Authored by Tiger Research, this report delves into the escalating skepticism surrounding the cryptocurrency market as it navigates a perceived downturn. The central question looming over investors and innovators alike is: have we truly entered another crypto winter?

Navigating the Crypto Landscape: Is This a Winter, a Spring, or a New Era?

Key Insights

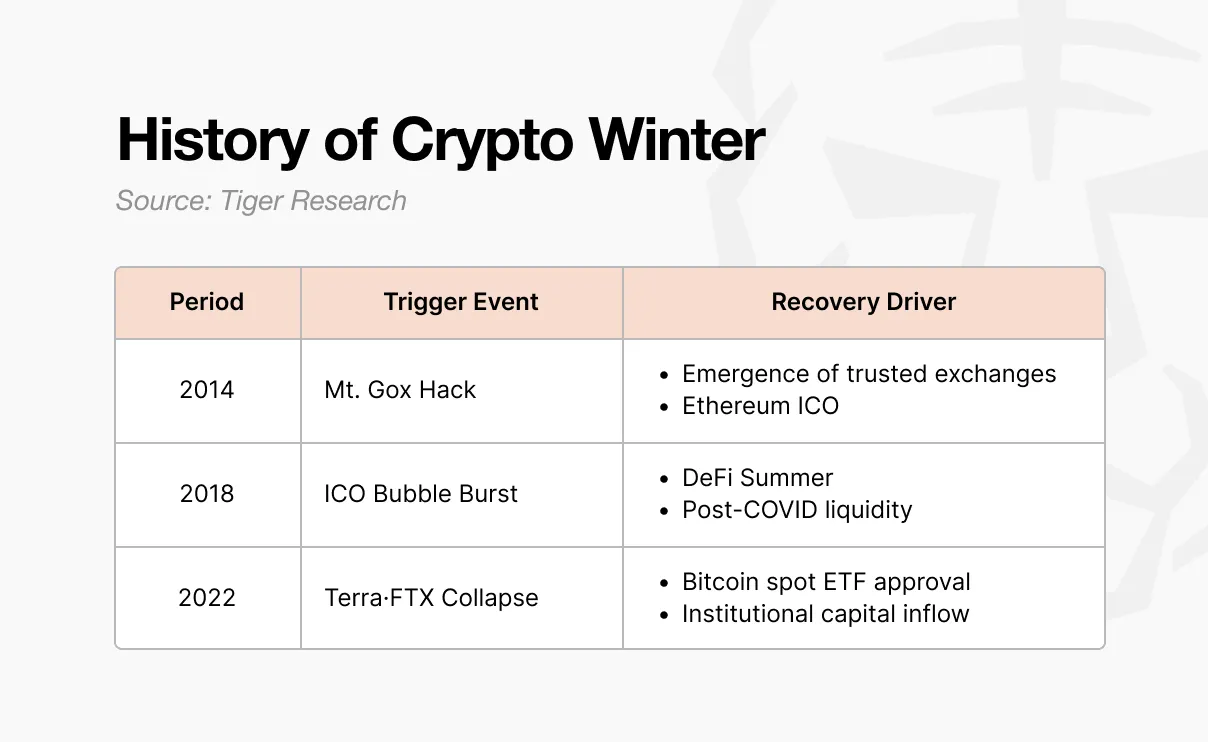

- Crypto winters historically follow a distinct sequence: a major catalyzing event, followed by a collapse of trust, culminating in a talent drain.

- Unlike previous downturns driven by internal industry failures, the current market fluctuations are primarily influenced by external macroeconomic factors, positioning us in a unique phase—neither a deep winter nor a full-blown spring.

