DeFi’s Dangerous Evolution: The Unseen Risks of the “Curator” Model

In the traditional stock market, the figure of the fund manager once commanded immense trust, only to later face widespread disillusionment. Retail investors, captivated by the promise of professional expertise and lower risk compared to direct trading, poured their savings into funds managed by individuals with prestigious degrees and gleaming résumés. Yet, market downturns brutally exposed the limitations of this “professionalism” against systemic risks. Worse, the incentive structure was inherently flawed: profits were hailed as the manager’s skill, while losses became the investor’s burden, masked by management fees and performance bonuses.

Today, this familiar, problematic dynamic has found a new, even more perilous home in the decentralized finance (DeFi) space. The “fund manager” has been rebranded as the “Curator” or “external manager” on-chain, operating with a disturbing lack of oversight.

These new custodians of capital are unburdened by qualification exams, regulatory scrutiny, or even the need to disclose their true identities. Their entry point? A simple “vault” on a DeFi protocol, luring billions with the irresistible bait of astronomically high annualized yields. What happens to these funds, and how they’re truly utilized, remains a complete mystery to investors.

$93 Million Vanishes: The Stream Finance Catastrophe

The DeFi world was rocked on November 3, 2025, when Stream Finance abruptly announced the suspension of all deposits and withdrawals. The following day, an official statement confirmed the worst: an external fund manager had been liquidated on October 11 during a period of intense market volatility, resulting in a staggering loss of approximately $93 million in fund assets. Stream’s internal stablecoin, xUSD, immediately spiraled, collapsing from $1 to a low of $0.43 within hours.

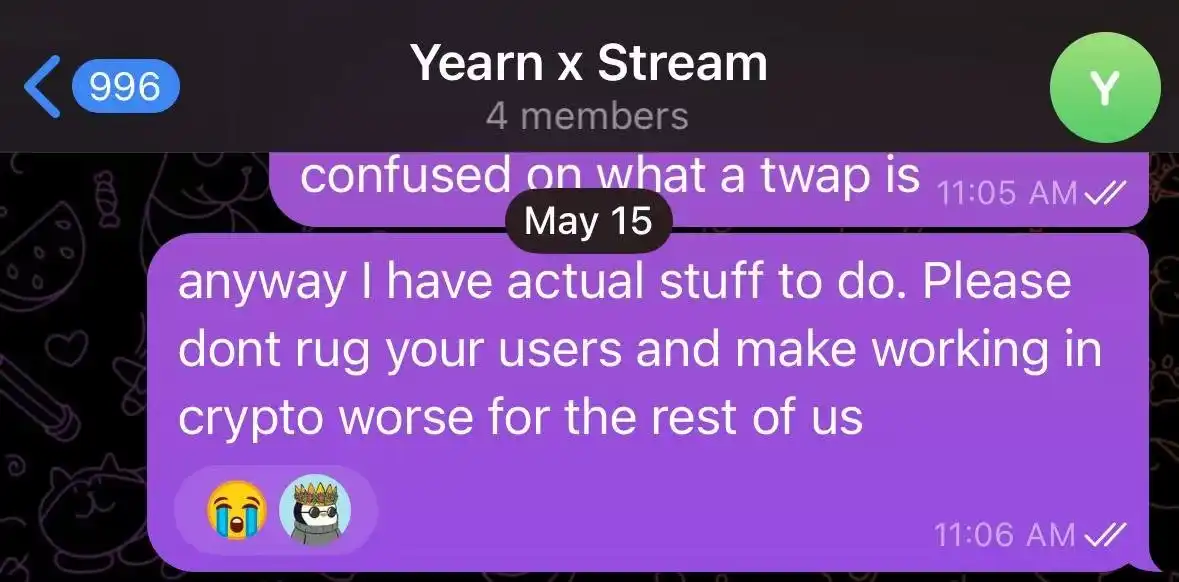

This wasn’t an unforeseen calamity. A stark warning had been issued 172 days prior by Yearn’s core developer, Schlag. His assessment, delivered with chilling prescience, was unequivocal:

“It only takes one conversation with them and 5 minutes browsing their Debank to realize this is going to end badly.”

