Original Authors: Castle Labs & Vincent

Translated and Compiled by: LlamaC

From the mythical quest for the Golden Fleece to the deep mines of South Africa, humanity has been captivated by the enduring allure of gold. This noble and enigmatic treasure, often described as captured sunlight, may indeed originate from the cosmos’s depths, as scientists postulate its birth in the cataclysmic collisions of dying stars—supernovae. While the Earth’s core holds the vast majority of this precious metal, meteorites delivered the accessible portions to our planet’s surface.

Throughout recorded history, gold has served as the bedrock of commerce, a universal hard currency.

Astonishingly, if all the gold ever extracted by humankind were consolidated, it would form a cube approximately 20 meters on each side, weighing an estimated 176,000 tons. This immense wealth, capable of fitting into a single warehouse, highlights gold’s unique portability—a stark contrast to assets like stocks, art, oil, or collectibles that demand vast physical space or extensive management resources.

Gold’s preeminence as the ultimate store of value stems from its inherent lack of counterparty risk; it is the sole asset that is not simultaneously someone else’s liability. As J.P. Morgan famously declared, “Gold is money, everything else is credit.” Its exceptionally high Stock-to-Flow Ratio not only guarantees scarcity but also insulates it from the arbitrary devaluations inherent in fiat currencies. For millennia, from ancient Lydian coins to modern central bank reserves, gold has steadfastly maintained its role as a stable anchor, offering liquidity and an immutable store of value amidst financial, political, and social upheavals.

However, recent years have witnessed the emergence of a formidable contender vying for the coveted title of “money.”

Despite their distinct volatility and cryptographic nature, cryptocurrencies like Bitcoin have been provocatively labeled “gold killers.”

Often hailed as “digital gold,” Bitcoin prompts critical questions: Can it truly supplant traditional gold? And if so, is it prudent to abandon such a time-honored asset?

This article delves into the roles of gold and Bitcoin within the contemporary economic landscape, decentralized finance (DeFi), and the fundamental attributes of money. We will conduct a comparative analysis to assess their potential for coexistence in a fiercely competitive macroeconomic environment, examining current trends to determine if Bitcoin genuinely embodies the characteristics of “digital gold.”

Ultimately, a diversified asset ecosystem benefits the global economy. Fiat currencies, whose values are largely dictated by discretionary monetary policies, are likely to be superseded by purer forms of money. Whether it is gold, or a yet-to-be-invented asset, the future may offer alternatives that transcend the inherent depreciation of fiat, a fatal flaw in our current debt-reliant economic system.

Gold’s Enduring Legacy in Global Finance

For centuries, gold has been the unwavering bedrock of the financial system, serving as the sole reserve asset. This status was not legislated but forged by the immutable laws of physics. As former Federal Reserve Chairman Alan Greenspan famously articulated in his 1999 testimony, “Gold still represents the ultimate form of payment in the world. Fiat money has no place in a crisis; gold always will.”

Gold’s universal acceptance is rooted in intrinsic qualities that set it apart from all other materials, establishing its enduring position as a “sound money” store of value, as defined by Aristotle:

-

Durability: As a noble metal, gold is remarkably resistant to most chemical reactions. Unlike silver, it does not oxidize or tarnish, ensuring its physical integrity over extended periods. This unique chemical stability makes it invaluable not only in economic reserves but also in high-tech infrastructure, from electric vehicles and drones to defense systems and rockets. Gold simply does not rust.

-

Fungibility: Gold’s inherent softness and malleability facilitate its easy shaping, casting, and division. This enables its standardization into interchangeable coins or bars, where one unit is essentially identical to another, provided weight (traditionally ounces or grams) and purity (commonly 14k, 18k, and 24k) are consistent.

-

Stability: Gold offers a reliable store of value. Its scarcity and practical utility (remaining the optimal, albeit costly, choice for critical industrial applications) allow it to retain value over time, largely immune to the inflationary pressures that erode fiat currencies. Furthermore, as the ultimate store of value, gold carries no counterparty risk.

-

Portability: As a dense and highly valuable metal, even small quantities of gold command significant worth. This exceptional value-to-weight ratio allows for the efficient transport of substantial wealth, distinguishing it from bulkier commodities like silver, art, or other goods. A mere half-kilogram of gold can easily be carried in a pocket.

