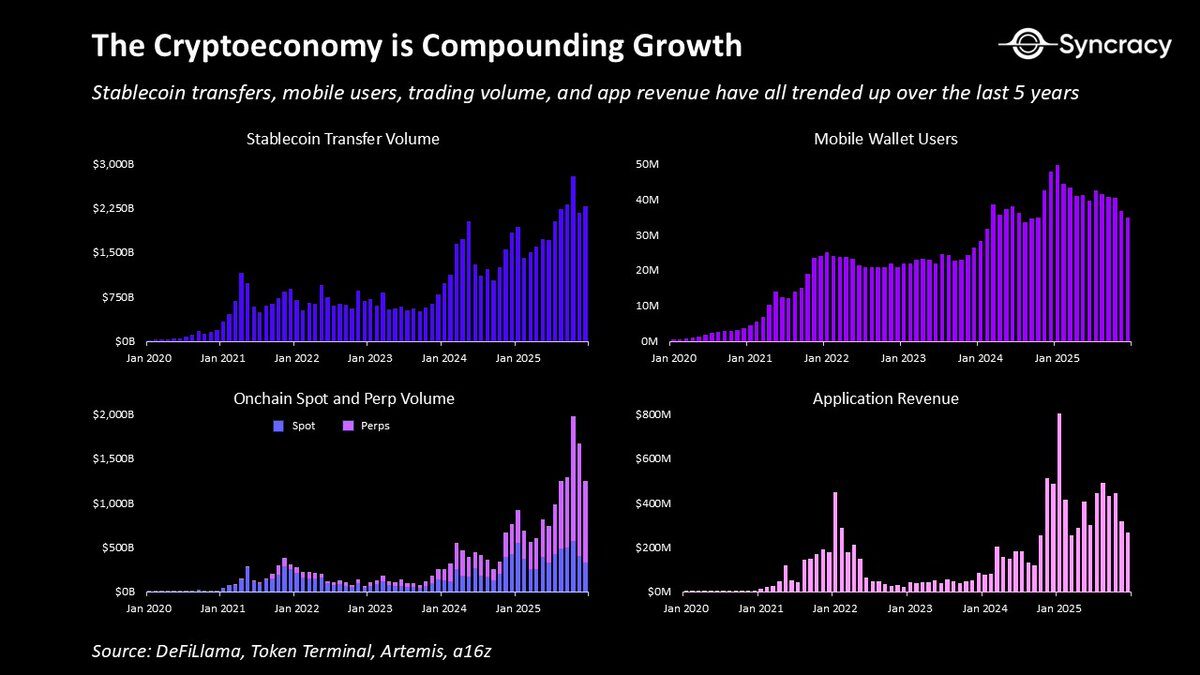

Firstly, beyond digital gold, a multitude of use cases are now exhibiting compound growth, with many more in transition. Over the past few years, the crypto economy has delivered:

- Peer-to-peer network platforms: Empowering users to transact and execute contractual relationships without governmental or corporate intermediaries.

- Digital dollars: Storable and transferable anywhere on Earth with internet access, providing cheap and reliable money for billions.

- Permissionless exchanges: Enabling anyone, anywhere, to trade top global assets across any asset class, 24/7, in transparent venues.

- Novel derivative instruments: Such as event contracts and perpetual swaps, offering valuable predictive insights and more efficient price discovery to society.

- Global collateral markets: Allowing users to access credit permissionlessly through transparent, automated infrastructure, substantially reducing counterparty risk.

- Democratized asset creation platforms: Empowering individuals and institutions to issue publicly tradable assets at minimal cost.

- Open financing platforms: Enabling anyone in the world to raise capital for their businesses, overcoming local economic limitations.

- Physical infrastructure networks (DePIN): Distributing operations to independent operators through crowdsourced capital, creating more scalable and resilient infrastructure.

This is by no means an exhaustive list of all the valuable use cases built by the industry to date. The critical takeaway is that many of these are demonstrating real value and are continuing to grow, regardless of crypto asset price movements.

Concurrently, dual equity-token models are being rectified as regulatory pressures ease and founders increasingly recognize the cost of misalignment. Many existing projects are merging assets and revenue into a single token, while others are clearly delineating on-chain revenue for token holders and off-chain revenue for equity holders. Furthermore, disclosure practices are improving with the maturation of third-party data providers, reducing information asymmetry and enabling better analysis.

Simultaneously, a growing consensus has emerged around a simple, time-tested principle: with the rare exception of store-of-value assets like Bitcoin (BTC) and Ethereum (ETH), 99.9% of assets need to generate cash flows. As more fundamentally-driven investors enter the asset class, these frameworks will only be further reinforced, leading to increased rationality.

Indeed, given enough time, the concept of “autonomous sovereign ownership of on-chain cash flow” may be understood as a paradigm unlock on par with “autonomous sovereign digital store of value.” After all, when else in history could you hold a digital bearer asset that autonomously pays you from anywhere on Earth whenever its program is utilized?

