Authored by Ignas, DeFi; Compiled by CryptoLeo

The Great Rotation: Bitcoin’s Victory and the Shifting Crypto Landscape

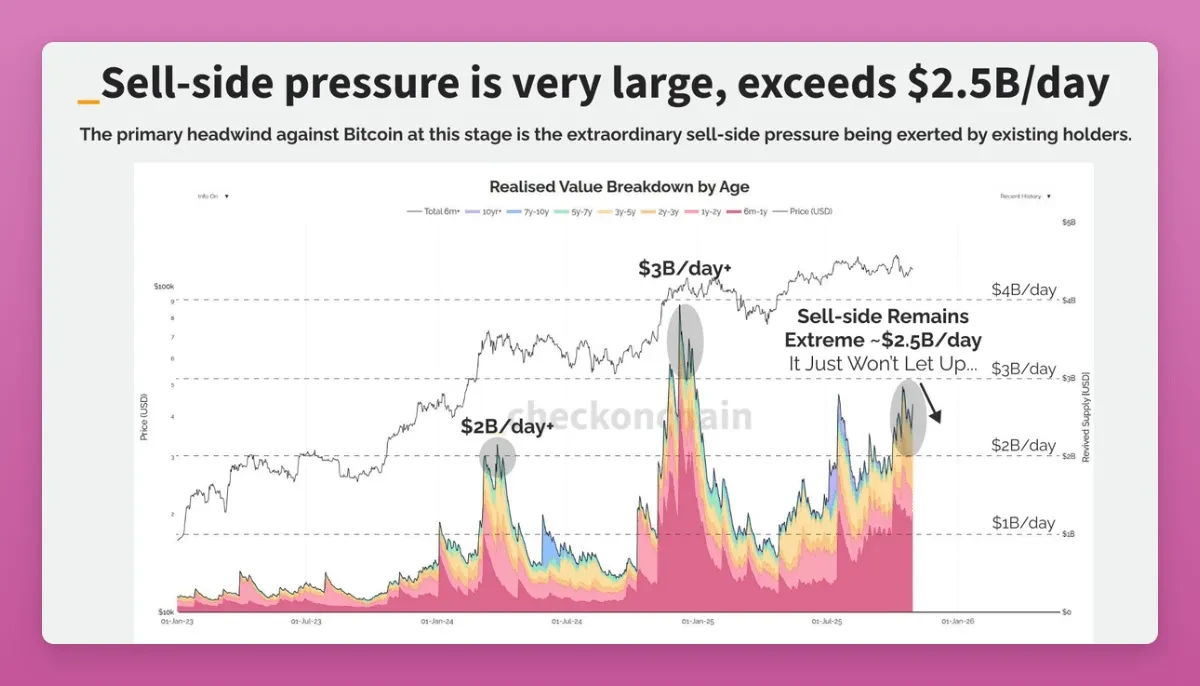

Despite a confluence of bullish catalysts—including the landmark approval of Bitcoin spot ETFs, accelerating institutional adoption, the passage of the GENIUS Act, and the impending Clarity Act—Bitcoin’s price has remained remarkably range-bound. This intriguing stability persists amidst a landscape free from major regulatory crackdowns, crippling hacks, or fundamental narrative collapses, yet overall market liquidity appears constrained.

According to Ignas, a prominent voice in the DeFi space, this perplexing market behavior signals a profound structural transformation: a “Great Rotation.” This isn’t a sign of weakness, but rather a healthy, natural evolution where early Bitcoin investors are systematically de-risking and realizing profits, while a new wave of sophisticated investors strategically buys the dips. This process is fundamentally reshaping the ownership landscape of digital assets.

Key Insights from the Great Rotation Theory:

- Early Bitcoin adopters are strategically converting their long-held gains into realized profits.

- This shift represents a deliberate, non-panicked transition from concentrated “whale” ownership to a more distributed and mature holder base.

- Among all traceable on-chain indicators, significant selling activity from large, early holders stands out as the most obvious signal.

A Closer Look at Bitcoin (BTC)