-

Identifiability: Gold’s distinct physical properties make its authenticity relatively straightforward to verify. Modern devices, such as the Sigma Metalytics Verifier, can instantly detect counterfeits.

Thus, gold stands as an almost perfect store of value, with one significant caveat: its physical nature. Gold is not a digital credit card, nor a line of code. Transporting gold, even for an ordinary citizen holding a modest bar, can be as cumbersome as moving uranium; forgotten declaration forms can lead to customs seizure and hefty fines. It is susceptible to theft, alteration, concealment, or misappropriation. And, given human fallibility, it can simply be lost.

Operation Fish in 1940 vividly illustrates this logistical nightmare. As Nazi Germany advanced, Britain secretly relocated £2.5 billion worth of gold to Canada to safeguard it from enemy capture—the largest physical wealth transfer in history. Today, trillions of dollars can traverse continents with a single click.

Perhaps the most infamous act of state-sanctioned seizure was Franklin D. Roosevelt’s Executive Order 6102 in 1933, which criminalized the private ownership of monetary gold by U.S. citizens. Unlike a password or mnemonic phrase, gold cannot be stored in memory; it must be physically held, and once located, it can be confiscated. Gold offers no yield, pays no dividends, and incurs substantial storage and insurance costs. Much of the world’s gold rests in vaults in London, Switzerland, Singapore, or Manhattan, lying dormant like an ancient, forgotten sphinx.

Given humanity’s ingenuity and perpetual quest for improvement, it was inevitable that a superior alternative to this “barbarous relic” would emerge. While gold itself is near perfect, the astonishing pace of financial innovation necessitated a modern equivalent. Born from disillusionment with archaic traditional financial mechanisms and a desire for renewal, Bitcoin was initially conceived as a counter-system. Yet, it swiftly pioneered a powerful new paradigm, far exceeding its initial scope: the potential to be considered the digital equivalent of gold.

The Advent of Digital Assets

In 2008, amidst the global financial crisis, Satoshi Nakamoto published the whitepaper “Bitcoin: A Peer-to-Peer Electronic Cash System.” This groundbreaking document proposed a solution to the double-spending problem without the need for a centralized trusted authority.

If gold is money by nature, Bitcoin is money engineered by code. It is scarce, computationally intensive to “mine,” boasts a finite supply, and is inherently indestructible. The invention of the blockchain ignited a “Cambrian explosion” of digital assets, some proving revolutionary, others ultimately worthless.

While Bitcoin rapidly solidified its “digital gold” narrative due to its hard-capped supply of 21 million units, other tokens emerged to fulfill diverse economic niches.

