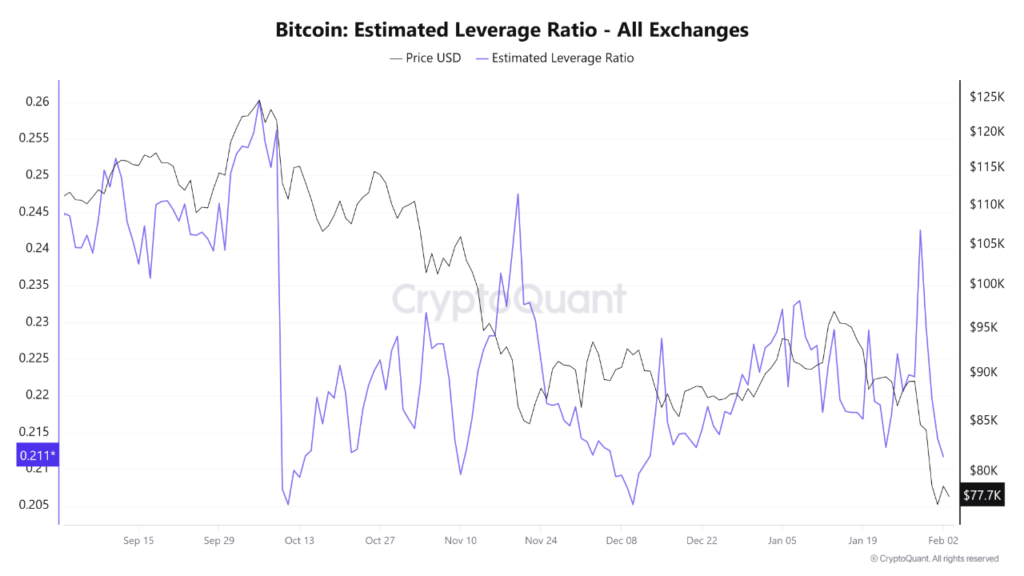

Bitcoin Investors Scale Back Risk as Leverage Ratio Hits Multi-Month Low

A notable transformation in Bitcoin (BTC) investor behavior is currently unfolding, as evidenced by recent data on the “Estimated Leverage Ratio.” Across the entire network, this crucial metric has plummeted to approximately 0.21, marking its lowest level since mid-December—a period characterized by relatively higher trading activity. This significant decline underscores a clear reduction in investors’ reliance on leveraged positions and signals a broader shift towards diminishing risk appetite among the majority of traders.

In contrast to the overall market trend, data from Binance presents a nuanced picture. While Binance’s leverage ratio has also seen a distinct retreat from its previous peaks, it currently hovers around 0.17—a figure that, interestingly, remains above its December levels. This suggests that despite the broader market’s move towards de-risking, a segment of traders on Binance continues to maintain a comparatively higher degree of leveraged exposure.

This widespread reduction in leverage coincides with a period of heightened BTC price volatility, notably with the cryptocurrency twice dipping below the $75,000 mark. In response to sustained price pressure and limited upward corrections, many market participants have proactively chosen to deleverage as a strategic risk management measure. Historically, a leverage ratio nearing 0.21 has often served as a robust indicator of a more balanced and stable market environment, significantly mitigating the risk of large-scale forced liquidations typically triggered by excessive leverage. This current trend, therefore, may herald a healthier, more resilient market going forward, characterized by less speculative excess and a stronger foundation.

Disclaimer: This article is intended solely for the purpose of providing market information. All content and views expressed herein are for reference only, do not constitute investment advice, and do not necessarily represent the opinions or positions of Blockcast. Investors are strongly advised to exercise their own judgment and make independent trading decisions. The author and Blockcast shall not be held liable for any direct or indirect losses incurred by investors as a result of their trading activities.