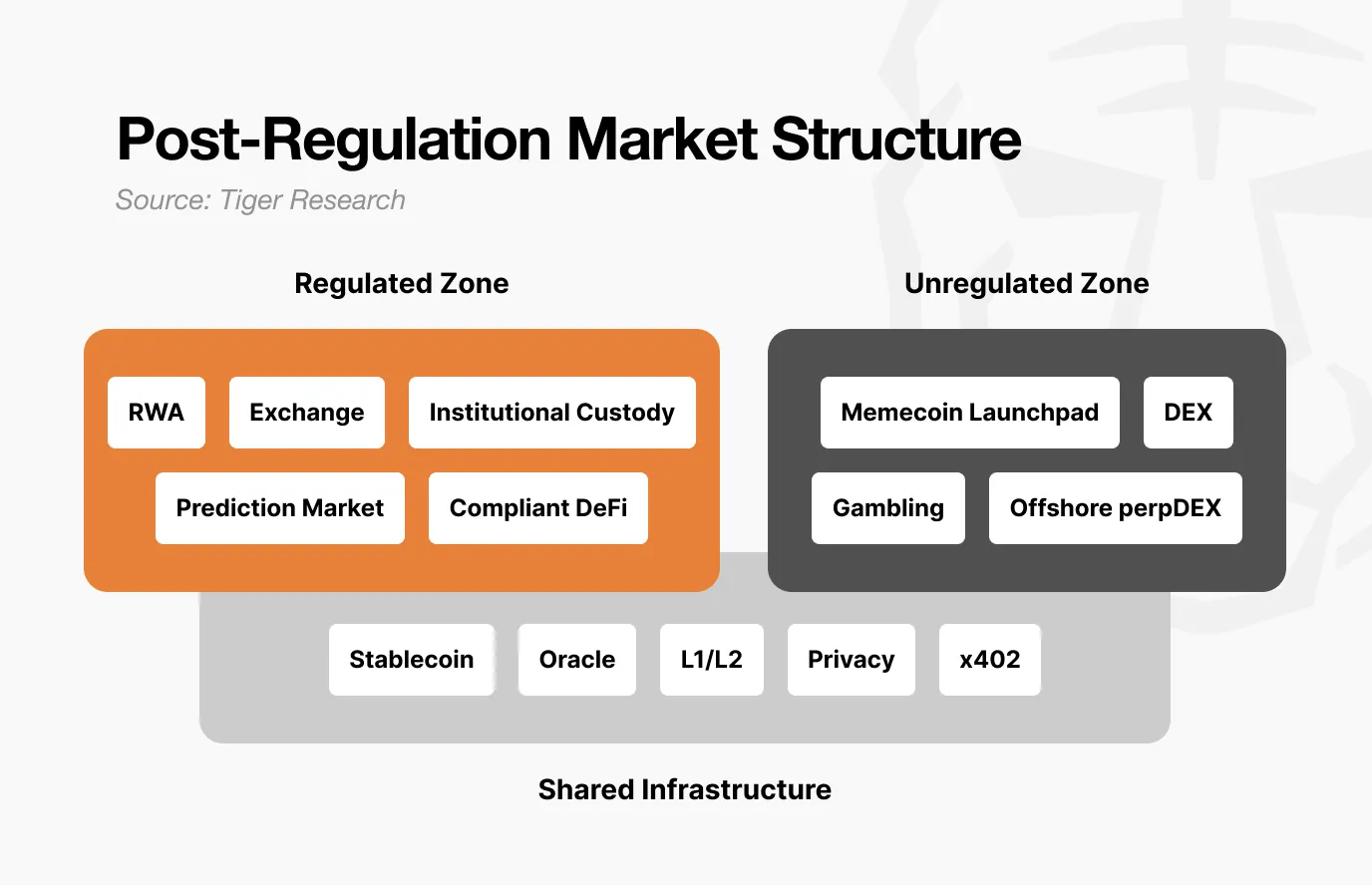

- The market has fundamentally restructured post-regulation, segmenting into regulated zones, unregulated innovation hubs, and shared infrastructure. This new paradigm has effectively dissolved the traditional “trickle-down” effect of capital.

- Funds flowing into Bitcoin via ETFs tend to remain within the regulated ecosystem, indicating a shift in institutional capital behavior.

- The advent of the next significant bull market hinges on the emergence of groundbreaking “killer applications” and a supportive global macroeconomic environment.

1. Unpacking Past Crypto Winters: A Historical Perspective

Source: Tiger Research

The cryptocurrency market’s inaugural winter struck in 2014. This period was largely defined by the catastrophic collapse of Mt. Gox, which, at its peak, processed 70% of global Bitcoin transactions. A devastating hack led to the disappearance of approximately 850,000 Bitcoins, shattering market confidence. From the ashes, however, a new generation of exchanges emerged, fortified with robust internal controls and audit mechanisms, gradually restoring trust. This era also saw the groundbreaking entry of Ethereum via its Initial Coin Offering (ICO), opening unprecedented avenues for project vision and fundraising.

