Bitmine Immersion’s Aggressive Ethereum Bet Leads to Over $6.6 Billion in Unrealized Losses Amid Crypto Market Turmoil

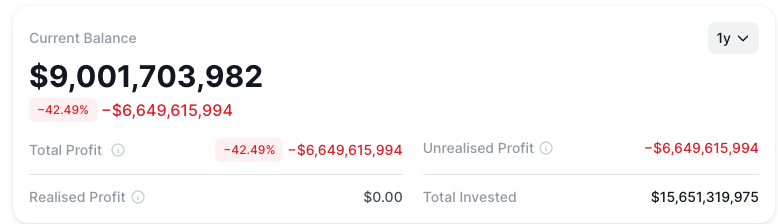

Bitmine Immersion, the publicly traded company helmed by the renowned “Wall Street Oracle” Tom Lee, is currently navigating a significant financial storm. Its bold strategy of accumulating substantial Ethereum (ETH) holdings as a core asset has led to staggering unrealized losses exceeding $6.6 billion, triggered by the recent sharp downturn across the cryptocurrency market.

The scale of Bitmine’s commitment to Ethereum is immense. Fresh data from the tracking platform Dropstab reveals that the company recently expanded its ETH reserves, acquiring over 40,000 additional tokens. This latest acquisition pushes Bitmine’s total Ethereum holdings to approximately 4.24 million ETH, a colossal sum representing about 3.5% of the cryptocurrency’s entire circulating supply.

However, this concentrated bet has proven precarious. The broader crypto market has experienced a pronounced weakening, with Ethereum’s price briefly dipping below the $2,200 mark today (December 2). Consequently, the total value of Bitmine’s digital asset portfolio has plummeted from an October high of nearly $140 billion to approximately $90 billion, marking a dramatic and swift reduction in its paper valuation.

Bitmine’s aggressive financial strategy is once again under intense market scrutiny. While the trend of incorporating cryptocurrencies onto corporate balance sheets has gained traction in this market cycle, an overly concentrated exposure can significantly magnify volatility risks, particularly during sharp market reversals and periods of diminished liquidity.

Market analysts are pointing to a factor beyond mere fundamental weakness driving the current sell-off: a “cascading liquidation” event in the derivatives market. As Ethereum’s price continues its descent, a large volume of leveraged contract positions are being forcibly closed due to insufficient margin. This mechanism intensifies selling pressure, perpetuating a vicious cycle of “decline — liquidation — further decline” that exacerbates market instability.

In light of this significant market correction, Tom Lee’s public commentary has noticeably shifted towards a more cautious stance. While he reiterates his long-term optimism for the cryptocurrency market, he candidly acknowledges that the sector is currently undergoing a crucial “deleveraging” phase. Lee has issued a warning that the market environment in early 2026 could be “quite bumpy,” advising investors to prepare for a challenging period of sustained volatility before a semblance of stability can be achieved.

Disclaimer: This article provides market information only. All content and views are for reference only and do not constitute investment advice. They do not represent the views or positions of BlockTempo. Investors should make their own decisions and transactions. The author and BlockTempo will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.