Stream Finance positioned itself as a yield-aggregating DeFi protocol, promising users returns by depositing funds into Curator-managed vaults. The protocol claimed to diversify investments across various on-chain and off-chain strategies.

The collapse stemmed from two critical failures: Firstly, an external Curator engaged in opaque off-chain trading with user funds, leading to the liquidation of their positions on October 11. Secondly, on-chain analysts uncovered that Stream Finance was also involved in recursive lending with Elixir Protocol’s deUSD, employing minimal real capital to generate significant leverage. While not the direct cause of the losses, this “leveraging on leverage” model drastically amplified the protocol’s systemic risk, setting the stage for a cascading failure.

The combined effect was catastrophic: $160 million in user funds were frozen, the broader ecosystem faced $285 million in systemic risk, Euler Protocol incurred $137 million in bad debt, and with 65% of Elixir’s deUSD backed by Stream assets, $68 million teetered on the brink of collapse.

How did this “Curator” model, so easily identifiable as risky by seasoned developers, manage to attract over $8 billion in capital? And how has it fundamentally shifted DeFi from its foundational ideals of transparency and trustworthiness towards a systemic crisis?

DeFi’s Fatal Transformation: From Code to Curators

To grasp the crisis’s origins, we must revisit DeFi’s core philosophy. Early DeFi protocols like Aave and Compound were built on the principle of “Code is law.” Every transaction, every loan, adhered to immutable rules embedded in smart contracts, ensuring transparency and public verifiability. Users contributed to vast, shared liquidity pools, and borrowers were required to provide over-collateralization. This algorithmic governance minimized human intervention, confining risks to systemic factors like smart contract vulnerabilities or extreme market liquidations, never the unpredictable “human risk” of a fund manager.

However, the relentless pursuit of higher yields has propelled a new generation of DeFi protocols, including Morpho and Euler, towards a different model. Critiquing the perceived inefficiency of Aave’s common liquidity pools, where capital might sit idle, these protocols introduced the “Curator” model. Instead of depositing into a single, unified pool, users now select individual “Vaults” managed by Curators. Funds are transferred into these vaults, and the Curator assumes full responsibility for investment strategies and yield generation.