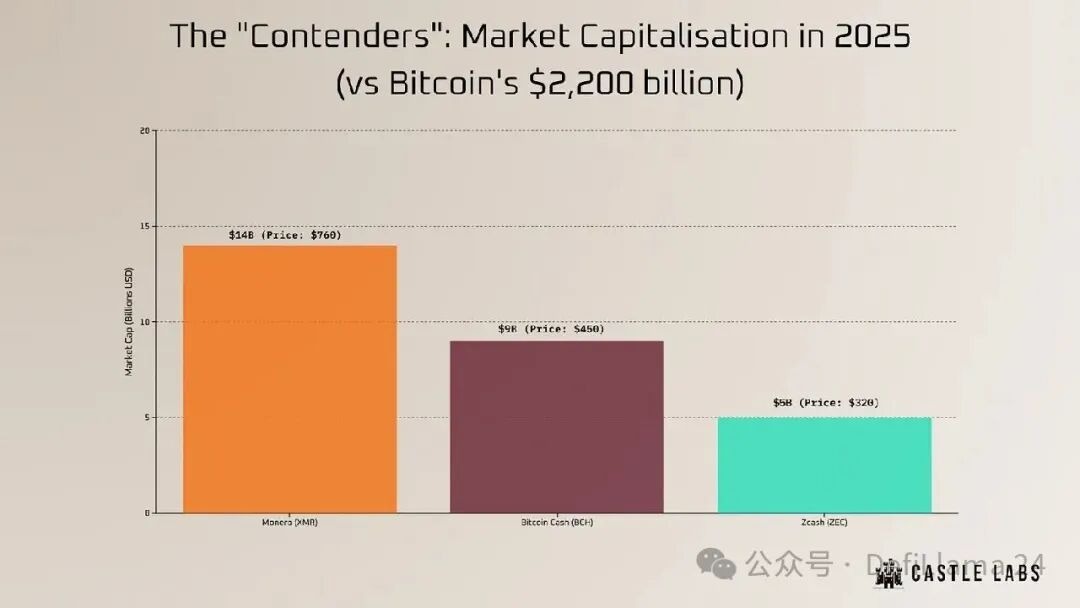

In 2011, Litecoin positioned itself as “Bitcoin’s silver,” promoting faster, lower-cost transactions. Four years later, in 2015, Ethereum introduced the concept of a “world computer,” replacing gold’s passive store-of-value function with active, programmable smart contracts. Today, it stands as the second-largest cryptocurrency by market capitalization, its position robust despite periods of price volatility. Privacy tokens like Monero (XMR) and Zcash (ZEC) aimed to replicate the anonymity of physical cash and gold, a feature absent from Bitcoin’s transparent public ledger. In 2025, fueled by the privacy narrative, these tokens experienced surges even as mainstream cryptocurrencies faced downturns.

As altcoins, major cryptocurrencies, and Bitcoin itself experienced declines, ZEC, followed by Monero, initiated an unexpected rally, liquidating many bearish positions. However, the combined market capitalization of these privacy-focused tokens remained negligible, posing no serious long-term challenge to Bitcoin’s dominance.

High-performance blockchains such as Solana or MegaETH, prioritizing speed over decentralization, aimed for transaction processing capabilities on par with Nasdaq, far surpassing traditional wire transfer speeds. While these platforms successfully attracted entrepreneurs, institutional capital, and banks, the burgeoning L1/L2 landscape became so vast that predicting long-term survivors proved challenging. The prevailing narrative of the 2010s was not coexistence, but rather a relentless drive for new trends to obliterate the old.

The industry’s zealous intent to displace precious metals was vividly encapsulated in Grayscale’s controversial 2019 “Drop Gold” advertising campaign. This campaign depicted gold investors as weary executives burdened by heavy, shiny rocks, while agile millennials glided past them, effortlessly managing their digital wealth.

The message was clear: gold was heavy, tangible, and archaic; cryptocurrency was light, digital, and unequivocally the money of the future. Yet, promoting “gold is dead” when Bitcoin was still largely a niche asset for early adopters was perhaps a premature and ill-conceived marketing ploy. Nevertheless, the public embraced this narrative post-COVID-19. While Grayscale’s vindication took time, the subsequent Bitcoin cycle provided ample justification.

This burgeoning appetite for risk assets suggested that scarcity could be engineered and designed, not merely discovered through mining.

It remains to be seen whether this artificial, deliberately designed commodity was truly destined to replace physical assets in the eyes of sovereign nations, but the market’s performance throughout the 2020s indicated that investors had largely bought into the vision.

Bitcoin’s Ascent: From Niche to Trillion-Dollar Asset

Between 2010 and 2025, Bitcoin transcended its origins within mysterious cypherpunk circles to become a prominent topic in Wall Street boardrooms, transforming from a speculative novelty into a trillion-dollar titan. This fifteen-year journey was far from smooth, marked by numerous crashes, yet each downturn was invariably followed by a resurgence to new all-time highs.

Media skepticism persisted, with Bitcoin declared “dead” approximately 450 times. The narrative arc was anything but linear. The story truly ignited with the retail frenzy of 2017, where some enthusiasts even liquidated homes to invest. Driven by this retail mania, ICO speculation, and a pervasive sense of recklessness, Bitcoin surged from under $1,000 to nearly $20,000. However, it subsequently crashed that same year, dragging the entire cryptocurrency market into a deep bear market that, at the time, seemed terminal.

The “macro hedge” era of 2020, championed by legendary figures like Paul Tudor Jones and Michael Saylor, reignited interest in this controversial asset. Bitcoin found the institutional advocates it needed, positioning itself as a macro asset capable of challenging gold. The pivotal breakthrough arrived in January 2024, with the U.S. Securities and Exchange Commission (SEC) approving a spot Bitcoin ETF.

