By: Nancy, PANews

After a prolonged period of dormancy, Ore, a veteran Solana-based mining protocol, has dramatically re-entered the spotlight. Amidst a generally sluggish market, Ore has not only witnessed its token price hit a new annual high but also experienced a sustained surge in daily protocol revenue, rapidly igniting market enthusiasm. This remarkable turnaround is primarily attributed to the recent launch of its revamped V2 mining protocol, which introduces comprehensive upgrades to both its operational mechanisms and economic model.

Revenue and Token Price Soar as Ore Unveils New Mining Protocol

The veteran project, Ore, has recently recaptured significant attention, even earning a retweet from the official Solana account, sparking widespread market interest and discussion.

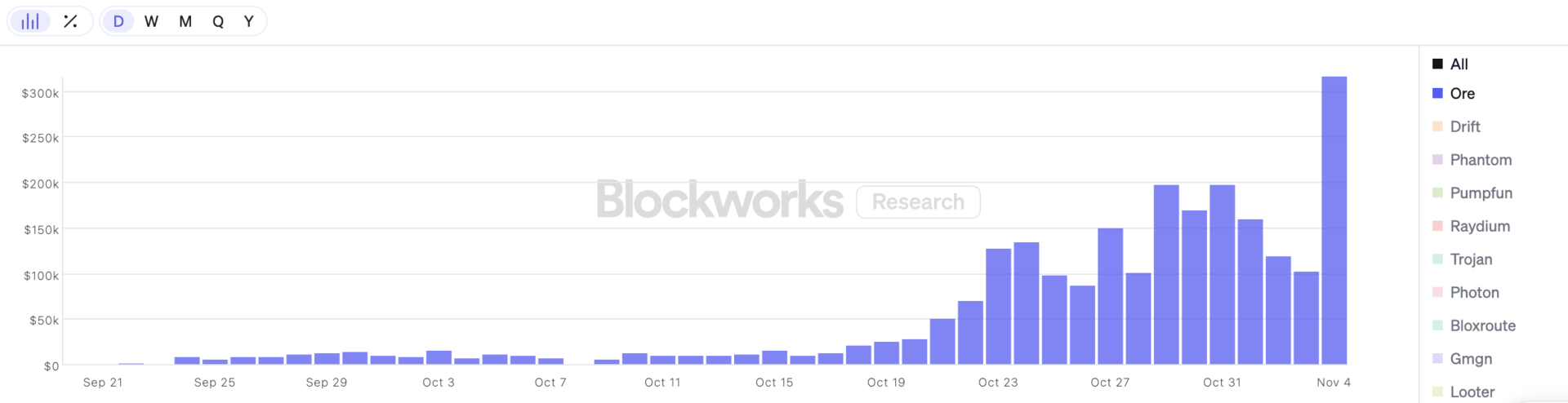

Data unequivocally supports this surge in popularity. According to Blockworks Research, Ore’s cumulative revenue had surpassed an impressive $1.689 million by November 6th. Prior to mid-October this year, its daily revenue had long languished at low levels, often hovering around a few thousand dollars. However, starting October 22nd, Ore’s daily revenue experienced an explosive growth, skyrocketing to over a hundred thousand dollars within just ten days. Its latest single-day revenue reached $316,000, marking an astonishing increase of approximately 576 times compared to its historical low of around $548. Furthermore, the protocol generated $1.094 million in revenue over the past week alone, accounting for 64.7% of its total cumulative earnings.

In tandem with this revenue explosion, the ORE token price has also demonstrated a powerful rally. CoinGecko data reveals that as of November 6th, ORE was trading at approximately $249, boasting a staggering 2,445.2% increase over the past 30 days. This surge marks a new annual high, pushing its latest market capitalization beyond $100 million.

Ore’s resurgence stems directly from the launch of its brand-new mining protocol on October 22nd. On that day, after months of silence, Ore’s official Twitter account announced its return with an entirely new mining protocol, aiming to achieve a sustainable token economic system and a robust protocol value capture mechanism, ultimately building a native store-of-value asset on the Solana blockchain.

