By Wenser, Odaily Planet Daily

The ‘Poor Man’s Gold’ No More: Silver’s Explosive Rally and the Dawn of Digital Investment Avenues

Silver, the precious metal once affectionately known as “poor man’s gold,” is currently captivating global markets with an astonishing surge. Its meteoric rise is nothing short of remarkable, redefining its status in the investment landscape.

Recently, silver prices momentarily breached an all-time high of $117 per ounce. This monumental achievement means that since the peak of the 2017 crypto cycle, silver has delivered an astounding cumulative gain of approximately 517%, officially surpassing Bitcoin’s rise (around 500%) and significantly outperforming gold (just under 300%). According to data from 8marketcap, silver currently trades around $110, boasting a colossal market capitalization of $6.18 trillion, making it the second-largest global asset, trailing only gold. This incredible performance has naturally ignited fervent interest across the market. Beyond traditional avenues like silver funds or physical silver purchases via brokers and offline stores, tokenized silver is emerging as a compelling alternative, particularly through leveraged contracts on trading platforms and on-chain Perp DEX platforms.

The Landscape of Tokenized Silver: Two Key Players with Notable Liquidity

The tokenized silver sector, as reported by Coingecko, holds an approximate total market capitalization of $446 million, experiencing a 24-hour increase of about 5.6%. Within this nascent but growing market, two specific silver tokens stand out for their relatively robust liquidity:

Kinesis Silver (KAG): Market Cap Approximately $406 Million

Much like its gold counterpart, KAU, the KAG silver token is a product of Kinesis, a UK digital asset utility platform registered in the Cayman Islands. It is primarily traded on platforms such as Kinesis Money, BitMart, and the UAE-based Emirex.

- Collateralization: KAG is backed by fully insured and regularly audited vaults, with storage distributed globally. Each token is pegged to 1 ounce of investment-grade silver.

- Utility: It supports global real-time payments, allows for physical silver redemption, and notably, incurs no storage fees.

- Potential Risks: Similar to Tether’s XAUT gold token, KAG’s stability is heavily reliant on the issuer’s asset credibility, coupled with inherent regulatory uncertainties. Furthermore, its relatively smaller market capitalization can lead to moderate market depth, making it susceptible to volatility that may cause premiums or discounts. Its efficiency also depends significantly on how trading platforms manage order matching.

Despite these considerations, Coingecko data indicates KAG’s 24-hour trading volume is approximately $5.5 million, positioning it as the second most actively traded silver token in the market.

iShares Silver Trust (SLV): Market Cap Approximately $39.5 Million

Launched by Ondo Finance, this tokenized silver asset is pegged to the iShares Silver Trust and holds corresponding physical silver through BlackRock’s iShares Silver Trust (SLV) ETF.

- Advantages: It tracks a regulated, traditional SLV ETF, offering good liquidity and supporting instant minting or redemption for non-US users. This token seamlessly blends traditional finance with blockchain convenience, benefits from institutional-grade endorsement, and eliminates the need for investors to directly handle physical silver.

- Potential Risks: Its primary dependency lies in the asset credibility of issuers like BlackRock and Ondo. It does not confer direct physical silver ownership or redemption rights. Investors also incur certain ETF fund management fees. Trading for US users is restricted, and the token faces potential securities regulatory limitations.

The Ondo Finance tokenized SLV, often referred to as SLVON for trading purposes, is available on major centralized exchanges including Gate, Bitmart, Bitget, and AscendEX. Notably, SLVON also supports contract trading with leverage up to 10x. Coingecko data reveals SLVON’s 24-hour trading volume is approximately $21.2 million, making it the highest-volume silver token in the market.

Beyond KAG and SLVON, other silver tokens, such as Silver rStock (SLVR) from Solana ecosystem tokenization platform Remora Market and offerings from Token Teknoloji A.Ş, often exhibit significant price discrepancies with physical silver and are generally not recommended for trading.

Leveraged Silver Trading Platforms: Hyperliquid, Binance, Bitget, and More

In addition to spot tokenized silver, a diverse array of platforms—including US stock tokenization platforms, on-chain Perp DEXs, CEXs, and DEXs—have opened doors to silver-related leveraged contract trading, offering leverage ranging from 20x to an impressive 100x. Here are some prominent platforms for your reference:

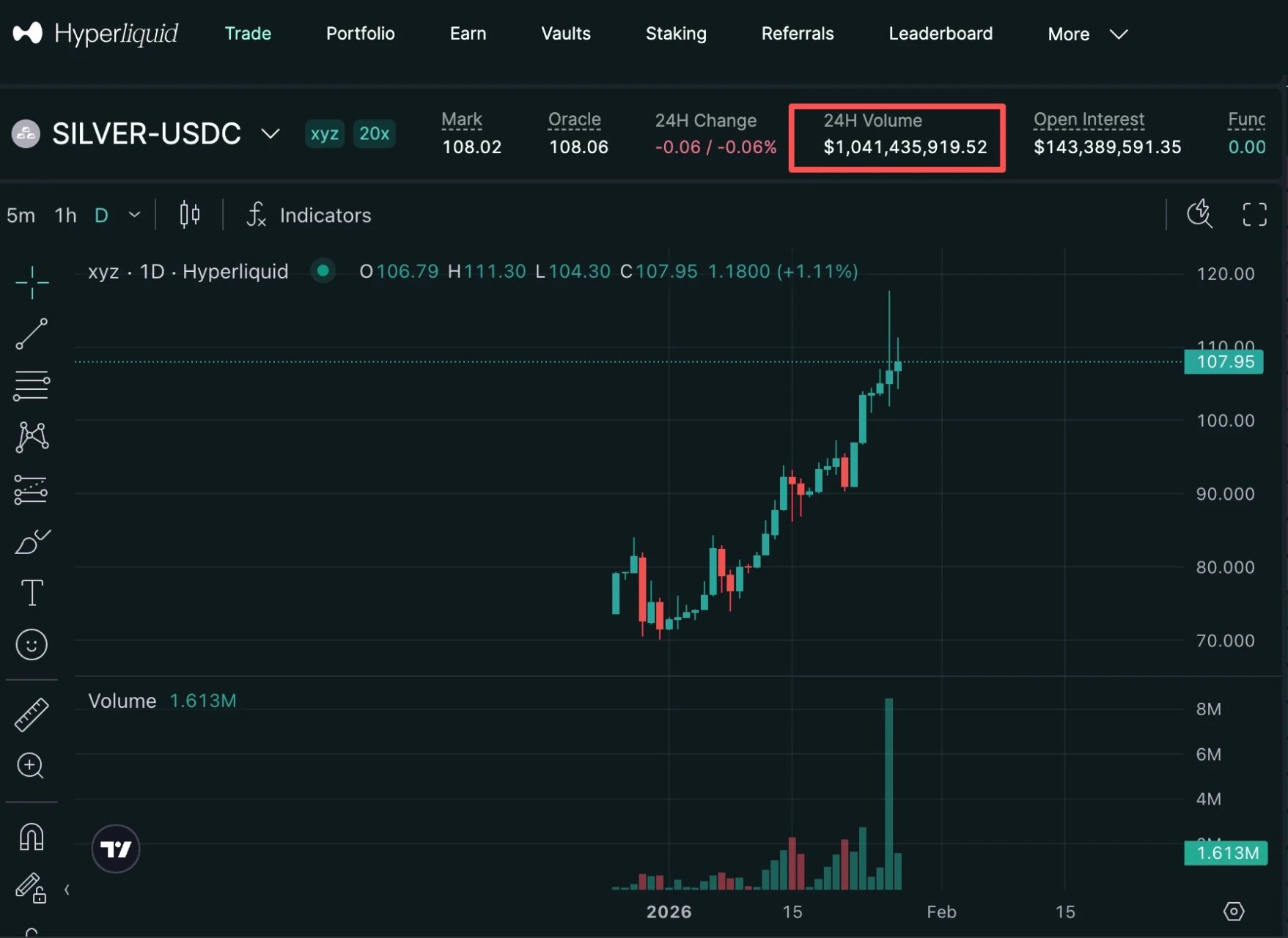

Hyperliquid

The Silver/USDC contract trading pair on Hyperliquid has seen its 24-hour trading volume soar past $1 billion, indicating substantial market activity and liquidity.

Binance

Binance supports leveraged trading for the XAG/USDT pair, offering up to 100x leverage. Currently, its 24-hour trading volume stands at $1.32 billion. According to official announcements, this trading option officially launched on January 7th (though initial announcements indicated up to 50x leverage). In related news, Binance is set to adjust the price index components for its gold token XAU/USDT contract on January 29, 2026.