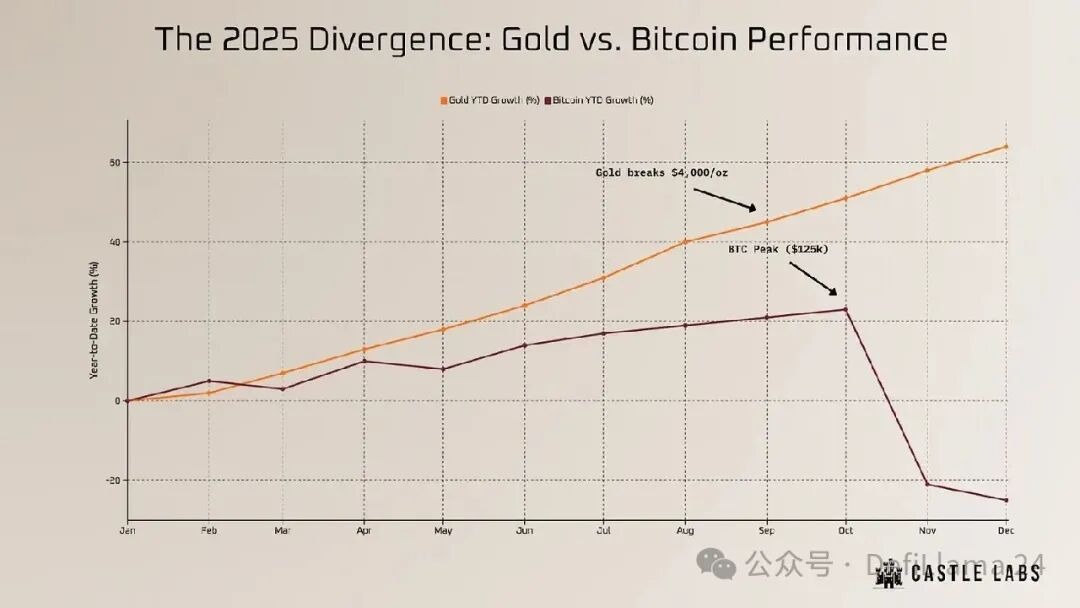

In a mere 15 years, Bitcoin evolved from a libertarian cyber-token into an Exchange Traded Fund (ETF) that channeled billions in regulated capital. BlackRock, Fidelity, and VanEck became the new torchbearers for Bitcoin; the basement-dwelling geeks of yesteryear, now potentially billionaires, might have set aside their anti-capitalist ideologies for a yacht or two. Institutional acceptance propelled Bitcoin past the psychological barrier of $100,000 in December 2024, culminating in a frenzied peak of $125,000 by October 2025. At this juncture, the supercycle theory appeared irrefutable. Even discussions within the U.S. government regarding strategic Bitcoin reserves sent crypto traders into raptures.

However, by October, a critical pricing vulnerability in Binance’s USDe triggered a cascade of liquidations across all leveraged long positions. While the market soon initiated a rebound, the preceding price wick was eventually filled, and Bitcoin entered a slow, grinding decline, sliding towards a potential critical support level; whispers of a drop to $67,000 began to circulate. The seemingly endless cycle presented a starkly different picture by the end of 2025.

Despite Bitcoin reaching new all-time highs, the broader market, including blue-chip projects like Aave, Ethereum, Solana, and Ethena, failed to recover. Bitcoin once again stood resilient, yet its relative strength did not translate into widespread market support. This divergence underscored Bitcoin’s unique status: not merely a novel asset, but a robust and enduring one. Through absolute scarcity, particularly its first-mover advantage, it successfully replicated the monetary premium traditionally associated with precious metals. Unlike fiat currencies prone to endless devaluation, Bitcoin offered a decentralized beacon, possessing durability, divisibility, and instant portability. Despite its inherent volatility due to its relative immaturity, it had effectively digitized gold’s intrinsic qualities, achieving a near-monopoly within its asset class.

By November 2025, a brutal correction saw Bitcoin retreat to $80,000, dragging down the rest of the market. To the dismay of many, traditional assets—stocks, gold, silver, collectibles, and everything in between—were simultaneously experiencing parabolic surges. Was this the end for cryptocurrency, particularly the altcoin sector?

Had the promise of true decentralized money been exchanged for an ETF ticker and a pump-and-dump spectacle? Was the “institutions are coming” narrative merely a sophisticated marketing ploy? A regulated, taxed, and closely monitored asset, now struggling to keep pace with the broader market, seemed even less exciting than gold.

Gold prices soared parabolically, silver closely followed, and even copper—a humble metal vital for electronics and weaponry—saw its price spiral out of control.