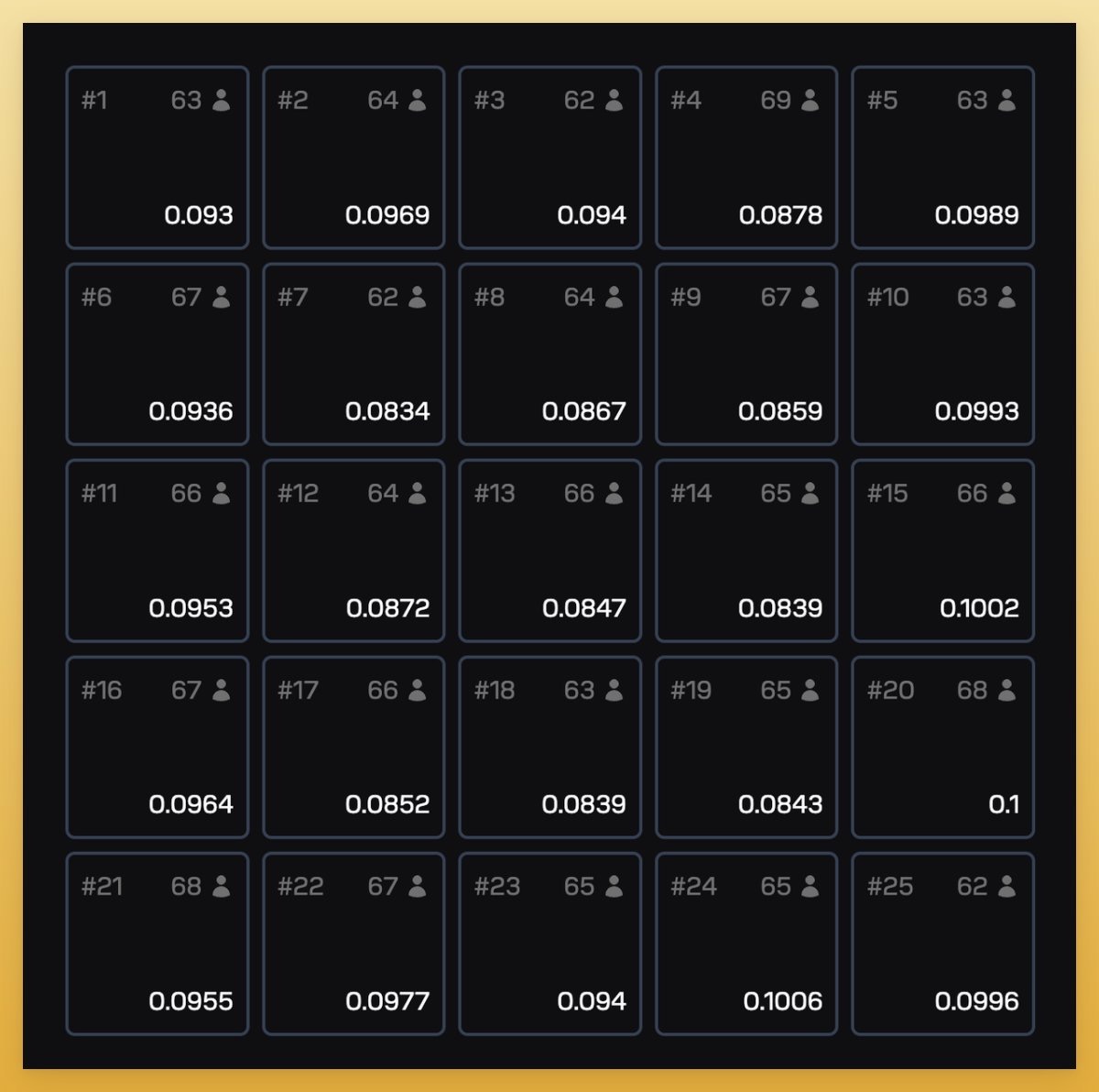

The new mining mechanism is ingeniously designed as an on-chain game. It operates on a 5×5 grid comprising 25 blocks, with each round lasting one minute. Miners can “occupy space” on the grid by staking SOL tokens. At the end of each round, the system randomly selects a winning block. All SOL staked in the other 24 non-winning blocks are then proportionally distributed to the miners within the winning block, based on the size of their occupied space. Additionally, one lucky miner in the winning block receives an extra 1 ORE as a reward (approximately every three rounds, a special round occurs).

