Taiwan’s Virtual Asset Leaders Unite for Public Education and Enhanced Security

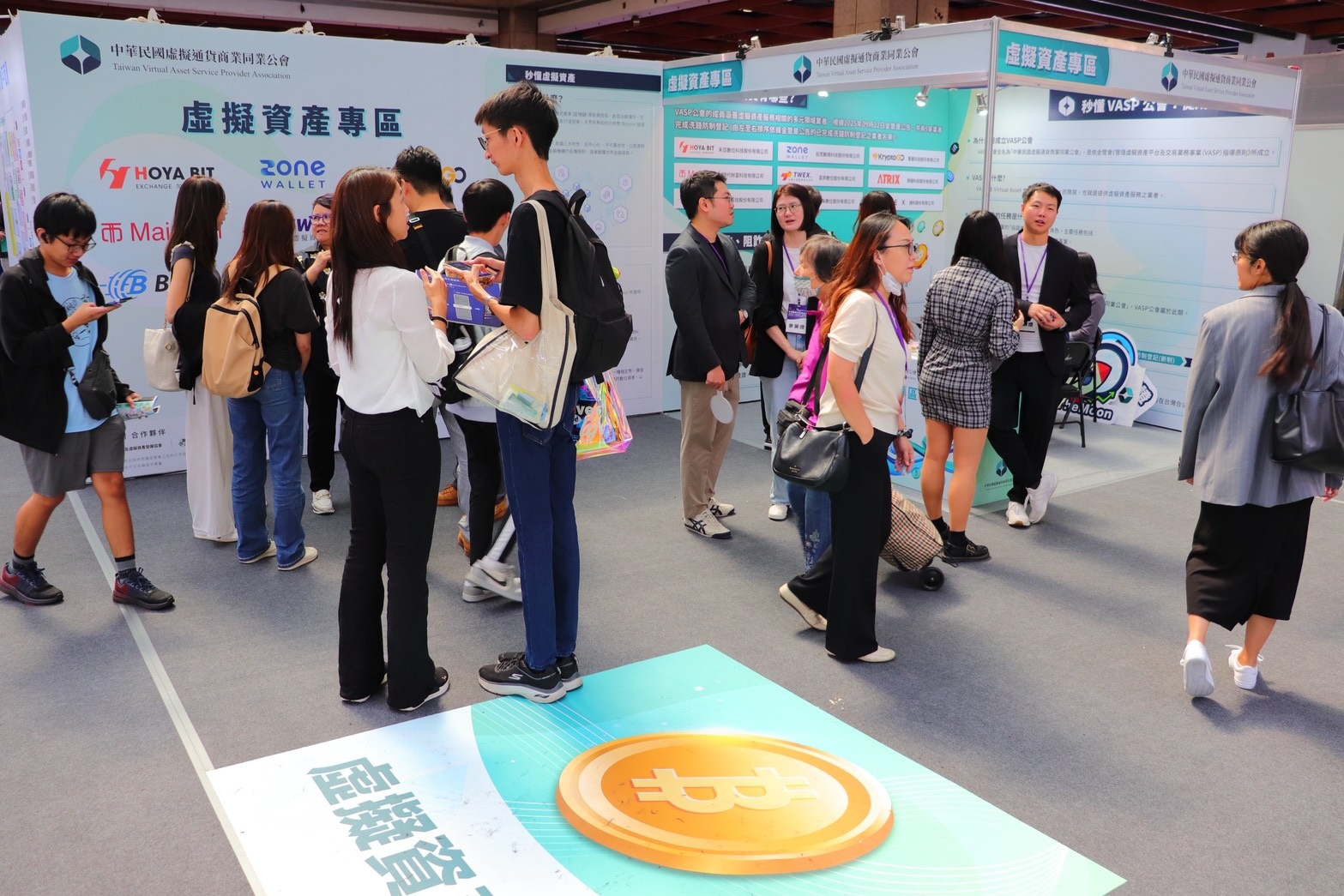

In a landmark move for Taiwan’s burgeoning digital economy, the nation’s legal virtual asset service providers (VASPs) have made their unprecedented “joint debut.” Orchestrated by the Taiwan Virtual Asset Commercial Association (VACA), this collective effort saw several operators—all having successfully completed the Financial Supervisory Commission (FSC)’s anti-money laundering (AML) registration—establish a dedicated “Virtual Asset Zone” (VASP Zone) at the prestigious Taipei International Financial Expo. This pioneering initiative is set to demystify virtual assets for the public, highlight legitimate platforms, promote secure investment practices, and usher in a new chapter of regulatory compliance and trust.

Combating Fraud: The Critical Role of Regulation and Education

As virtual assets increasingly integrate into mainstream financial systems globally, the shadow of fraud continues to loom large. Unscrupulous actors frequently exploit the innovative nature of digital assets, donning a “legal facade” to ensnare unsuspecting investors, leading to significant financial losses. This growing concern underscores the urgent need for robust regulatory frameworks and comprehensive public education.

The newly launched “Virtual Asset Zone” is a direct response to these challenges. Beyond showcasing the industry’s commitment to regulatory progress, it serves as a vital educational hub. Here, legal Taiwanese operators actively engage with the public, providing essential guidance on “how to identify legitimate exchanges” and “strategies for safe investment and fraud prevention.” The overarching goal is to dismantle prevailing misconceptions surrounding virtual assets and foster a more informed and secure investment environment.

As of September 22nd this year, the nine operators officially approved by the FSC for anti-money laundering registration include:

- HOYA BIT (Hoya Digital Technology)

- ZONE Wallet (Pioneer Digital Technology)

- KryptoGO (KryptoGO Technology)

- MaiCoin/MAX (Modern Wealth Technology)

- Taiwan Mobile Virtual Asset Exchange (Fu Sheng Digital)

- ATRIX (Cross-chain Technology)

- BitoPro (Bito Technology)

- HzBit (Hong Zhu Digital)