The ICO phenomenon proved to be the spark for the subsequent bull market. The ease with which anyone could issue tokens and raise capital fueled the exuberant boom of 2017. Billions of dollars poured into countless projects, many of which were little more than whitepapers, ultimately lacking substantive development or utility.

The bubble inevitably burst in 2018, ushering in the second crypto winter. Regulatory crackdowns in South Korea, China, and the United States precipitated a sharp market correction. This period of stagnation persisted until 2020. The onset of the COVID-19 pandemic, paradoxically, injected massive liquidity into global markets. This influx, coupled with the rise of decentralized finance (DeFi) protocols like Uniswap, Compound, and Aave, reignited investor interest and brought capital back into the crypto space.

The third winter, commencing in 2022, was arguably the most brutal. The spectacular collapse of Terra-Luna triggered a domino effect, leading to the failures of major entities such as Celsius, Three Arrows Capital, and FTX. This wasn’t merely a price correction; it was a systemic shock that fundamentally challenged the industry’s structure. However, a turning point arrived in January 2024 with the U.S. SEC’s approval of spot Bitcoin Exchange Traded Funds (ETFs). This, alongside the Bitcoin halving and emerging pro-crypto political stances (e.g., Trump’s policies), once again drew significant capital into the market.

2. The Crypto Winter Blueprint: A Recurring Pattern of Collapse

A striking consistency defines all three historical crypto winters: each began with a major disruptive event, which then eroded trust, ultimately leading to a significant talent drain.

The cycle invariably commences with a seismic event. Whether it was the Mt. Gox hack, the widespread regulatory reforms impacting ICOs, the Terra-Luna implosion, or the FTX bankruptcy, each incident, despite its unique scale and nature, plunged the entire market into profound panic.

The initial shock swiftly propagates, triggering a profound collapse of trust. Discussions about future innovations give way to existential questions about the very legitimacy and utility of cryptocurrency. The collaborative spirit among developers dissipates, replaced by an atmosphere of blame and finger-pointing over accountability.

This pervasive doubt inevitably culminates in a talent drain. The very builders and innovators who had previously propelled the blockchain space forward begin to question its viability. In 2014, many pivoted to fintech and established tech giants. By 2018, the exodus shifted towards traditional financial institutions and the burgeoning field of artificial intelligence. These departures were driven by a search for perceived stability and more robust opportunities.

3. Is This Truly a Crypto Winter? Dissecting the Current Market

While echoes of past crypto winter patterns are discernible today, a crucial distinction exists.

- Major Events:

- The Trump Meme Coin issuance, which saw its market cap surge to $27 billion in a single day before plummeting by 90%.

- The “10.11 Liquidation Event,” where the U.S. announcement of a 100% tariff increase on Chinese goods triggered Binance’s largest historical liquidation event, amounting to $19 billion.

- Trust Collapse: Skepticism is indeed spreading across the industry, with attention shifting from product development to internal recriminations.

- Talent Drain Pressure: The rapid advancements in the artificial intelligence sector present a compelling alternative, promising potentially quicker returns and greater wealth compared to crypto.

However, labeling the current environment a “crypto winter” might be a mischaracterization. Previous winters were largely self-inflicted wounds: a hacked exchange, widespread ICO scams, or the outright fraud of FTX. The industry’s internal failings were the primary drivers of lost trust.

The present situation tells a different story.

The approval of Bitcoin ETFs sparked a bull run, while subsequent tariff policies and interest rate fluctuations have triggered the recent downturn. This indicates that external macroeconomic forces are now both propelling and constraining the market.

Source: Tiger Research

Crucially, the builders are still here.

Innovations like Real World Assets (RWA), Perpetual Decentralized Exchanges (PerpDEX), prediction markets, InfoFi, and privacy-enhancing solutions continue to emerge and evolve. While these new narratives may not have shaken the entire market with the same intensity as early DeFi, they have not vanished. The industry itself is not in collapse; rather, the external operating environment has fundamentally shifted.