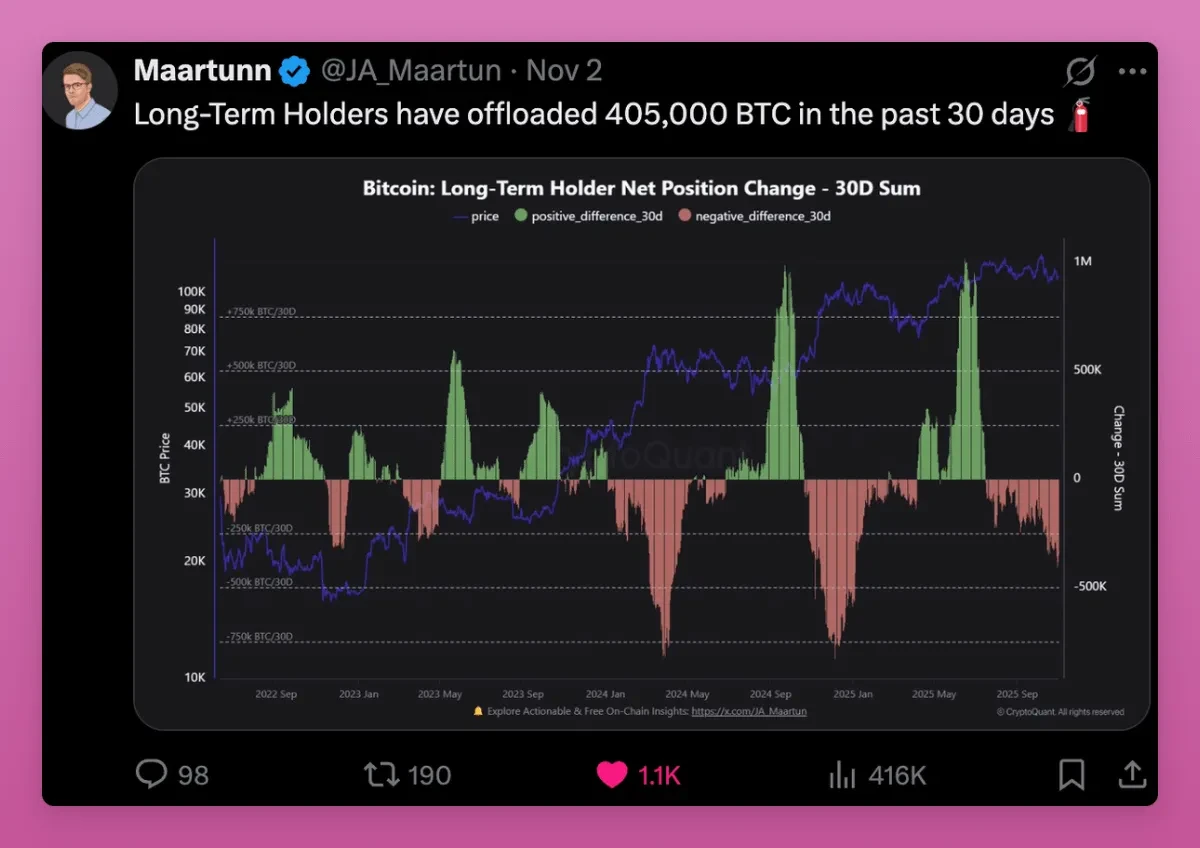

Over the past 30 days, long-term Bitcoin holders have divested approximately 405,000 BTC, a substantial sum representing 1.9% of the total circulating supply. This significant movement of capital underscores the ongoing re-distribution of wealth within the Bitcoin ecosystem.

A compelling case study is Owen Gunden, a legendary early Bitcoin whale. Known for his substantial trading activity on Mt.Gox and his role as a LedgerX board member, Gunden’s associated wallets once held over 11,000 BTC, positioning him among the largest individual on-chain holders. Recent on-chain analysis reveals his wallets have initiated large transfers of BTC to Kraken in multiple tranches—a pattern typically indicative of selling. Analysts suggest he may be preparing to liquidate a significant portion of his holdings, potentially exceeding $1 billion in value.

While Gunden has maintained a low profile on social media since 2018, his actions align perfectly with the “Great Rotation” thesis. This phenomenon sees some early holders transitioning into Bitcoin ETFs for tax efficiencies, while others strategically diversify their portfolios, perhaps exploring alternative assets like Zcash (ZEC).