Had gold, after all, always been the sole bastion of sound money?

Gold’s Resurgence: The Triumph of 2025

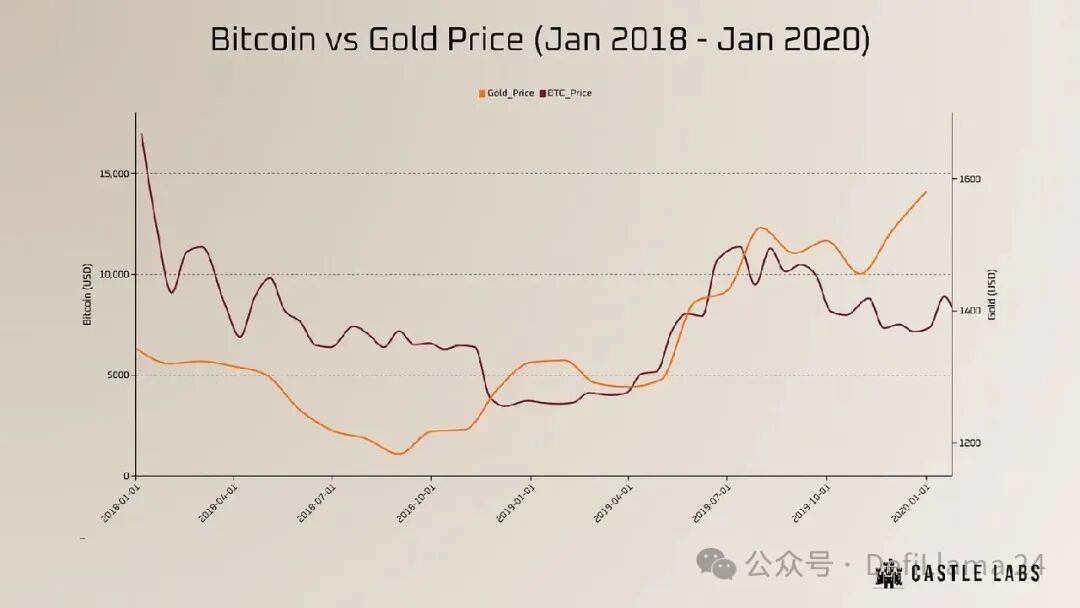

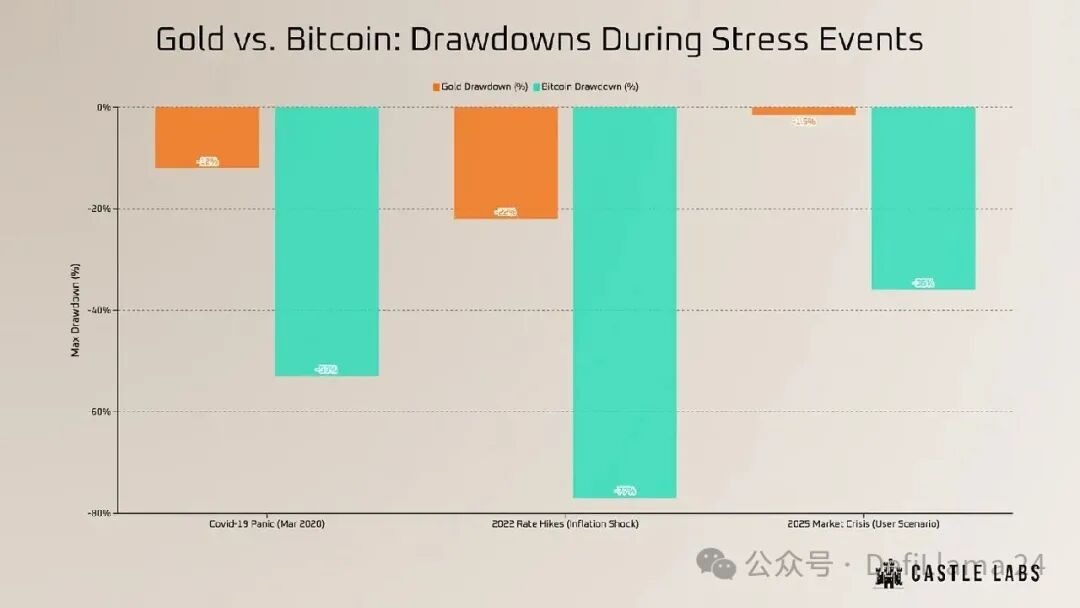

While Bitcoin undeniably meets many criteria for sound money, the events of 2025 indicated that it had not yet fully demonstrated the characteristics of “digital gold.”