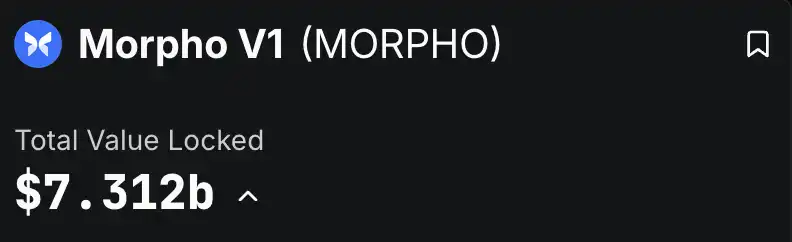

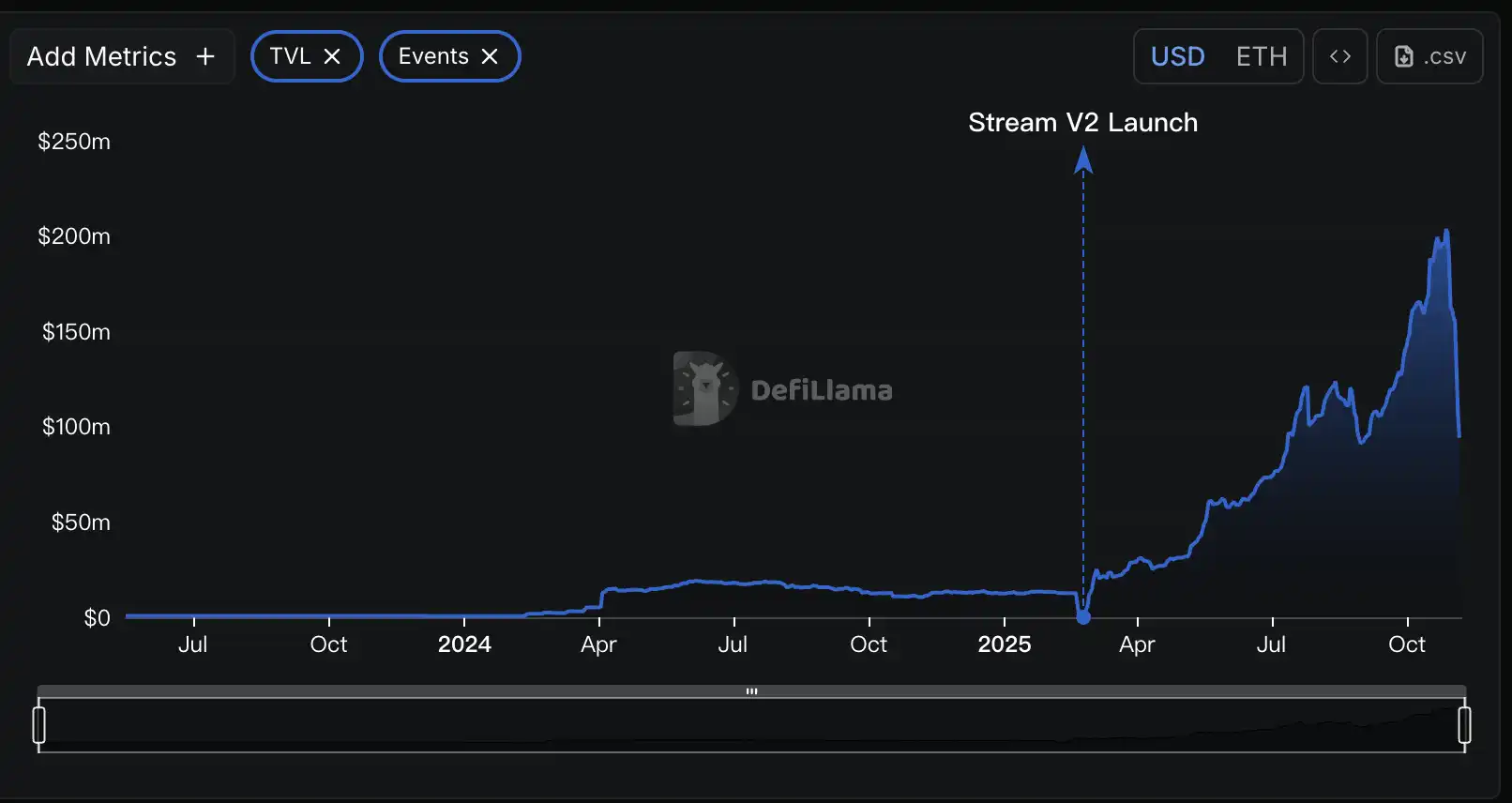

The adoption of this model has been explosive. DeFiLlama data reveals that Morpho and Euler alone boast a combined Total Value Locked (TVL) exceeding $8 billion, with Morpho V1 at $7.3 billion and Euler V2 at $1.1 billion.

This staggering figure means over $8 billion in real capital is now entrusted to a multitude of Curators, whose backgrounds and methodologies are largely opaque.

While the promise of “professional management” and superior yields sounds appealing, a closer look reveals a troubling resemblance to the P2P lending failures of the past. P2P’s inherent flaw was the inability of individual lenders to assess the true creditworthiness of borrowers, with high-interest promises often masking profound default risks.

The Curator model mirrors this perfectly. The protocol acts merely as a matching service. Users’ funds, seemingly placed with a “professional,” are in reality deposited into a black box.

