Market Meltdown: US Political Deadlock and DeFi Instability Drive Crypto Lower

Just yesterday morning, optimism was high for a swift resolution to the looming US government shutdown. However, by evening, the situation took a dramatic turn, sending shockwaves through global markets. House Speaker Mike Johnson publicly expressed dim hopes for a short-term solution, while former President Trump’s call to abolish the “filibuster” policy highlighted deep internal divisions within the Republican Party, let alone between the two major parties. This political impasse has cast a long shadow over the US economy, triggering a sharp decline in US equities and dragging the cryptocurrency market down with it, with Bitcoin (BTC) once again dipping below the critical $102,000 mark.

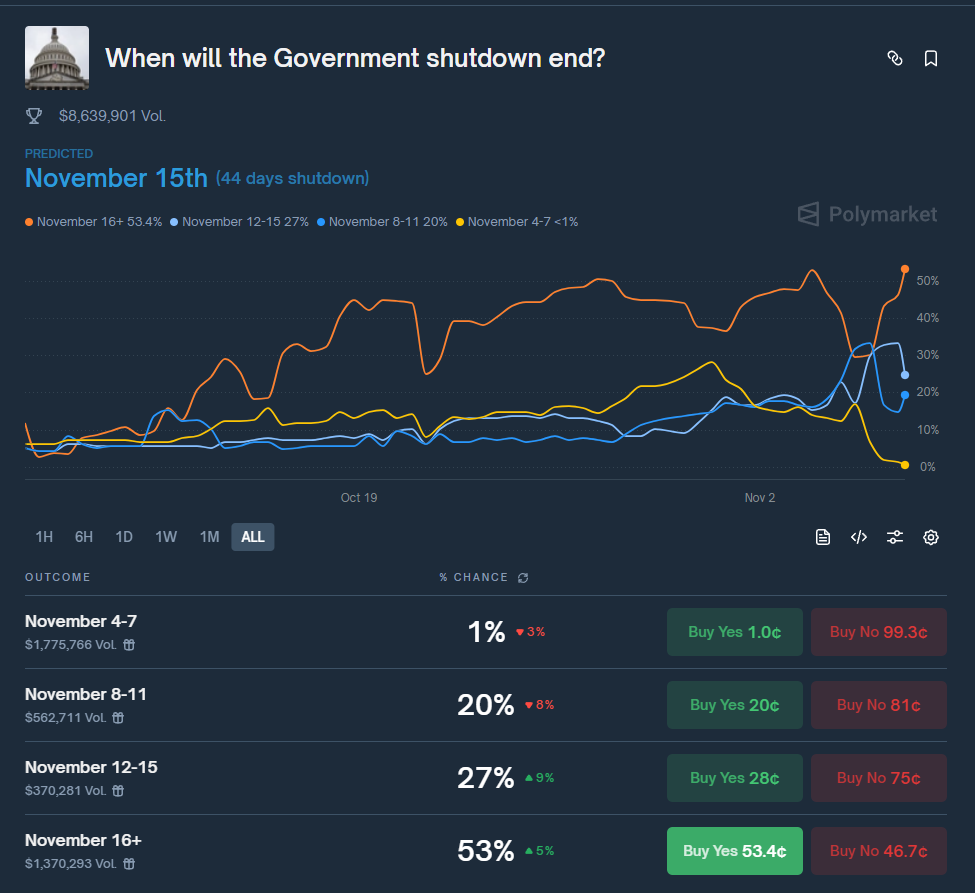

The fluctuating predictions on Polymarket, a leading prediction market, vividly illustrate the market’s wavering confidence. The probability of the shutdown ending before the 16th initially plummeted below 30% yesterday, only to rebound above 50% by nightfall, before hopes were once again dashed. This volatile sentiment underscores a prevailing bearish mood within the crypto sphere. In such an environment, any negative news is met with an immediate flight to safety by investors. Coupled with dwindling liquidity, the market’s capacity to absorb sell-offs is severely diminished, raising concerns that sudden price drops could trigger even deeper corrections.

Adding to the market’s woes is a growing ripple effect within the Decentralized Finance (DeFi) ecosystem, stemming from the recent Balancer hack. This incident has not only led to instability among certain stablecoins but has also exposed vulnerabilities in other prominent DeFi platforms like Euler Finance and ListaDAO. Reports indicate a continuous drain of liquidity from these platforms, leaving some users unable to withdraw their collateralized assets. This unfolding DeFi crisis poses a significant threat to overall crypto market liquidity, potentially exacerbating current downturns.

Given these precarious conditions, investors with assets currently held on any DeFi platform are strongly advised to exercise extreme caution. If feasible, it is highly recommended to withdraw your assets back to your personal wallet as a precautionary measure to safeguard against potential losses during this period of heightened instability.

Disclaimer: This article is intended solely for the purpose of providing market information. All content and views expressed herein are for reference only and do not constitute investment advice. They do not represent the views or positions of BlockBeats. Investors are urged to make their own independent decisions and conduct their own trades. The author and BlockBeats will not be held responsible for any direct or indirect losses incurred by investors as a result of their trading activities.