In 2025, gold significantly outperformed Bitcoin, proving its enduring value as a hedge against inflation, geopolitical instability, and war, and, crucially, as a superior investment.

The global gold rally was marked by unprecedented official reserve accumulation. The National Bank of Poland led with aggressive purchases, while the Reserve Bank of India, Turkey, and China continued their steady buying. Brazil joined this trend by year-end, actively diversifying its assets. While central banks drove a strategic shift in gold’s focus from West to East, consumer demand for jewelry and physical gold bars remained highest in China and India, followed by the United States, Turkey, and Iran, where citizens increasingly used gold as their preferred hedge against domestic currency depreciation and economic instability.

In 2025 alone, the currencies of Turkey, Argentina, and Iran plummeted to historic lows. Institutional sentiment, once dismissive with “gold is dead,” had dramatically reversed to “gold to $5,000.” VanEck published analysis suggesting that persistent geopolitical instability, fiscal fragility, and inflation could propel gold prices to $5,000 per ounce by 2030, inevitably triggering an explosive growth in undervalued gold mining stocks. JPMorgan, the Wall Street titan, forecast an average gold price of $5,055 per ounce by the end of 2026, driven by a non-transitory structural shift.

JPMorgan identified two primary catalysts for this surge:

-

Accelerated gold accumulation by central banks (continuing the 2025 trend) to diversify assets and reduce reliance on the U.S. dollar.

-

A wave of Western ETF capital inflows, triggered by anticipated interest rate cuts from the Federal Reserve.

Gold was actively traded as an inflation hedge against currency debasement, reaffirming the timeless wisdom of ancient practices. Gold truly represented a bet on fear. For cryptocurrencies, conversely, regulatory tightening intensified globally, from the full implementation of the EU’s Markets in Crypto-Assets (MiCA) regulation to aggressive crackdowns by the U.S. Treasury on privacy coins and non-compliant stablecoins. Ultimately, the illusion of unbridled freedom shattered.

Navigating this turbulent transitional period made a clear assessment challenging. One could cynically conclude that Bitcoin’s test as “digital gold” had failed, representing a mere reversion to the mean. After a prolonged experiment, Bitcoin, in the eyes of both public and private institutions, had not passed the “sound money” test. While these institutions initially viewed the “digital gold” concept positively, they ultimately gravitated back to a familiar, reliable asset already held in vast quantities by central banks.

For risk-averse investors, the relative price stability of traditional gold offered another compelling advantage over Bitcoin. While precious metal prices fluctuate with global economic conditions, catastrophic crashes are rare. This stability is partly due to the immense difficulty of manipulating such a vast asset, even for institutions with sufficient capital to leverage the precious metals market through derivatives. Moreover, a significant portion of gold’s market capitalization—held in jewelry, central bank vaults, and private hoards—remains dormant, not actively circulating in the market.

Conversely, Bitcoin is inherently prone to leverage by both retail and institutional investors seeking to capitalize on intraday volatility. Indeed, it is far easier to influence an asset whose direction is dictated by dynamic liquidity than an inert physical commodity. Despite investor belief in its inflation-hedging narrative, Bitcoin exhibited the characteristics of an immature asset, marked by high volatility and unpredictable price swings. The performance expected of a reserve asset simply did not align with Bitcoin’s actual behavior. The recurring scares of stablecoin de-pegging served as a stark reminder: if you cannot physically hold it, you do not truly own it.

On one hand, gold stands as the ultimate physical asset; on the other, its custody presents significant challenges.

To entirely dismiss Bitcoin would be premature, yet to exclusively regard gold as the sole sound money in the digital age would be myopic.

Currently, the bullish fervor has subsided, with the “Baby Boomers” seemingly having reaped the majority of the profits. It is fair to say that few anticipated Bitcoin, after 15 years of maturation and fervent adoption, would fail to exhibit the attributes of a true reserve asset. Meanwhile, a titan that has governed our imagination, senses, and desires for millennia was destined to awaken from its slumber.

