CFTC Pushes for Leveraged Crypto Spot Trading in US: A New Era for Digital Assets

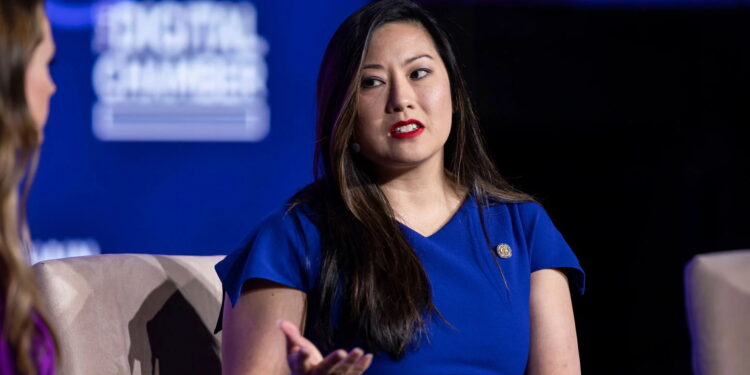

In a landmark move set to reshape the U.S. digital asset landscape, Caroline Pham, Acting Chair of the U.S. Commodity Futures Trading Commission (CFTC), has confirmed that the agency is actively engaging with several regulated exchanges. The goal? To facilitate the launch of “cryptocurrency spot products,” including crucial “leveraged trading” options, potentially as early as next month.

Pham, who currently leads the interim agency, is personally spearheading efforts to guide exchanges in developing compliant offerings, all while initiating a comprehensive reform of the CFTC itself.

A Proactive Regulatory Stance

A recent report by CoinDesk first brought these discussions to light, revealing that Caroline Pham has been in talks with various CFTC-approved “Designated Contract Markets (DCMs).” This diverse group includes established financial behemoths such as the Chicago Mercantile Exchange (CME), Chicago Board Options Exchange (Cboe), and Intercontinental Exchange (ICE), alongside prominent crypto-native players like Coinbase Derivatives, prediction market Kalshi, and Polymarket US.

Sources familiar with the discussions indicate that talks have centered on establishing frameworks for spot cryptocurrency products that incorporate margin, leverage, and financing. Concurrently, the CFTC is reportedly considering issuing specific guidelines to clarify the “operational details” for these transactions, ensuring robust implementation.

Confirmation from the Top

Caroline Pham herself publicly confirmed the CoinDesk report on social media platform X, retweeting the article with a succinct “True.”

— Caroline D. Pham (@CarolineDPham) November 9, 2025

In a subsequent statement, Pham articulated the CFTC’s strategy: “While working with Congress to advance legislative clarity, we are also leveraging existing regulatory authority to accelerate the implementation of policy recommendations from the ‘President’s Digital Asset Markets Working Group Report’.”

Leveraging Existing Authority: The Commodity Exchange Act

This bold stance signifies the CFTC’s commitment to proactive regulation, utilizing its existing authority under the Commodity Exchange Act rather than awaiting new congressional mandates. The Act’s provisions stipulate that all “retail commodity transactions” involving leverage, margin, or financing must be conducted on regulated exchanges.

Should these plans come to fruition, it would open the door for U.S. investors to engage in fully compliant leveraged spot cryptocurrency trading. For instance, with 5x leverage, a trader could manage a Bitcoin position worth $5,000 using just $1,000 of their own capital.

Elevating Market Standards and Investor Protection

While leveraged crypto products are commonplace on offshore platforms, their introduction onto CFTC-regulated exchanges would mark a pivotal moment. It would, for the first time, usher in institutional-grade oversight, robust risk management, and enhanced investor protection mechanisms for leveraged cryptocurrency trading within the U.S. market.

Future Outlook

The CoinDesk report also speculated on Caroline Pham’s future, suggesting she is expected to join the cryptocurrency payments company MoonPay as Chief Legal Officer (CLO) and Chief Administrative Officer (CAO) after her term at the CFTC concludes. However, Pham’s public statements did not address this particular rumor.

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views and positions of BlockTempo. Investors should make their own decisions and trades. The author and BlockTempo will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.