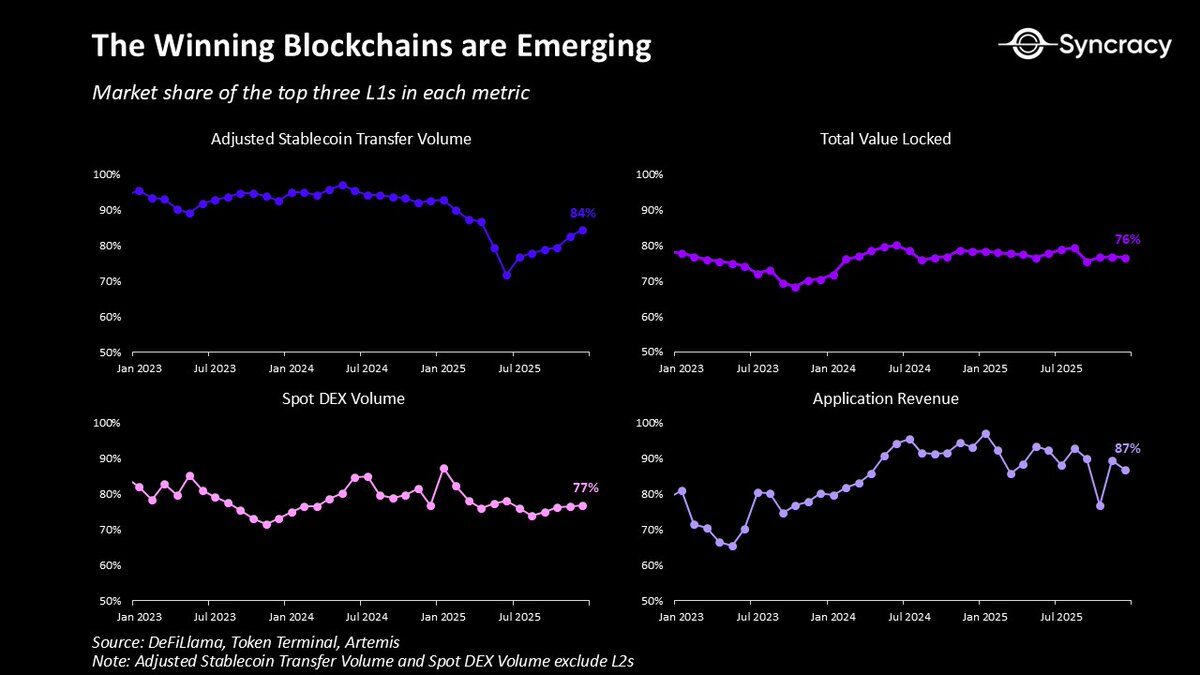

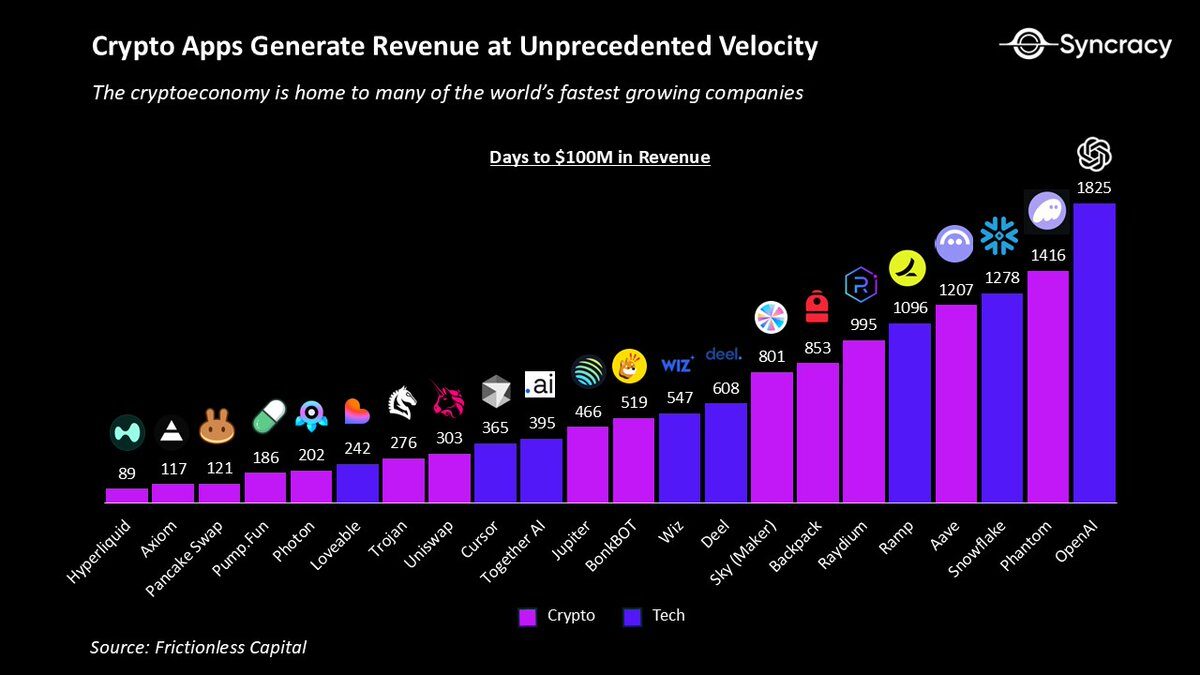

Against this backdrop, the winning blockchains are increasingly solidifying their position as the monetary and financial bedrock of the internet. Over time, Ethereum, Solana, and Hyperliquid are experiencing burgeoning network effects, fueled by their expanding ecosystems of assets, applications, businesses, and users. Their permissionless design and global distribution enable applications built on their platforms to become some of the fastest-growing businesses in the world, boasting unparalleled capital efficiency and revenue velocity. In the long run, these platforms are highly likely to underpin the entire total addressable market (TAM) of financial superapps—a domain currently contested by nearly every leading fintech company.

It is no surprise, then, that giants on Wall Street and in Silicon Valley are accelerating their blockchain initiatives at full throttle. Each week brings a fresh wave of product announcements, spanning everything from tokenization to stablecoins and everything in between.

Crucially, unlike previous eras of the crypto economy, these efforts are not mere experiments but production-grade offerings, predominantly built on public blockchains rather than isolated, private systems.

These activities are set to accelerate further as the lagging effects of regulatory changes continue to permeate the system in the coming quarters. With enhanced clarity, enterprises and institutions can finally shift their focus from “Is this legal?” to how blockchain can expand revenue opportunities, reduce costs, and unlock entirely new business models.

Perhaps one of the most telling indicators of the current state is how few industry analysts are modeling for exponential growth. Anecdotally, many of my sell-side and buy-side peers hesitate to even consider annual growth rates above 20%, fearing they might appear overly optimistic.

After four years of pain and a reset in valuations, it is now imperative to ask ourselves: What if it does achieve exponential growth? What if “daring to dream” yields rewards once again?

The Twilight Hour: An Idea Whose Time Has Come

“A candle casts a shadow.”

— Ursula LeGuin

On a crisp autumn day in 2018, before another weary day of investment banking, I walked into an old professor’s office to discuss all things blockchain. As I sat down, he recounted a conversation with a skeptical equity hedge fund manager who claimed crypto was entering a nuclear winter, a “solution in search of a problem.”

After a crash course on unsustainable sovereign debt burdens and the crumbling trust in institutions, he finally told me how he countered the skeptic: “Ten years from now, the world will thank us for building this parallel system.”

While we are not yet a decade out, his prediction appears remarkably prescient, as crypto increasingly feels like an idea whose time has truly come.