The Formidable Task of Dethroning Bitcoin

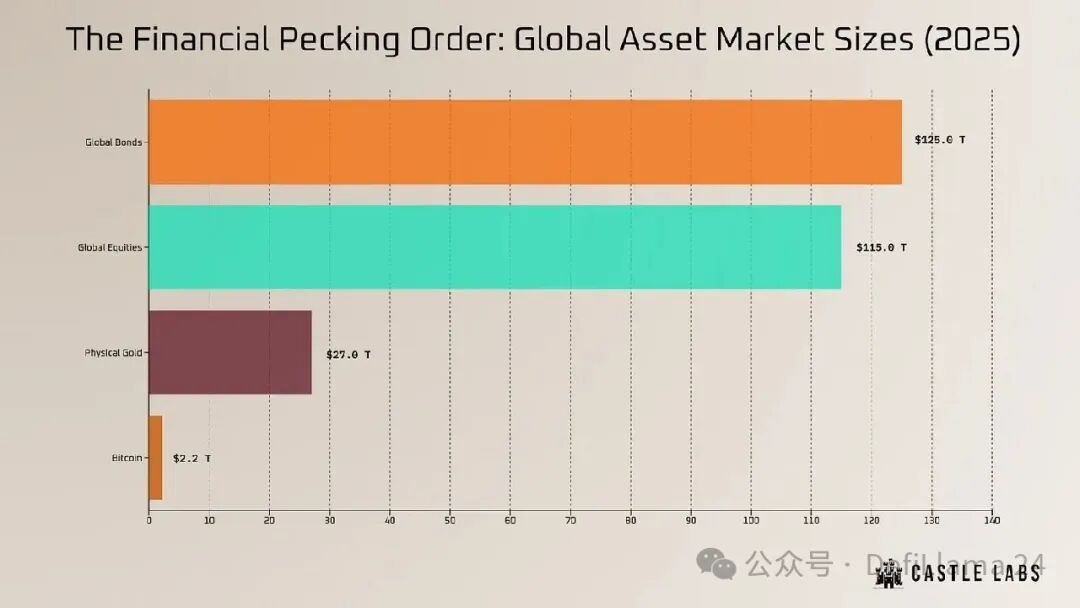

The notion that privacy tokens or Bitcoin forks might displace gold as the global store of value resurfaced in late 2025, but market data revealed a starkly different reality. While gold commanded an approximate market capitalization of $32 trillion, the combined market value of Monero (XMR) and Zcash (ZEC) struggled to surpass $20 billion—a mere fraction, comparable to a minor price fluctuation in a single tech giant like Nvidia.

In Q4 2025, Zcash briefly captured the attention of “Crypto Twitter” (CT), not for its “sound money” attributes, but due to a shifting narrative. Amidst a wave of delistings for privacy assets from compliant exchanges, Zcash, with its auditable features, managed to survive under the EU’s MiCA framework and the U.S. GENIUS Act. Furthermore, a marketing blitz by Solana’s founders triggered a degree of spontaneous ZEC buying frenzy.

Comparing ZEC’s price action to the stability of gold, silver, stocks, or private equity reveals that such movements hardly represent “sound money”; rather, they resemble “pump-and-dump” schemes. Indeed, privacy coins became regulatory pariahs in 2025. They catered to niche, short-lived narratives but proved insignificant in the broader boom-and-bust cycle. Even sporadic rallies, fueled by fears of surveillance and potential aversion to state intrusion, failed to attract the sustained institutional capital that the cryptocurrency sector desperately sought.

Ironically, tokens designed to circumvent institutions might only survive by relying on the very funds held by those institutions, but long-term survival often comes at the cost of transparency. It is inconceivable for major funds and banks to endorse an asset explicitly designed to bypass their systems. These alternatives unequivocally fail the “sound money” test: Bitcoin Cash (BCH) lost its “store of value” narrative years ago, becoming a payment network largely forgotten by both institutions and retail investors. With the rise of capital-rich stablecoins specifically designed for payments, Bitcoin Cash became increasingly irrelevant.

Having undergone two forks and lacking sustained community focus, Bitcoin Cash pales in comparison to Bitcoin. Zcash’s value proposition lies in its confidentiality. No sovereign nation can credibly build reserves on assets that global regulators are actively trying to suppress or that are highly susceptible to emotional market fluctuations. Such tokens are tools for private transactions, not for public treasuries, as they lack the liquidity and stability required to rival gold’s $32 trillion market capitalization.