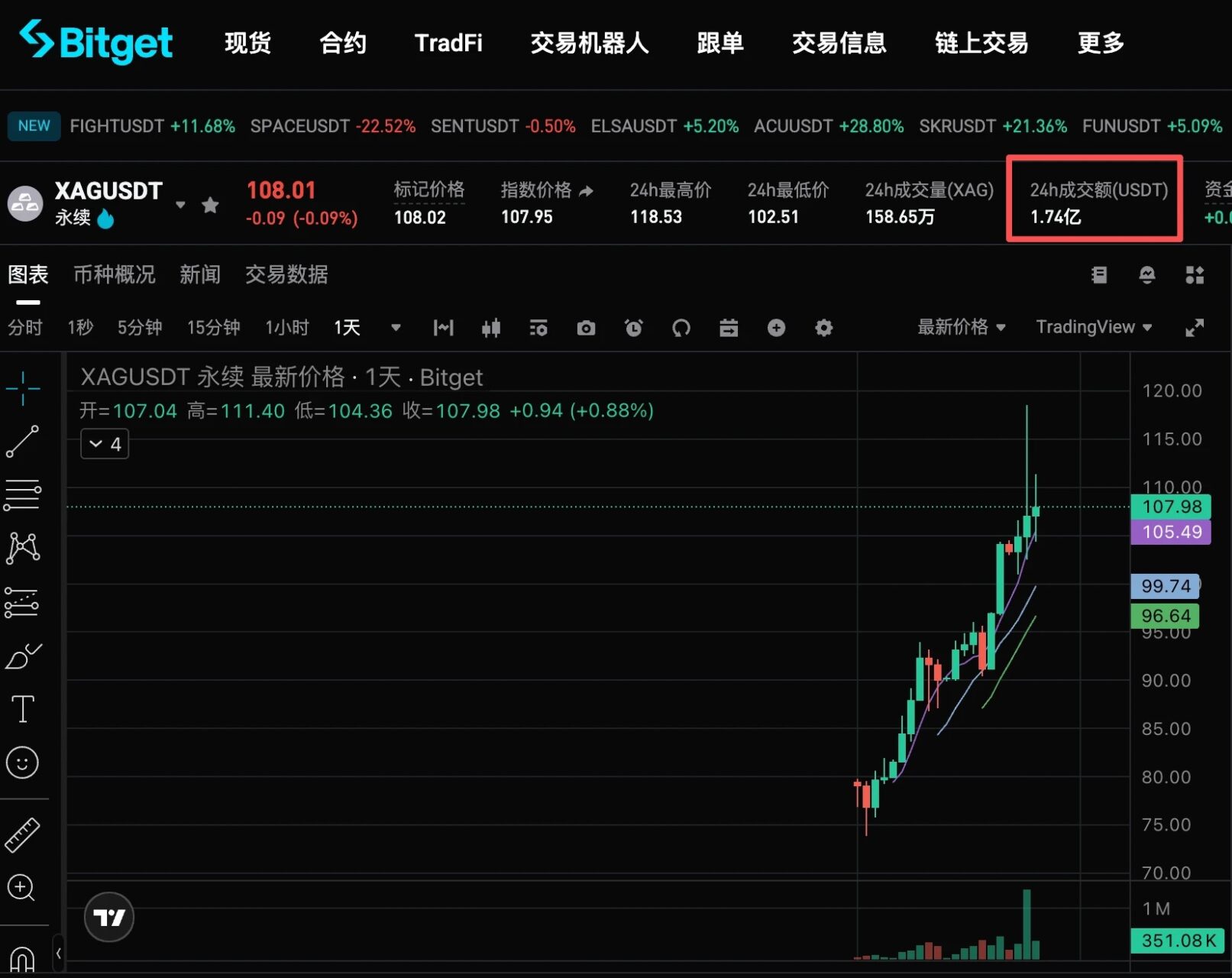

Bitget

Bitget facilitates leveraged trading for the XAG/USDT pair, with support for up to 50x leverage. Its current 24-hour trading volume is reported at $174 million.

Conclusion: Geopolitical Shifts and Monetary Policy as Catalysts for Precious Metals

Reflecting on recent developments, the re-emergence of geopolitical tensions, trade conflicts, and a leaning towards Federal Reserve interest rate cuts—all potentially exacerbated by figures like Donald Trump and his policy inclinations—serve as potent catalysts for rising precious metal prices. Specifically for silver, beyond its historical role in industrial applications and existing supply constraints, its burgeoning status as a risk-transfer asset and the evolving stance of the United States are proving pivotal.

Claudio Wewel, a strategist at J. Safra Sarasin, attributes silver’s sustained rally to two primary factors: waning market expectations for US interest rate reductions and silver’s newly designated status as a critical mineral. The US Department of the Interior’s decision in November to include silver on its critical minerals list has heightened the potential for tariffs on this metal. Wewel suggests this move exacerbates long-term supply tightness and is prompting US importers to accelerate their silver procurement. Concurrently, retail investors, finding gold prices at prohibitive historical highs, are increasingly pivoting to silver as a more accessible safe-haven asset.

In essence, silver’s impressive ascent is fueled by a dual dynamic of “scarcity” and “safe-haven appeal.” When combined with the recently intensified geopolitical tensions in the Middle East, it suggests that the current price rally for silver may be far from its peak.

(The above content is excerpted and reproduced with authorization from partner PANews. Original Link | Source: Odaily Planet Daily)

Disclaimer: This article is provided for market information purposes only. All content and views are for reference only and do not constitute investment advice, nor do they represent the views and positions of BlockBeats. Investors should make their own decisions and trades. The author and BlockBeats will not be liable for any direct or indirect losses incurred by investors’ transactions.