In a similar spirit, and the core thesis of this article, is the assertion that the world continues to underestimate what is being built here. Most relevant for us as investors is that the multi-year opportunities in leading projects are profoundly undervalued.

This last part is critical, because while crypto may be unstoppable, your favorite token might indeed be heading to zero. The flip side of crypto becoming unstoppable is that it is attracting far more intense competition, and the pressure to deliver has never been greater. As I mentioned, with institutions and enterprises entering, they are likely to clear out many weaker players. This isn’t to say they will win everything and co-opt the technology, but it does mean only a select few native players will emerge as the big winners around which the world reorients itself.

The point here is not to be cynical. In all nascent technology sectors, 90% of startups fail. The coming years may see more public failures, but this should not distract you from the bigger picture.

Perhaps no technology aligns more perfectly with the current global Zeitgeist than crypto: declining trust in institutions across developed societies, unsustainable government spending in G7 nations, blatant currency debasement by the world’s largest fiat issuers, the deglobalization and fragmentation of the international order, and a growing yearning for a fairer new system than the old. As software continues to eat the world, AI emerges as the latest accelerator, and younger generations inherit wealth from an aging baby boomer cohort, there has never been a better time for the crypto economy to break out of its own bubble.

While many analysts frame this moment using classic frameworks like the Gartner Hype Cycle and Carlota Perez’s “Post-frenzy” stage, implying that the best returns are behind us and a more mundane tooling phase lies ahead, the reality is far more intriguing.

The crypto economy is not a single, uniformly mature market, but rather a collection of products and businesses residing on different adoption curves. More importantly, speculation does not vanish when a technology enters its growth phase; it merely ebbs and flows with sentiment and the pace of innovation. Anyone telling you the age of speculation is over is likely just tired, or simply doesn’t understand history.

It is reasonable to be skeptical, but do not be cynical. We are reimagining how money, finance, and our most crucial economic institutions are governed. This endeavor should be challenging, but equally fun and exhilarating.

Your task now is to figure out how best to leverage this unfolding reality, rather than writing endless tweet threads arguing why it’s all doomed to fail.

For those willing to bet on the dawn of a new era, rather than mourn the sunset of the old, an opportunity of a lifetime awaits, cutting through the fog of disillusionment and uncertainty.