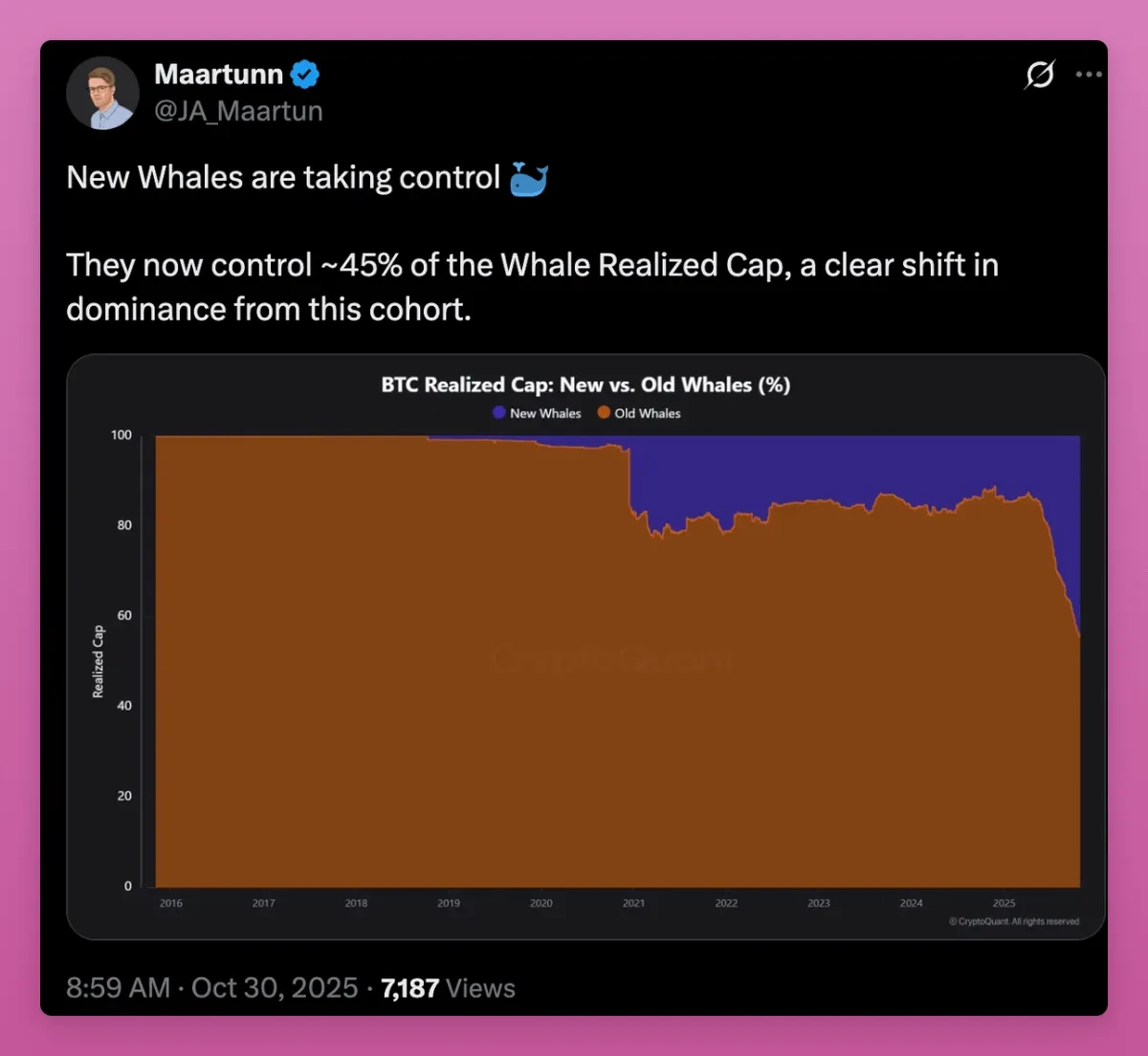

As Bitcoin’s supply shifts from these pioneering whales to a new cohort of buyers, the average cost basis for BTC continues its upward trajectory, indicating that new, higher-cost holders are increasingly influencing the market dynamics.

This upward trend in the average cost basis, moving from early miners to institutional ETF buyers and other new entrants, is clearly reflected in the climbing Market Value to Realized Value (MVRV) ratio. For context, MVRV, a crucial on-chain valuation metric developed by Murad Mahmudov and David Puell in 2018, assesses whether Bitcoin is overvalued or undervalued by comparing its current market price to the average cost basis of all coins.

Initially, some might interpret this as a bearish indicator. It suggests that while established whales have enjoyed immense profits over the years, many new entrants are currently holding at a loss. With Bitcoin’s average cost basis now nearing $110,800, there’s a natural concern that sustained underperformance could lead to capitulation from these newer investors.

However, the escalating MVRV ratio, in this context, signals a healthy dispersion of ownership and a maturation of the asset. Bitcoin is transitioning from a highly concentrated asset held by a few ultra-low-cost pioneers to a more diversified pool of holders with a higher, yet more sustainable, cost basis. This structural shift is, in fact, a fundamentally bullish signal for Bitcoin’s long-term trajectory. But what about beyond Bitcoin?

Ethereum’s Chip Handover: A Parallel Evolution?

