Bitcoin’s Protracted Correction: A Deep Dive into Market Liquidity and Fading Demand

Bitcoin (BTC) is currently navigating its fifth consecutive month of market correction, a challenging phase primarily triggered by a significant event on October 10th. This incident unleashed a massive liquidity crisis, particularly within the futures market, where Open Interest plummeted by over 70,000 BTC in a single day – equating to a staggering $8 billion wiped from the market.

Unpacking the Broader Liquidity Squeeze

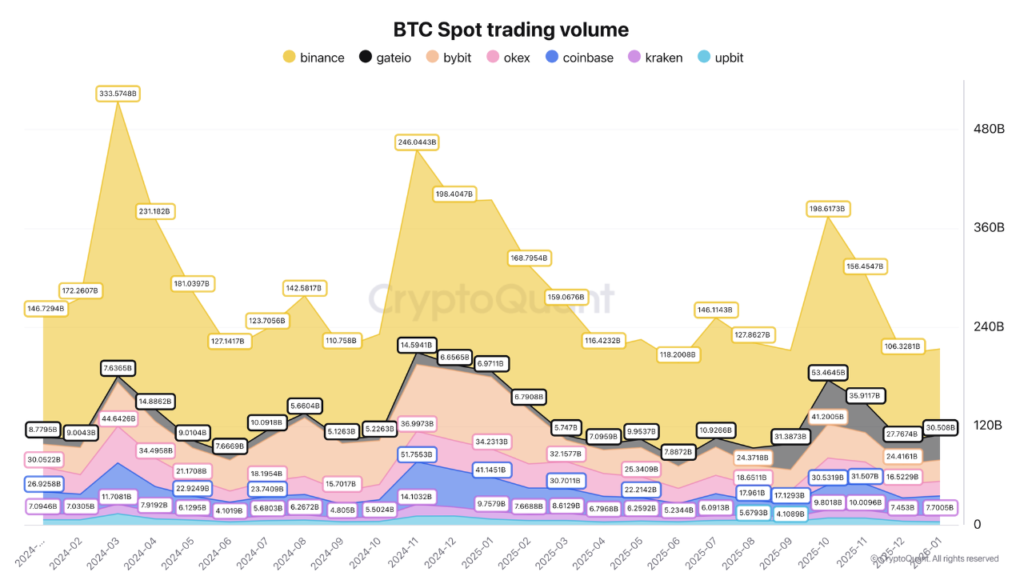

However, the futures market shock was merely one facet of a broader liquidity squeeze. The overall market health has been further compromised by notable stablecoin outflows from exchanges, contributing to a substantial $10 billion reduction in the total stablecoin market capitalization during this period. Concurrently, the spot market has witnessed a dramatic downturn in trading activity. Since last October, BTC spot trading volume has effectively halved.

While Binance continues to dominate with a $104 billion share of current volume, this figure pales in comparison to its nearly $200 billion volume recorded in October. Other major platforms also experienced significant reductions, with Gate.io’s October volume at $53 billion and Bybit’s at $47 billion, highlighting the drastic decline across the board.

Investor Exodus and the Path to Recovery

This dramatic contraction in trading volume has pushed the market to some of its lowest activity levels observed in recent times, signaling a pronounced investor exodus from the crypto space and a corresponding weakening of demand. The prevailing environment remains fraught with uncertainty, deterring risk-taking investments.

For any sustainable recovery to materialize, a keen focus on market demand trends is paramount. The most crucial barometer for a genuine turnaround will undoubtedly be a significant rebound in spot trading volume, indicating renewed investor confidence and market participation.

Disclaimer: This article provides market information for reference only. All content and views are for informational purposes and do not constitute investment advice. They do not represent the views or positions of the author or Blockcast. Investors should make their own decisions and trades. The author and Blockcast shall not bear any responsibility for direct or indirect losses incurred by investors’ transactions.