In essence, if we haven’t experienced a true “spring” driven by internal industry growth, then the concept of a “winter” in the traditional sense may not apply.

4. A New Dawn: Reshaping the Market in a Regulated Era

Underpinning this unique market phase is a profound structural transformation brought about by increasing regulation. The market has distinctly segmented into three tiers: 1) Regulated Zones, 2) Unregulated Innovation Hubs, and 3) Shared Infrastructure.

Source: Tiger Research

The Regulated Zones encompass areas like RWA tokenization, centralized exchanges, institutional custody solutions, compliant prediction markets, and regulated DeFi. These segments demand rigorous auditing, transparent disclosures, and robust legal protections. While their growth trajectory may be slower, they attract substantial, stable institutional capital.

However, operating within these regulated frameworks means that the explosive, often 100x gains seen in the past are unlikely. Volatility is significantly reduced, limiting both extreme upside potential and severe downside risks.

Conversely, the Unregulated Innovation Hubs are poised to become even more speculative. With low barriers to entry and rapid price swings, it will be common to witness assets surge 100x in a day only to plummet 90% the next.

Yet, these unregulated spaces are far from insignificant. They serve as fertile testing grounds, fostering creativity and birthing novel industries. Once validated and matured, successful innovations from these hubs can transition into regulated zones—a path already forged by DeFi and now being followed by prediction markets. The demarcation between these dynamic, unregulated testbeds and the more established, regulated industries will become increasingly fluid.

Shared Infrastructure, including stablecoins and oracles, forms the connective tissue across both regulated and unregulated environments. Whether it’s institutional RWA payments or transactions on platforms like Pump.fun, they often leverage the same USDC. Similarly, oracles provide critical data for everything from tokenized bond verification to anonymous DEX liquidations.

This market segmentation has fundamentally altered capital flows.

Historically, a surge in Bitcoin prices would trigger a “trickle-down effect,” lifting other cryptocurrencies. This is no longer the case. Institutional capital entering via ETFs largely remains within Bitcoin, confined to the regulated sphere. Funds within regulated zones are unlikely to flow into their unregulated counterparts. Liquidity now gravitates only to assets where value has been rigorously verified. Even then, Bitcoin’s long-term value as a safe asset, relative to risk assets, is still being proven.

5. Charting the Course: Conditions for the Next Crypto Bull Run

With regulatory frameworks gradually solidifying and developers continuing to build, two critical elements remain to ignite the next bull market.

Firstly, the unregulated domain must give rise to truly novel “killer applications.” These innovations must deliver unprecedented value, akin to the transformative “DeFi Summer” of 2020. While concepts like AI agents, InfoFi, and on-chain social platforms are promising candidates, their current scale isn’t sufficient to propel the entire market. We need to re-establish a clear pathway where experimental successes in unregulated spaces are validated and seamlessly transition into regulated environments, much like DeFi and, more recently, prediction markets have demonstrated.

Secondly, a favorable macroeconomic environment is paramount. Even with regulatory clarity, active development, and robust infrastructure, the industry’s growth potential remains constrained without supportive global economic conditions. The explosive growth of “DeFi Summer” in 2020 coincided with massive liquidity injections post-COVID-19. Similarly, the rally following the 2024 ETF approvals was buoyed by market expectations of interest rate cuts. Regardless of the crypto industry’s internal strengths, it cannot dictate global interest rates or liquidity. For widespread adoption and recognition, an improvement in the broader macroeconomic landscape is indispensable.

The traditional “crypto bull market,” characterized by a synchronized surge across all cryptocurrency prices, is unlikely to recur. The market has irrevocably diversified. While regulated sectors will experience steady, stable growth, unregulated segments will continue to be marked by extreme volatility.

The next bull market will eventually arrive, but its benefits will not be universally distributed.

(The content above is an authorized excerpt and reproduction from our partner PANews. Original Article Link | Source: Tiger Research)

Disclaimer: This article is provided for market information purposes only. All content and views are for reference and do not constitute investment advice. They do not represent the views or positions of BlockBeats. Investors are solely responsible for their own decisions and trades. The author and BlockBeats disclaim all liability for any direct or indirect losses incurred by investors as a result of their transactions.