Bitcoin Set to Dominate Gold: Pantera Capital CEO Predicts Decade of Unprecedented Growth

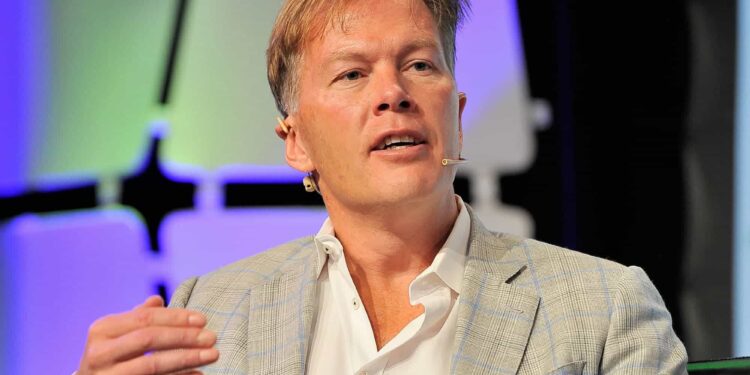

Despite the recent volatility and downturns in the cryptocurrency market, Pantera Capital Founder and CEO Dan Morehead urges investors with a true long-term vision to cast their gaze a decade into the future. His conviction remains unwavering: the next ten years will see Bitcoin vastly outperform gold, a reality he deems “obvious.”

Morehead delivered this bold forecast at the Ondo Summit in New York this past Tuesday, where he engaged in a compelling discussion alongside fellow Wall Street luminary Tom Lee, Chairman of Bitmine Immersion (BMNR). Their dialogue delved into critical topics including inflation, cryptocurrency market cycles, and the evolving landscape of institutional investment.

Challenging Fiat: The Case for Fixed-Supply Assets

Morehead underscored the structural flaws within the traditional fiat currency system, citing the insidious erosion of purchasing power. “Paper money is depreciating at 3% per year, and yet it’s still called stable currency,” he remarked. “But if you extend that over your lifetime, it actually equates to a 90% loss of purchasing power.”

In light of this systemic devaluation, he posited that investing in assets with a “fixed supply” is the only truly rational choice. This fundamental advantage, he noted, is shared by both gold and Bitcoin.

Bitcoin and Gold: A Cyclical Rivalry and Shifting Allocations

Addressing the competitive dynamic between these two store-of-value assets, Morehead highlighted their tendency for cyclical leadership. While acknowledging gold’s recent strong performance, he emphasized that “historical experience shows their performances will alternate in leading.”

He further elaborated on the fierce competition for asset allocation, pointing out that capital inflows into Bitcoin ETFs and Gold ETFs have been remarkably similar in recent years, underscoring their parallel roles in diversified portfolios.

Debating Market Cycles and Institutional Readiness

The conversation also saw Tom Lee challenge the widely accepted “four-year cycle” theory in crypto. “I don’t think this is a four-year cycle,” Lee stated, referencing the sustained surge in Ethereum’s on-chain activity and the unprecedented speed of deleveraging during last October’s market crash – an event he described as “even more severe than the FTX implosion in November 2022.” Lee concluded that the current market correction exhibits a different structure from past cycles.

Morehead, in turn, staunchly refuted the notion that the cryptocurrency market has entered a bubble phase. He pointed to the stark reality that truly large institutional investors still hold virtually no crypto assets.

“Those alternative investment institutions that manage hundreds of billions of dollars have almost no Bitcoin or crypto assets in their hands. That’s precisely why I remain extremely bullish.”

“When the median institutional holding is ‘0.0’, it’s simply impossible to form a bubble.”

In Morehead’s view, the long list of reasons that once deterred institutions from entering the crypto space is now rapidly diminishing. He highlighted that “the long list of reasons for saying ‘no’ to crypto has now almost all been crossed off.”

With the maturation of custody services and increasing regulatory clarity, blockchain assets, boasting an average annualized return of 80% over the past 12 years and a low correlation with traditional stock markets, represent a rare asset class offering both high growth and significant risk diversification. “Historically, there has never been a better asset class than this,” Morehead asserted.

The Geopolitical Shift: A Global Bitcoin Arms Race

Looking ahead, Morehead believes the most profound long-term catalyst will emerge from shifts in national-level asset allocation. He envisioned a potential global “Bitcoin arms race,” suggesting that both U.S. allies and geopolitical rivals alike may soon re-evaluate their reserve asset structures.

“Nations will eventually realize how insane it is, like China, to store millennia of accumulated national wealth in assets (U.S. Treasuries) that can be frozen at any time by the U.S. Treasury Secretary,” he declared. “In contrast, buying Bitcoin is actually much smarter.”

Disclaimer: This article provides market information only. All content and views are for reference purposes and do not constitute investment advice. They do not represent the views or positions of the author or BlockTempo. Investors should make their own decisions and transactions, and the author and BlockTempo will not be held responsible for any direct or indirect losses incurred by investors.