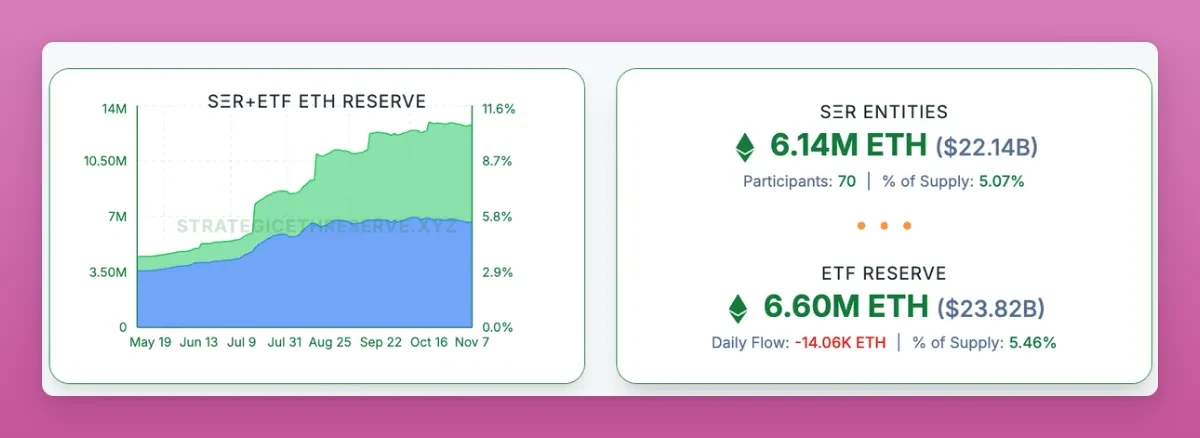

Can Ethereum (ETH) demonstrate a similar “Great Rotation” pattern? Such a phenomenon could partially explain ETH’s perceived price lag relative to Bitcoin. In many respects, Ethereum has also achieved significant milestones: like Bitcoin, it now boasts ETF products, Digital Asset Trusts (DATs), and increasing institutional interest, albeit with distinct characteristics.

Data suggests Ethereum is undergoing a comparable, albeit earlier and more complex, transitional phase. Intriguingly, ETH is rapidly catching up to BTC in terms of institutional adoption: approximately 11% of all ETH is currently held within DATs and ETFs.

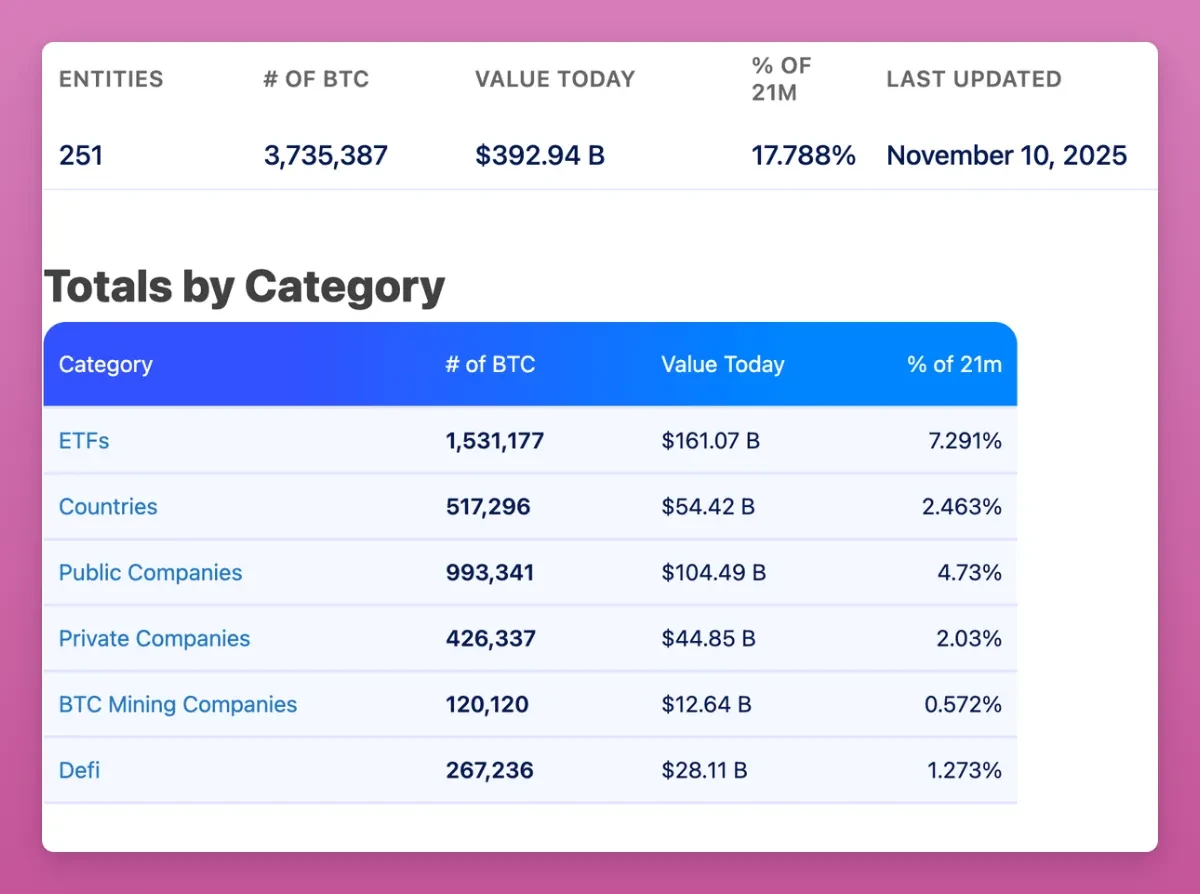

While Bitcoin benefits from a larger institutional footprint, with roughly 17.8% of its supply held by spot ETFs and major corporate treasuries (a testament to figures like Michael Saylor’s long-term conviction), Ethereum is clearly gaining momentum in this arena.

