Bitcoin’s Deep Dive: Unpacking the Bear Market and Pinpointing the Potential Bottom

Bitcoin has been on a persistent downward trajectory, recently settling around the $64,000 mark. This sustained decline has left many investors grappling with the crucial question: “How much further will this bear market extend?” BTC has now shed nearly 48% from its peak, a magnitude of decline reminiscent of significant historical market events such as the Luna collapse and the FTX bankruptcy. Several catalysts are fueling this downturn, including substantial institutional investor withdrawals from Exchange-Traded Funds (ETFs)—totaling $12 billion in outflows over just three months—a surge in global risk aversion, and a perceived lack of compelling new narratives within the broader crypto ecosystem.

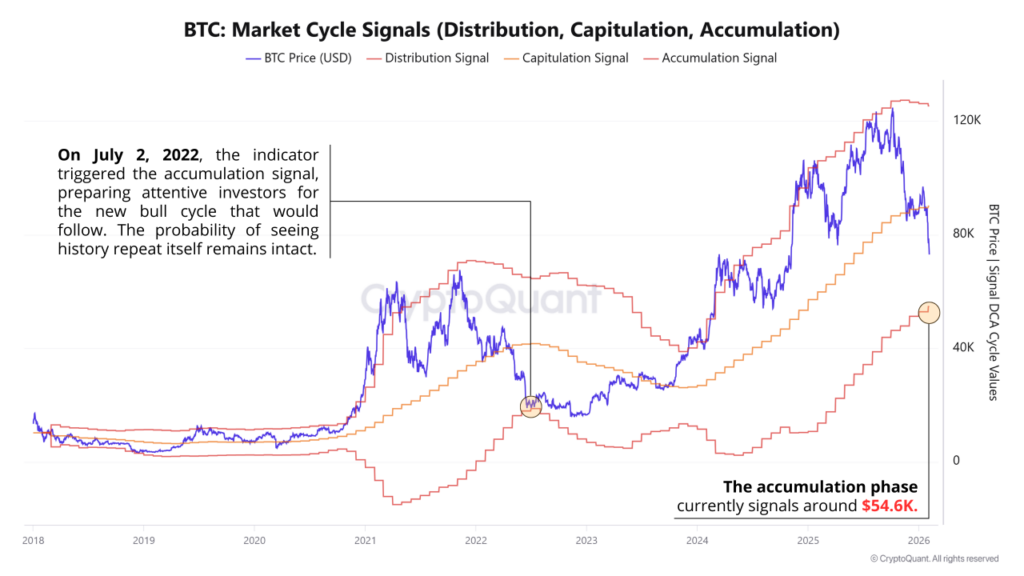

Amidst this pervasive uncertainty, the market’s collective focus has shifted towards identifying the “accumulation zone.” This critical price range signifies where selling pressure typically exhausts, paving the way for “whales” and institutional funds to re-enter the market with renewed strength, thereby signaling the potential conclusion of the downtrend. To navigate this complex landscape, we turn to CryptoQuant’s highly regarded “Market Cycle Signal.” This indicator famously provided an accurate prediction for the bottom of the 2022 bear market and segments Bitcoin’s market cycles into three distinct phases using monthly Bollinger Bands:

- Distribution: Characterized by prices touching the upper Bollinger Band, reflecting a state of market euphoria and overextension.

- Capitulation: Occurs when the price breaks below the 20-month moving average during a decline, seeking robust support at the lower band, indicative of widespread panic and forced selling.

- Accumulation: The phase where the price finds robust support at the lower Bollinger Band and enters a period of consolidation, marking an opportune buying stage for savvy investors.

Currently, Bitcoin’s price is gravitating towards the threshold that historically marks the onset of the accumulation phase. Drawing parallels with the trend observed during the 2022 bear market, the “BTC Market Cycle Signal” suggests that the bottom for this current cycle is projected to be approximately around the $54,600 level. This critical juncture signifies a pivotal transition from the “capitulation” phase towards “accumulation.” Based on a thorough historical analysis of the signal, this $54,600 mark emerges as the primary predicted zone for the bottom of the current bear market.

Disclaimer: This article is intended solely for market information purposes. All content and opinions provided herein are for reference only and do not constitute investment advice. They do not represent the views or positions of BlockTempo. Investors are strongly advised to conduct their own due diligence and make independent investment decisions. The author and BlockTempo shall not be held liable for any direct or indirect losses incurred by investors as a result of their trading activities.