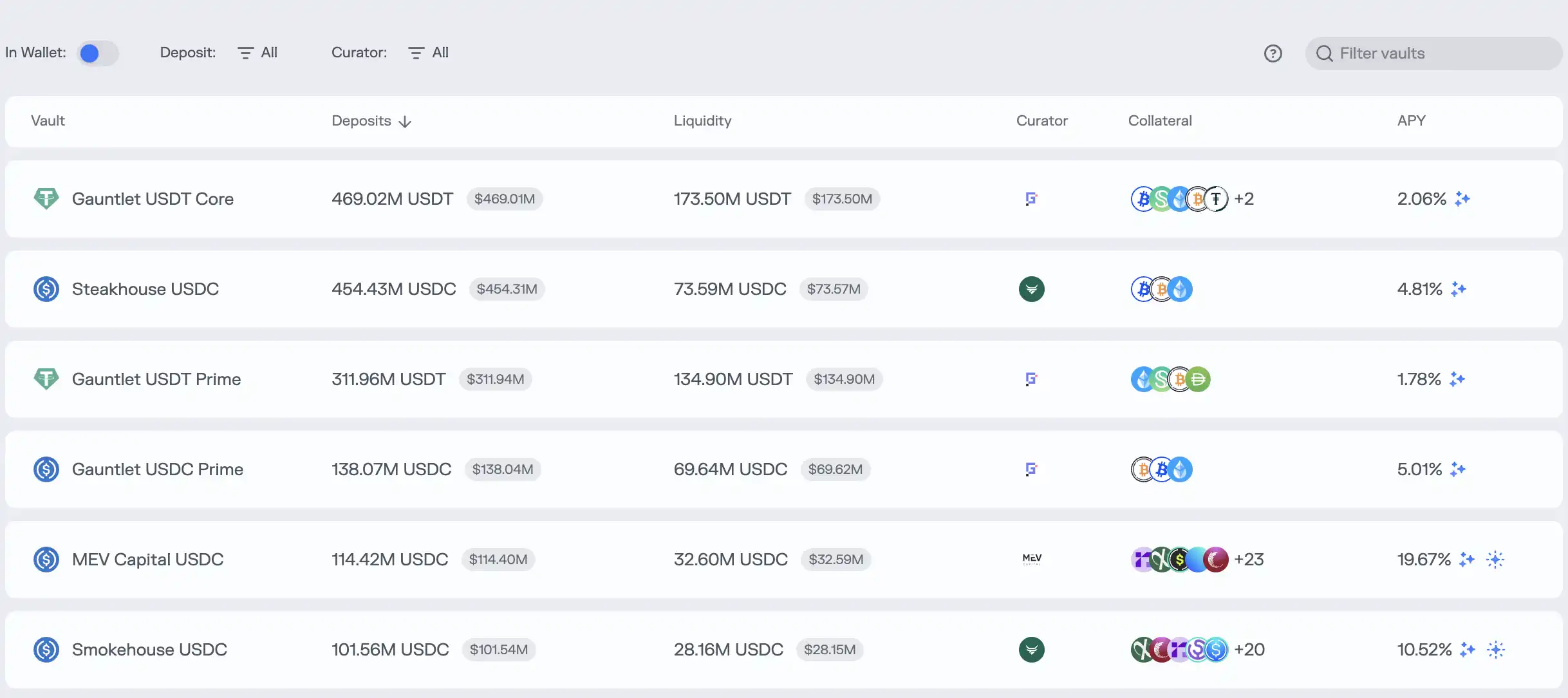

Consider Morpho: users navigate a website displaying various Curator-managed vaults, each flaunting enticing Annual Percentage Yields (APYs) and brief strategy descriptions.