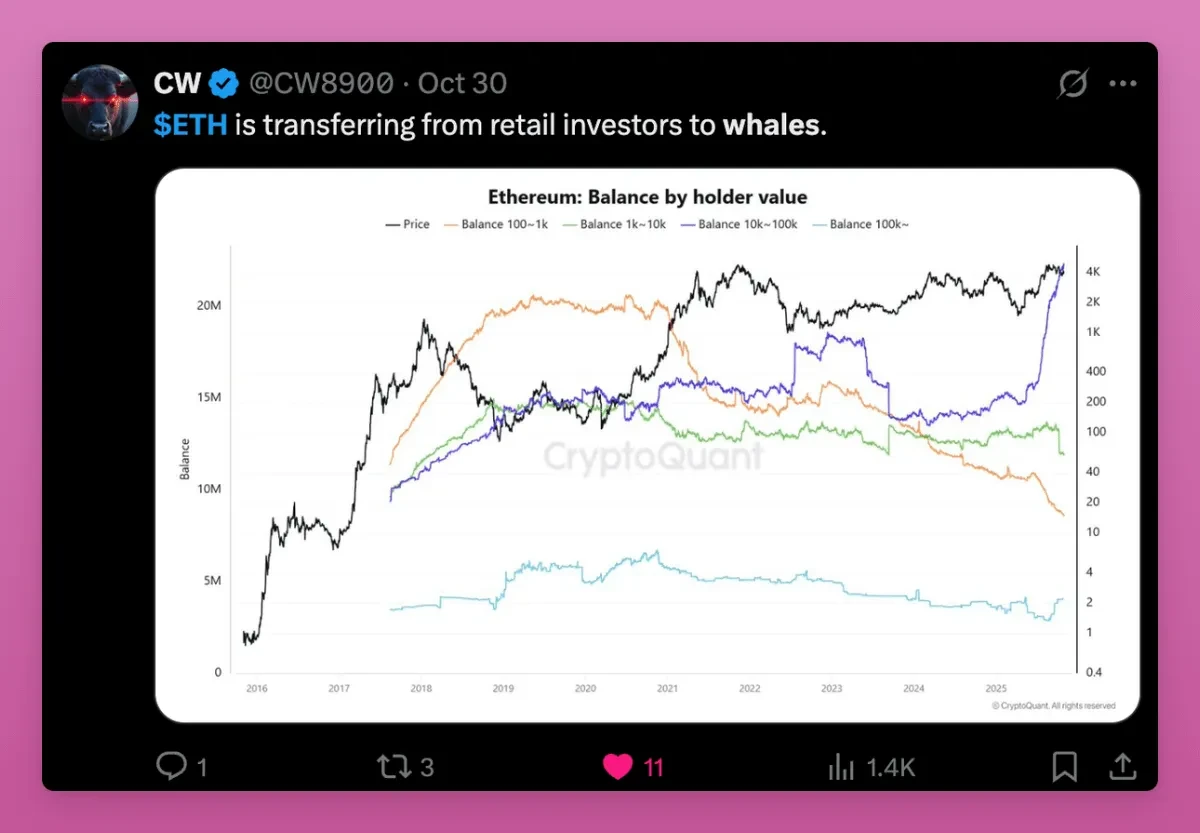

Identifying a precise “whale-to-new-whale” rotation for ETH, similar to BTC, proves challenging. As noted by CryptoQuant’s Ki Young Ju, Ethereum’s account-based model differs significantly from Bitcoin’s UTXO model, making direct statistical comparisons difficult. Nevertheless, a distinct pattern emerges: while Bitcoin’s rotation is primarily between established and new whales, Ethereum’s major shift appears to be from retail investors to larger, more sophisticated holders.

The chart below further illustrates this trend of ETH ownership consolidating from retail hands into those of whales.

The realized price for large accounts (holding over 100,000 ETH) is experiencing a rapid ascent. This indicates that new, substantial buyers are entering the market at higher price points, while smaller retail holders are divesting. Crucially, all the lines representing different wallet sizes (orange, green, purple) are now converging, signifying a homogenization of the cost basis across various holder groups. This convergence suggests a comprehensive reset of the cost basis, where older tokens have transferred into the hands of new holders.

Such a cost basis reset is a critical precursor to the conclusion of an accumulation cycle and subsequent significant price appreciation. Structurally, it signals that Ethereum’s supply is migrating into stronger, more committed hands, presenting a decidedly bullish outlook for ETH.

Several factors underpin this strategic shift:

- Retail investors are divesting, while whales and institutional funds are accumulating. This is driven by the increasing prevalence of stablecoins and tokenization, the emergence of staking ETFs, and broader institutional engagement.

- Retail often views ETH as mere “gas,” losing conviction as other Layer 1s emerge. In contrast, sophisticated investors perceive ETH as yield-generating collateral, accumulating it for long-term on-chain returns.

- During Bitcoin’s period of clear dominance, Ethereum remained in a regulatory “grey area,” giving whales an early advantage before broader institutional entry.

