The ‘1011 Flash Crash’: Unpacking the $28 Billion Crypto Meltdown and the Blame Game

A heated debate has erupted among some of the most influential figures in the cryptocurrency industry, centered on the origins of the “1011 Flash Crash” that occurred on October 11, 2025 (UTC+8). This unprecedented event triggered over $19 billion in leveraged position liquidations within 24 hours, marking the largest single-day plunge in crypto history. With more than 16,000 trading accounts obliterated and a staggering scale of market losses, the incident has become a critical benchmark for assessing the crypto industry’s maturity.

Recently, Cathie Wood, CEO of Ark Invest, and Star, CEO of OKX, reignited the crypto community’s discussion by commenting on the “1011 Flash Crash.” Their remarks have largely pointed fingers at Binance, the world’s largest crypto asset exchange, pushing it into the spotlight. Binance’s leadership has actively pushed back, characterizing the event as a natural (albeit severe) market adjustment driven by macroeconomic shocks, rather than an internal software error.

A Brief Retrospective: The “1011 Flash Crash”

The incident unfolded between October 10 and 11, 2025, amidst escalating global financial instability. U.S. President Trump’s threats of “100% tariffs” on China intensified U.S.-China trade tensions, leading to a significant downturn in traditional markets. The S&P 500 and Nasdaq indices experienced their largest single-day declines in nearly six months, wiping approximately $1.5 trillion from the U.S. stock market capitalization. The cryptocurrency sector, already burdened by record-high leverage, saw its pain amplified, triggering a cascading effect. Bitcoin plummeted by $12,000 in mere minutes, a nearly 10% drop, narrowly avoiding the critical $100,000 threshold.

At the time, Bitcoin derivatives open interest had surpassed $100 billion, nearing historical peaks. Concurrently, on-chain data indicated that most holders were in profit, setting the stage for rapid deleveraging. As the sell-off intensified, market makers activated risk controls, withdrawing liquidity and creating a vacuum that exacerbated price volatility. Ethereum network congestion further complicated matters, with gas fees soaring above 100 gwei, delaying transfers and arbitrage opportunities, and further thinning order books.

The aftermath was truly astonishing. Over $19 billion in positions were liquidated across various exchanges, impacting millions of traders. Bitcoin ultimately plunged by as much as 14%, with altcoins experiencing even steeper declines. Stablecoin-like assets, including Ethena’s USDe, dramatically de-pegged on Binance, briefly falling to $0.65 before recovering. Critics suggest this de-pegging was linked to Binance’s promotion of USDe as high-yield collateral, which exacerbated the chain of liquidations. Subsequently, the total cryptocurrency market capitalization dropped by over 20%, hovering around $3.2 trillion.

Controversy Reignites: Binance Under Scrutiny

During a Fox Business interview on January 26, 2026, Ark Invest CEO Cathie Wood, a staunch Bitcoin bull, revisited the crash. She labeled it a “forced deleveraging event” that saw approximately $28 billion evaporate from the entire system. Wood specifically described the incident as a “software glitch on Binance” that artificially triggered system deleveraging. She further asserted that the market’s current struggle to reclaim all-time highs stems from the damage inflicted on investor confidence. “On October 10th, in the crypto world… this flash crash was related to a Binance software glitch, and it deleveraged the system,” Wood stated.

Executives from rival platforms quickly joined the fray. In an X post on January 31, OKX CEO Star unequivocally attributed the “1011 Flash Crash” to “irresponsible marketing campaigns by certain companies.”

He elaborated, “On October 10, tens of billions of dollars were liquidated. As CEO of OKX, we observed clearly that the crypto market’s microstructure fundamentally changed after that day. Many industry participants believe that this damage was more severe than the FTX collapse. Since then, discussions about why it happened and how to prevent it from happening again have been very extensive. The root cause is not hard to identify.”

In his X thread, Star meticulously analyzed Binance’s then-active promotion of USDe wealth management products, highlighting the inherent high-risk nature of USDe.

He criticized Binance’s aggressive campaign promoting USDe with a 12% annual percentage rate (APR) yield, while simultaneously treating it as collateral equivalent to stablecoins like USDT. Star argued that this encouraged a high-risk leverage cycle—converting USDT to USDe, borrowing more, and repeating the process—artificially inflating yields to 70% while downplaying the hedge fund-grade risks intrinsic to Ethena’s product. He contended that even a minor market tremor would be sufficient to trigger a collapse. Consequently, when volatility struck, USDe rapidly de-pegged, leading to cascading liquidations. Weak risk management surrounding assets like WETH and BNSOL further amplified the crash, with some tokens briefly nearing zero.

However, Star concluded by emphasizing, “I am discussing the root causes, not attributing blame or attacking Binance. Publicly discussing systemic risk can sometimes be uncomfortable, but it is necessary if the industry is to mature responsibly.” He added, “As the largest global platform, Binance wields immense influence—and the commensurate responsibility of an industry leader. Long-term trust in crypto cannot be built on short-term gain games, excessive leverage, or marketing practices that obscure risk. The industry needs leaders who prioritize market stability, transparency, and responsible innovation.”