Building on this foundation, the system introduces the “Motherlode” prize pool mechanism. Each mining round injects 0.2 ORE into this pool, with a 1/625 chance of triggering an additional jackpot. If not triggered, the prize pool continues to accumulate. Once triggered, the entire accumulated reward is distributed proportionally among the winners based on their contribution. This design functions similarly to a progressive jackpot, enhancing random incentives and encouraging long-term participation.

When miners withdraw their rewards, they incur a 10% “refining fee.” This fee is automatically and proportionally redistributed to other miners who have not yet withdrawn their rewards. This mechanism implies that the longer tokens are held, the higher the potential returns, thereby incentivizing long-term holding and mitigating selling pressure.

Furthermore, Ore automatically collects 10% of the SOL mining rewards as protocol revenue. Of this, 90% is burned, and the remaining 10% is distributed as yield to stakers. This ensures a continuous value flow back into the ecosystem.

According to official disclosures, the ORE token maintains its original maximum supply cap of 5 million, with a stable issuance rate of 1 ORE per minute on average. However, with the introduction of protocol revenue and an automatic buyback and burn mechanism, the net issuance can dynamically balance between inflation and deflation. If protocol revenue is sufficient, ORE could enter a deflationary phase. Dune data indicates that ORE has been in a deflationary state over the past 7 days, with its total supply decreasing by 400 tokens.

Evidently, compared to its earlier PoW mining model, Ore’s new mining protocol incorporates multiple optimizations in mechanism design, incentive structure, and economic sustainability.

Once Congested Solana, Earlier Updates Failed to Sustain Popularity

Ore originally launched as an innovative PoW mining protocol on Solana, developed by Regolith Labs, led by the anonymous developer Hardhat Chad. It emerged as a champion project from the Solana Renaissance Hackathon. Public records show that Regolith Labs completed a $3 million seed round in September 2024, attracting investments from notable firms including Foundation Capital, Colosseum, and Solana Ventures.

The project’s initial goal was to introduce a Bitcoin-style mining mechanism to the Solana network, aiming for fair and pre-mine-free token distribution. Users didn’t need specialized ASIC miners; ordinary devices like computers, tablets, or mobile phones could participate by solving cryptographic puzzles. This low-barrier design quickly garnered significant attention, making Ore a hot topic within the Solana ecosystem.

Upon the launch of Ore v1, user adoption was astonishingly rapid. It briefly became the highest-volume program on Solana, generating approximately 1 million transactions per hour at its peak. Some users reported daily earnings reaching thousands of dollars during peak periods, further fueling participation and driving the ORE price from an initial $93 to a peak of $3,786.

However, v1’s algorithm proved susceptible to exploitation. Some miners boosted their “hit rate” by submitting high-frequency transactions, leading to a deluge of spam transactions that severely congested the Solana network. Consequently, Ore was forced to temporarily halt mining. Hardhat Chad explained that it would take several weeks to assemble a team, research, and launch a v2 version. This adjustment also led to a recovery in ORE’s price.

In August 2024, Ore v2 relaunched mining, introducing several improvements to address v1’s pain points, including optimized anti-Sybil attack strategies, adjusted mining difficulty, and the introduction of a staking mechanism. However, mining yields fell short of expectations, causing the ORE price to steadily decline and its popularity to wane.

Ore’s latest mining mechanism, however, cleverly integrates elements of GameFi and DeFi, moving beyond the simplistic “mine-sell-withdraw” model. Through a delayed redemption mechanism, miners are incentivized to maintain continuous participation to maximize their benefits. It appears that a redemption rush would only be triggered when the reward pool nears the staking pool. Simultaneously, the protocol has significantly enhanced the sustainability of its economic model, making ORE more aligned with the market’s preference for deflationary narratives. Whether this renewed mining frenzy can be sustained, however, remains to be seen.

(The above content is excerpted and reprinted with authorization from our partner PANews, original link)

Disclaimer: This article is for market information purposes only. All content and opinions are for reference only, do not constitute investment advice, and do not represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not be liable for any direct or indirect losses incurred by investors’ transactions.