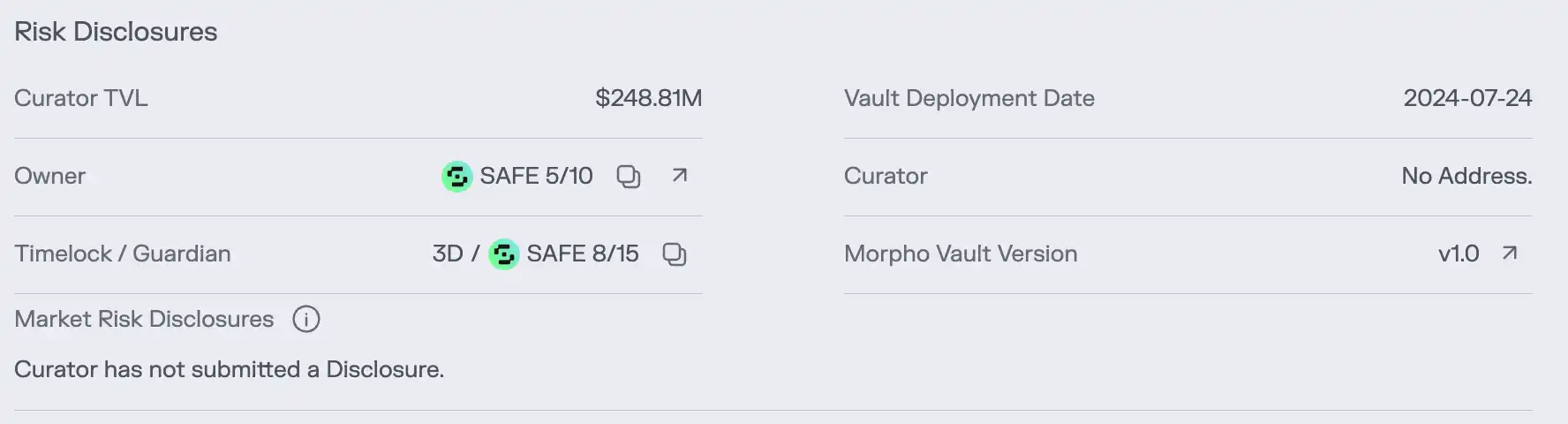

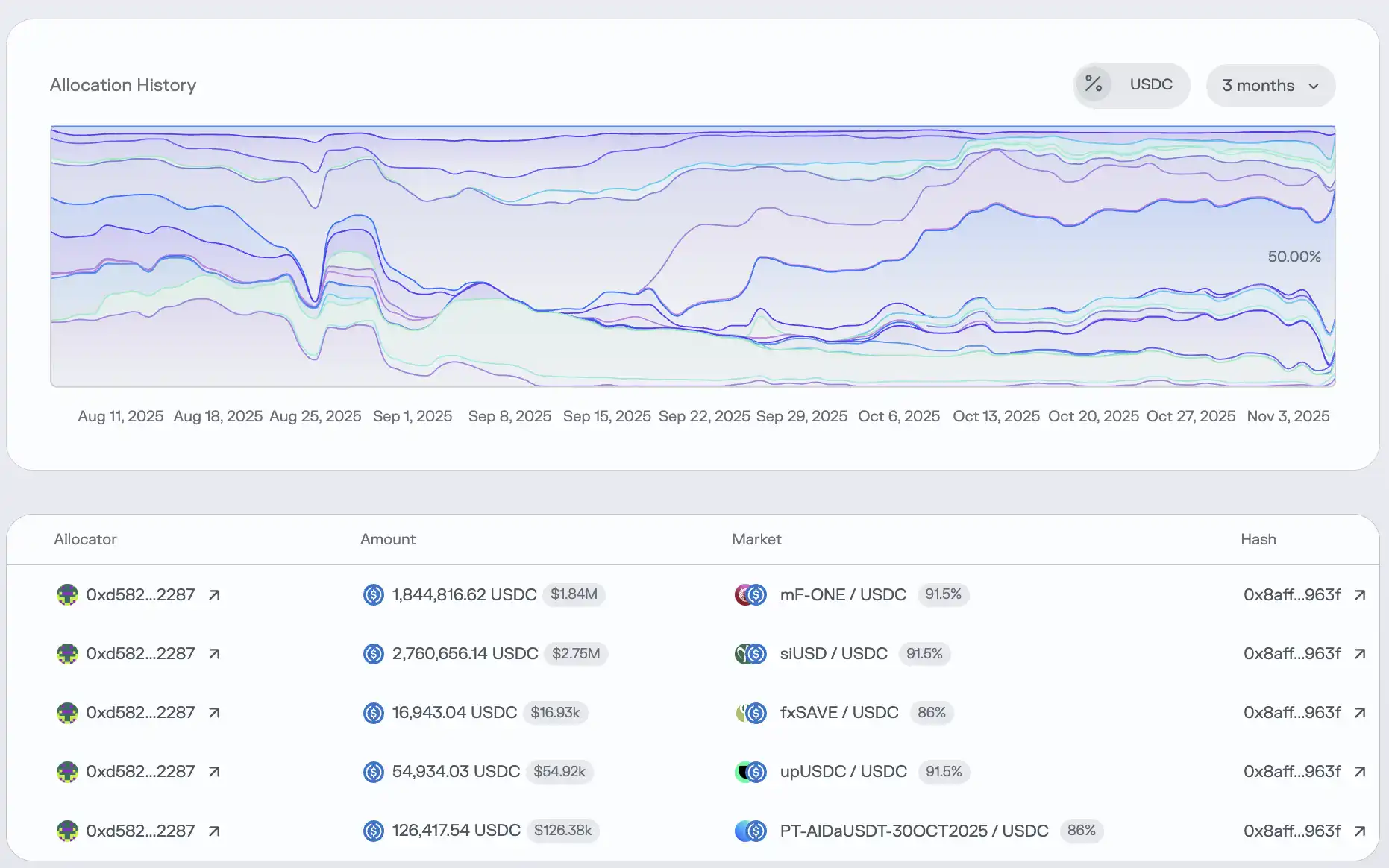

A simple “deposit” button is all it takes to commit assets like USDC. Yet, beyond vague descriptions and fluctuating historical returns, users typically have zero insight into a vault’s internal operations.

Crucial risk information is often relegated to an obscure “Risk” page. Even if an investor finds this page, they might only see specific holdings. Essential metrics like leverage ratios and overall risk exposure, vital for assessing asset safety, are conspicuously absent.

Morpho CEO Paul Frambot once stated, “Aave is a bank, and Morpho is the infrastructure for banks.” This implies that while Morpho provides the tools, the actual “banking business”—risk management and capital allocation—is outsourced to these Curators. The promise of “decentralization” is reduced to the mere act of depositing and withdrawing, while the most critical element, risk management, rests entirely in the hands of unregulated, often anonymous, individuals. This is, in essence, “decentralized funding, centralized management.”

Traditional DeFi’s relative safety stemmed from minimizing the “human variable.” The Curator model reintroduces this unpredictable, significant risk into the blockchain. When trust supplants verifiable code, and transparency gives way to black-box operations, the very foundation of DeFi’s security begins to crumble.

When “Curators” and Protocols Collude