- XREX (XREX Inc.)

VACA: Charting the Course for Industry Coordination and Anti-Fraud Collaboration

Ms. Tsai Yu-Ling, Chief Consultant of VACA, reflected on the industry’s journey, acknowledging the “pioneering spirit and challenges overcome” by operators in laying the groundwork for Taiwan’s virtual asset market. She lauded their sustained efforts in compliance and innovation, emphasizing VACA’s crucial role as an “indispensable bridge” in forging industry consensus and facilitating effective oversight by regulatory authorities.

Mr. Cheng Kuang-Tai, Chairman of VACA, highlighted the profound significance of the “Virtual Asset Zone.” He stated, “This isn’t merely the first collective showcase of our operators; it symbolizes a new dawn for industry unity, collaborative effort, and the tangible implementation of compliance.”

Looking ahead, Chairman Cheng outlined VACA’s critical mandate: to support regulatory bodies in advancing the “Virtual Asset Service Act” and its eight accompanying sub-laws. Furthermore, the association is committed to integrating with cross-institutional information-sharing mechanisms, including joining the “Securities and Futures Anti-Fraud Consultation Hotline.” This strategic collaboration aims to construct a more comprehensive, cross-domain anti-fraud reporting system, thereby significantly bolstering industry trustworthiness and security.

Engaging the Public: Interactive Learning and Trust Building

The Virtual Asset Zone offers a dynamic and informative experience. Visitors can access a dedicated VACA consultation desk for general inquiries, alongside individual booths from various legal operators providing in-depth guidance on investment safety, fraud prevention, and real-time consultation. To enhance public engagement and understanding, the zone also features interactive check-in activities, inviting attendees to personally explore the unique services and features of each trading platform. This accessible approach is designed to cultivate accurate public perception and confidence in the virtual asset landscape.

Disclaimer: This article provides market information only. All content and views are for reference and do not constitute investment advice, nor do they represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.