The synergy of ETFs and DATs is making Ethereum’s holder base increasingly institutional. However, whether these new institutional players are inherently long-term growth-oriented remains to be seen. A notable concern is “ETHZilla” (likely referring to an entity like Grayscale’s ETHE) announcing ETH sales to repurchase its own shares. While not a cause for panic, it establishes a precedent for such actions.

In essence, Ethereum also aligns with the “Great Rotation” theory. Its structure appears less straightforward than Bitcoin’s due to its more diverse holder base, broader range of use cases (e.g., liquid staking consolidating into large wallets), and a multitude of reasons for holders to transfer tokens on-chain.

Solana’s Chip Movement: Following the Trail

Pinpointing Solana’s (SOL) exact stage within the Great Rotation theory presents unique challenges, particularly in clearly identifying institutional wallets or major holders. Nevertheless, discernible patterns are emerging.

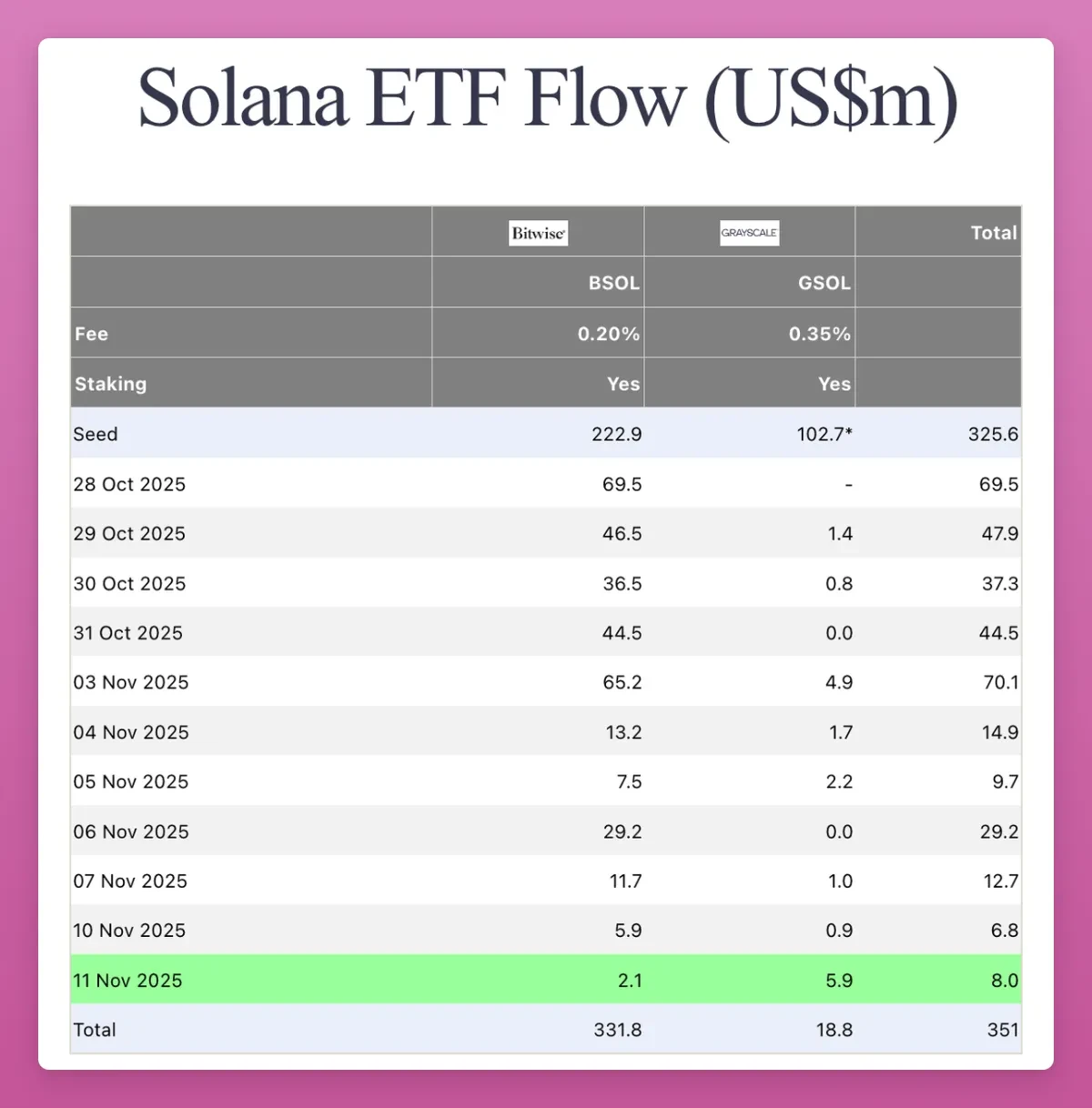

Solana is now entering a similar phase of institutionalization as Ethereum. Last month, a SOL spot ETF quietly debuted, garnering positive, albeit not exceptionally high, daily inflows totaling $351 million. This quiet entry signifies a growing acceptance within traditional finance.