The Curator model merely opened Pandora’s Box; the tacit collusion between protocols and Curators has unleashed its full malevolence. Curators typically profit from management fees and performance bonuses, creating a powerful incentive to chase high-risk, high-reward strategies. With user funds as their principal, they bear little responsibility for losses, yet stand to gain significantly from successes. This “internalized gains, externalized risks” dynamic is a recipe for moral hazard. As DeFiance Capital founder Arthur aptly put it, the Curator’s mindset becomes: “If I mess up, it’s your money. If I get it right, it’s my money.”

Alarmingly, protocols, rather than acting as guardians, have often become enablers in this dangerous game. In a fiercely competitive market, attracting Total Value Locked (TVL) is paramount, necessitating astonishingly high Annual Percentage Yields (APYs). These high APYs are precisely what aggressive Curators deliver. Consequently, protocols not only overlook risky Curator behavior but actively encourage high-interest vaults as a marketing draw.

Stream Finance exemplifies this opaque operation. While Stream claimed a TVL of up to $500 million, DeFiLlama data showed its peak TVL at only $200 million. This discrepancy suggests that over three-fifths of user funds flowed into undisclosed off-chain strategies, managed by mysterious proprietary traders, completely abandoning DeFi’s core tenet of transparency.

The statement from prominent Curator organization RE7 Labs, following the Stream Finance implosion, laid bare this entanglement of interests. They admitted to identifying “centralized counterparty risk” during due diligence before listing Stream’s xUSD stablecoin. Yet, driven by “significant user and network demand,” they proceeded to list the asset and establish an independent lending pool. In essence, the pursuit of traffic and hype outweighed prudent risk management.