No complexity. No accident.

10/10 was caused by irresponsible marketing campaigns by certain companies.On October 10, tens of billions of dollars were liquidated. As CEO of OKX, we observed clearly that the crypto market’s microstructure fundamentally changed after that day.… pic.twitter.com/N1VlY4F7rt

— Star (@star_okx) January 31, 2026

Anatomy of a $28 Billion Collapse

The “1011 Flash Crash” remains the most significant deleveraging event since the collapse of FTX in 2022. During the period of extreme volatility, prices of certain collateral assets on the Binance platform—particularly liquid staking tokens within its “unified margin” system—exhibited severe deviations from global spot prices.

Traders reported that automated liquidation engines triggered prematurely, creating a “death spiral”: forced selling drove prices down, which in turn triggered even more liquidations. At its lowest point, Bitcoin plunged nearly 15% in minutes before rebounding, resulting in thousands of accounts exhibiting “negative balances” and sparking a heated debate over Binance’s infrastructure accountability.

Binance’s Response and Subsequent Measures

Binance has consistently maintained that major macroeconomic shocks were the primary drivers of the event. In an official blog post published on January 31, Binance stated that the key factors behind the market turmoil on October 11, 2025, included macroeconomic impacts, market maker risk control mechanisms, and Ethereum network congestion.

“While some views attribute this market volatility to Binance system issues, the reality is that cascading liquidations were primarily triggered by high-leverage positions under macroeconomic risk shocks, compounded by market maker risk control measures contracting liquidity, and Ethereum network congestion leading to delayed fund transfers.”

Binance emphasized that throughout the market turbulence, its core systems remained fully operational, with no platform-wide outages. All critical matching, risk validation, and liquidation functions continued to execute stably and without interruption.

Binance did, however, detail two specific issues: a 33-minute slowdown in asset transfers and temporary index deviations for USDe, WBETH, and BNSOL during periods of low liquidity. The exchange’s asset transfer subsystem experienced a 33-minute delay due to excessive traffic, and the indices for USDe, WBETH, and BNSOL showed temporary discrepancies owing to insufficient liquidity and on-chain delays. Despite these, Binance stressed that “individual platform issues on Binance were not the cause of this market flash crash.” The exchange highlighted that 75% of the liquidations occurred *before* these specific issues manifested, and its core matching engine, risk validation, and liquidation systems remained stable throughout the entire event.

Notably, Binance swiftly implemented contingency measures upon identifying these two faults.

Binance confirmed that, based on system logs and operational records, it compensated all eligible users affected between 05:18-05:51 (UTC+8) during the incident. To address these issues, the platform has since enhanced its caching, expanded database capacity and replicas, optimized connection management, segregated critical functionalities, and strengthened its front-end UI display mechanisms. Furthermore, parameters were tightened during the subsequent market stabilization phase, and immediate updates were initiated for the design of USDe, WBETH, and BNSOL. All affected users received appropriate compensation.

Binance underscored its commitment to transparency and user-centric measures. Indeed, as of October 22, 2025, the exchange had paid over $328 million in compensation to affected users. It also launched a $300 million “Together We Rise” industry recovery fund and provided $100 million in low-interest loans to ecosystem participants. In its initial announcement, Binance stated, “The event was driven by broader market conditions, not a fault on our platform.”

CZ’s Latest Statement

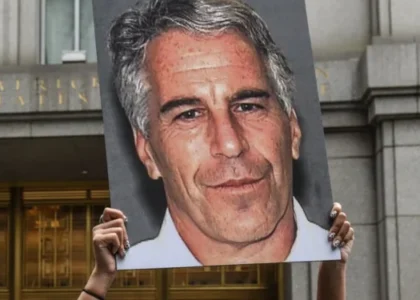

As one of the most influential and recognizable figures in the crypto industry, Changpeng Zhao (CZ) addressed recent community controversies surrounding Binance and himself during a recent AMA session. He refuted these narratives as “twisted FUD” (fear, uncertainty, and doubt) and underscored Binance’s resilience.

Zhao directly countered the backlash, dismissing accusations that Binance caused the crash as “far-fetched.” He argued that simplifying a complex market event to the responsibility of a single platform was overly simplistic. Categorizing these claims as “twisted FUD,” he reiterated that Binance had compensated users and urged a focus on long-term industry development rather than mutual finger-pointing. “Coordinated attacks do not build this space,” CZ remarked, referring to the ongoing criticism related to the crash and token listings.

He also defended his “buy and hold” philosophy. Regarding online claims of his personal net worth exceeding $90 billion, he clarified that this was a Forbes estimate, not actual cash. CZ stated he had never sold substantial crypto assets, had not cashed out, had no intention of holding fiat currency (including stablecoins), and certainly would not profit by “selling user assets.”

Disclaimer: This article is for market information purposes only. All content and opinions are for reference only and do not constitute investment advice, nor do they represent the views and positions of BlockBeats. Investors should make their own decisions and trades. The author and BlockBeats will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.