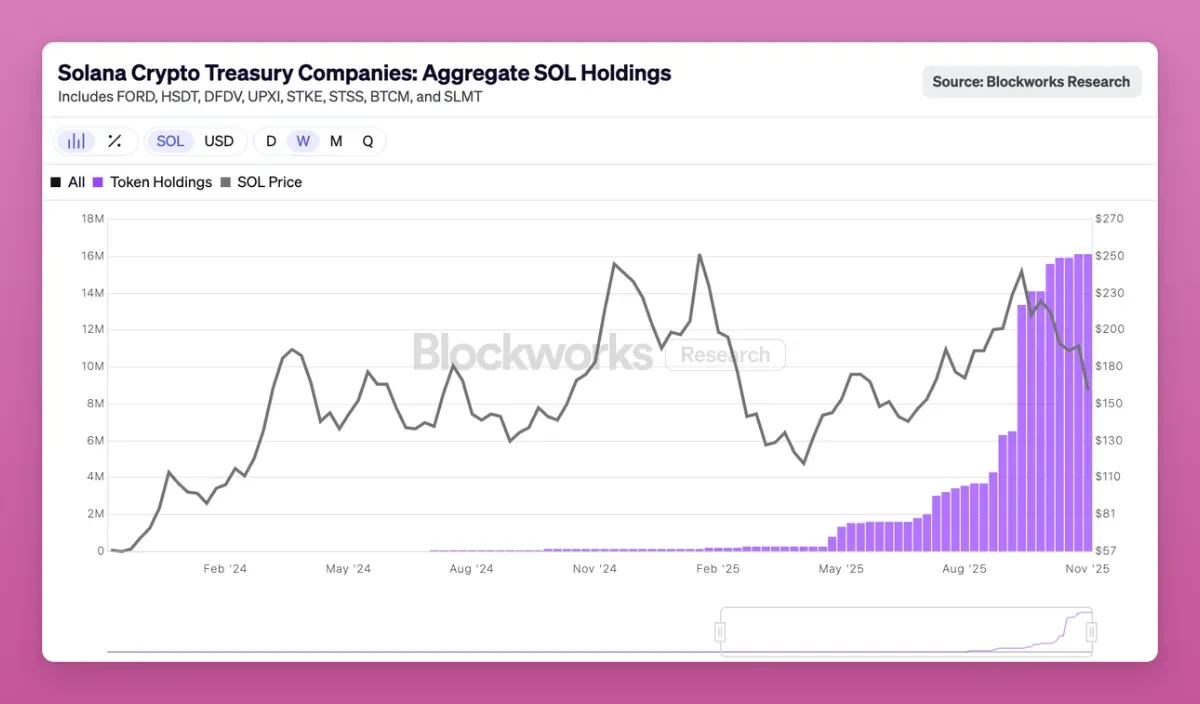

Furthermore, several DAT companies have begun acquiring substantial amounts of SOL:

Currently, an estimated 2.9% of all circulating SOL, valued at $2.5 billion, is held within DAT structures. (For more detailed information on SOL DAT structures, Helius provides an insightful article).

This indicates that Solana is progressively attracting the same TradFi infrastructure investors—including regulated funds and treasury companies—that have embraced Bitcoin and Ethereum, albeit on a smaller scale. While SOL’s on-chain data can be complex, a clear concentration remains among early insiders and venture capital wallets. These tokens are gradually migrating into the hands of new institutional buyers through ETFs and treasury vehicles.

The Great Rotation has indeed reached Solana, albeit operating on a slightly delayed cycle compared to its predecessors. Therefore, if the rotations for Bitcoin and, to some extent, Ethereum are nearing completion—potentially signaling imminent price surges—then Solana’s trajectory becomes more predictable.

What Happens Next: A New Paradigm for Crypto Cycles

The “Great Rotation” unfolds sequentially: Bitcoin leads, Ethereum follows with a slight lag, and Solana trails further behind. This begs the crucial question: where are we in the current market cycle?

Previous cycles often followed a straightforward pattern: Bitcoin surged first, then Ethereum, creating a cascading “wealth effect.” Profits from these major cryptocurrencies would then flow into lower-cap altcoins, uplifting the entire market.

This cycle, however, presents a different narrative.

Bitcoin appears to be in a phase of consolidation. Even with price increases, early players are either transitioning into ETFs or cashing out to improve their lives outside of crypto. This results in a muted wealth effect and limited spillover into the broader altcoin market. The lingering “PTSD” from events like FTX means investors are more cautious, and genuine hard work continues to be the primary driver.

Altcoins are no longer merely vying for monetary status alongside Bitcoin. Instead, they are competing fiercely on utility, yield generation, and speculative potential. Most projects, however, struggle to meet these stringent criteria. The categories poised for success in this evolving landscape include:

- Blockchains demonstrating genuine, widespread adoption: Ethereum, Solana, and perhaps one or two other robust contenders.