Despite sharing Bitcoin’s attractive and familiar 21 million token cap, Zcash remains firmly in Bitcoin’s shadow. Monero (XMR), Zcash’s primary alternative, enforces mandatory privacy. In terms of scarcity, Monero’s continuously increasing total supply, with a fixed number of new XMR minted per block (0.6), results in a perpetually declining inflation rate that trends towards, but never quite reaches, zero percent.

In this specific attribute, Monero more closely resembles physical gold than Bitcoin, possessing a stable and low annual inflation rate akin to gold (where miners extract new gold). However, XMR cannot replace gold as a reserve asset due to its lack of auditability. Its opaque ledger prevents public proof of reserves without compromising private keys or undermining the very privacy features upon which the token relies. Conversely, central banks demand public trust and transparency for their reserves, even if the actual accountability of U.S. and Chinese monetary reserves remains a subject of debate.

Through this analysis, it becomes evident that, structurally and theoretically, only Bitcoin possesses the potential to challenge gold. It has withstood the test of “sound money,” is well-capitalized, and has achieved widespread recognition at both institutional and individual levels.

Despite continuous competition, Bitcoin has unequivocally cemented its position as the core of the cryptocurrency ecosystem. It is the only digital asset to receive formal legal recognition from the U.S. government: in March 2025, an executive order officially designated over 200,000 seized BTC as national assets, rather than auctioning them, thereby establishing a Strategic Bitcoin Reserve (SBR). This move conferred legal legitimacy upon Bitcoin, with other nations like El Salvador (approximately 6,000 BTC) and Bhutan (mining around 13,000 BTC via hydropower) also establishing officially recognized SBRs. Currently, no other asset enjoys such widespread governmental endorsement as Bitcoin. However, the fervent dream of replacing gold remains unrealistic, not only due to Bitcoin’s exceptionally high volatility (in 2025, Bitcoin’s annualized volatility hovered around 45%, three times gold’s 15%), but also because its current market capitalization pales in comparison to gold and silver. Sovereign nations require profound liquidity and immense buffers to underpin their monetary policies; unless Bitcoin resumes parabolic growth and reaches $1 million per coin, it cannot command the dominance of gold.

The Best of Both Worlds?

For fifteen years, the most intense debate in finance has centered on the clash between bulky precious metals and ambitious digital assets: the battle between gold and Bitcoin. The events of 2025 temporarily settled this debate: gold reaffirmed its status as true money, while Bitcoin remained firmly categorized as a risk asset. While Bitcoin’s volatility reached historical highs, it did not plummet to a degree that necessitated extreme caution; however, the entire crypto ecosystem, with few exceptions, suffered significant losses. Gold reasserted its millennia-old position as the “king’s money”—the ultimate insurance asset for nations, accessible without electricity, internet, or permission.

The aggressive gold acquisitions by Poland, China, and Brazil, completely disregarding Bitcoin, underscore gold’s enduring appeal as the most sought-after commodity during turbulent times. Bitcoin, conversely, has matured into a high-beta asset, now seemingly imbued with institutional authority.

First and foremost, Bitcoin is an asset suited for traders who profit from its violent, bidirectional price swings. Its high volatility, portability, and liquidity enable capital to “teleport” across borders in seconds, circumventing the antiquated rails of traditional banking. While Bitcoin’s image as a frontier asset may have slightly diminished, gold’s superior reputation has only solidified: it was the undisputed winner of the past year. The monumental task of replacing gold was, in retrospect, always a misleading marketing gimmick. What the entire financial system now requires is coexistence, especially given that Bitcoin has spawned a multi-trillion dollar industry reliant on its continued development.

Nevertheless, cryptocurrency remains the kind of explosive asset that continues to captivate and drive relentless pursuit. In the turbulent years ahead, prudent investors will not choose between gold and code, for the two are fundamentally distinct. If gold guarantees generational wealth for building family legacies and empires, then Bitcoin is that eccentric, darling asset—elusive, at times seemingly irrational, yet possessing a mesmerizing and intoxicating charm. Whether it can fully evolve into the reserve asset we envision will only be revealed through further stress tests and years of trial and error.

(The above content is an authorized excerpt and reproduction from our partner PANews. Original Link | Source: LlamaC)

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice, nor do they represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses incurred by investor transactions.