When the very protocols become proponents and beneficiaries of high-risk strategies, risk assessments become hollow gestures. Users are no longer presented with genuine risk disclosures but rather a meticulously crafted marketing illusion, convinced that double- and triple-digit APYs are DeFi’s magic, unaware they are being led into a deep abyss.

The Domino Effect: A Systemic Crisis Unfolds

October 11, 2025, witnessed a brutal bloodbath in the crypto market, with nearly $20 billion in liquidations across the network within 24 hours. The resulting liquidity crisis and deep losses are now manifesting throughout DeFi.

Twitter analysis widely suggests that many DeFi protocol Curators, in their relentless chase for yield, adopted a high-risk off-chain strategy: “Selling Volatility.” This strategy essentially bets on market stability; in calm conditions, they profit from fees, but violent market swings can lead to catastrophic losses. The market crash on October 11 proved to be the trigger for this ticking time bomb.

Stream Finance became the first critical domino to fall. While the protocol didn’t disclose the Curator’s specific strategy, market consensus points to high-risk derivatives trading, likely involving volatility selling.

However, this was merely the beginning. As Stream Finance’s xUSD, xBTC, and other tokens were widely used as collateral and assets across various DeFi protocols, its collapse rapidly triggered an industry-wide chain reaction. Preliminary analysis by DeFi research firm Yields and More revealed direct debt exposure linked to Stream totaling $285 million, exposing a vast network of risk contagion. Elixir Protocol emerged as the largest victim, having lent $68 million in USDC to Stream, a loan that constituted a significant portion of its total reserves.

RE7 Labs, once a collaborator, also became a casualty. Its vaults across multiple lending protocols, having accepted xUSD and Elixir-related assets as collateral, now faced millions in bad debt risk.

The contagion spread further through complex “rehypothecation” pathways. Stream’s tokens were collateralized in mainstream lending protocols like Euler, Silo, and Morpho, which were themselves nested within other protocols. The collapse of a single node propagated rapidly through this intricate financial web, threatening the entire system.

The hidden dangers unearthed by the October 11 liquidation extend far beyond Stream Finance. As Yields and More warned, “This risk map is still incomplete, and we expect more affected liquidity pools and protocols to be revealed.” Indeed, another protocol, Stables Labs, and its stablecoin USDX, have recently faced similar community scrutiny over their operations.

The issues exposed by protocols like Stream Finance highlight a fatal flaw in this new Ce-DeFi (centralized management of decentralized finance) model: when transparency is absent, and power is concentrated in the hands of a few, user fund safety becomes entirely dependent on the integrity of fund managers. Without robust regulation and clear rules, this presents an unacceptably high risk.

The Ultimate Warning: You Are the Yield

From Aave’s transparent, on-chain banking model to Stream Finance’s opaque asset management black box, DeFi has undergone a perilous evolution in just a few short years. When the ideal of “decentralization” is twisted into a free-for-all of “deregulation,” and the narrative of “professional management” conceals the reality of opaque financial operations, we are left not with a superior financial system, but a dangerously compromised one.

The most profound lesson from this crisis is a re-evaluation of DeFi’s core values: transparency is far more critical than the mere label of decentralization. An opaque decentralized system is inherently more dangerous than a regulated centralized one. It lacks both the credibility and legal safeguards of traditional institutions, as well as the open, verifiable checks and balances that true decentralization promises.

Matt Hougan, Chief Investment Officer of Bitwise, famously cautioned crypto investors: “There are simply no double-digit yields without risk in the market.”

For every investor enticed by the allure of high APYs, a crucial question must be asked before clicking that “deposit” button:

Do you truly understand the source of this investment’s yield? If the answer is no, then a chilling reality awaits: you are the yield.

(The above content is an excerpt and reprint authorized by partner PANews, original link | Source: Blockbeats)

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice, nor do they represent the views and positions of Blockbeats. Investors should make their own decisions and trades. The author and Blockbeats will not be liable for any direct or indirect losses incurred by investors’ transactions.