- Products generating tangible cash flow or offering real value appreciation.

- Assets fulfilling unique demands that Bitcoin cannot address (e.g., Zcash for enhanced privacy).

- Infrastructure protocols capable of attracting significant fees and user attention.

- Stablecoins and Real-World Assets (RWAs).

The crypto space will undoubtedly continue to be a hotbed of innovation and experimentation. Identifying these nascent “hot spots” will be crucial, as everything else risks becoming mere market noise.

Uniswap’s decision to activate its fee switch represents a pivotal moment. While not the first, it is arguably the most prominent DeFi protocol to take this step, compelling others to follow suit and begin distributing fees (or conducting token buybacks) to their token holders.

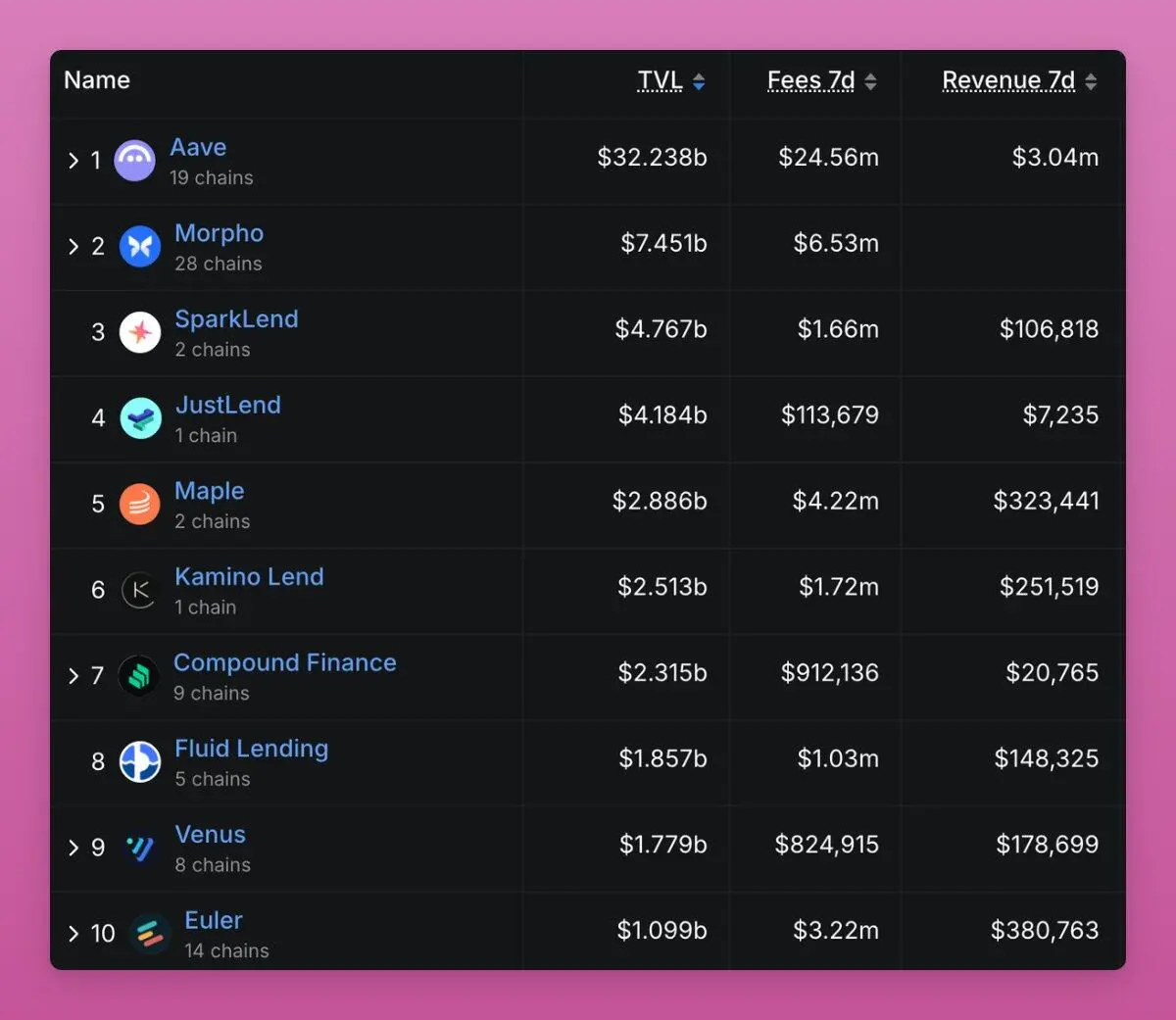

Already, five out of ten leading lending protocols have initiated revenue sharing with their token holders.

Consequently, Decentralized Autonomous Organizations (DAOs) are evolving into on-chain companies, where token value is intrinsically linked to the revenue they generate and redistribute. This fundamental shift points to where the next significant capital rotation will occur.