Strategy Leadership Reassures Investors Amid Bitcoin Volatility, Emphasizes Long-Term Vision

As Bitcoin navigates a period of significant price fluctuations, Phong Le, CEO of Strategy—the world’s largest corporate holder of Bitcoin—has stepped forward to reassure investors. Le firmly stated that the company’s balance sheet remains robust and that its financial health would only face a threat under “extreme” and sustained Bitcoin price declines.

Unwavering Financial Resilience: A Deep Dive into Strategy’s Stance

During a pivotal earnings call on Thursday, Phong Le offered a detailed perspective on Strategy’s financial safeguards. He articulated that Bitcoin would need to plummet to approximately $8,000 and maintain that valuation for an extended period of 5 to 6 years before the company would encounter genuine pressure regarding its convertible debt obligations. Le elaborated:

In an extreme adverse scenario, if the price of Bitcoin were to drop by 90% to $8,000, it is at that point our Bitcoin reserves’ value would align with our net debt level, rendering us unable to repay our convertible notes solely with our Bitcoin holdings.

Should such a situation materialize, we would then explore options such as debt restructuring, the issuance of new equity, or pursuing alternative debt financing.

Navigating Q4 Losses and Accounting Realities

Strategy recently reported a substantial net loss of $12.6 billion for the fourth quarter. This figure primarily reflects unrealized losses, or “paper losses,” recognized at market value due to Bitcoin’s price dipping below the company’s average acquisition cost. This accounting treatment is a direct consequence of the mark-to-market methodology Strategy employs for its digital asset holdings.

Andrew Kang, Strategy’s CFO, clarified the situation: “These financial results are unequivocally influenced by Bitcoin’s depreciation towards the close of the quarter, exacerbated by our adherence to a mark-to-market accounting framework.” He underscored, however, that Strategy remains committed to its long-term strategic objectives, steadfastly executing its plans despite prevailing market volatility.

A Steadfast Long-Term Vision Amidst Market Swings

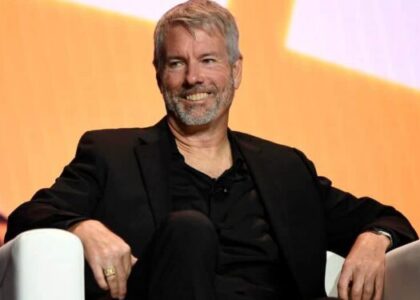

Further reinforcing investor confidence, Michael Saylor, Strategy’s Executive Chairman, reiterated the company’s enduring strategic perspective. He acknowledged the immediate challenges but emphasized the overarching commitment:

Quarterly fluctuations, such as those we are currently experiencing, can indeed be intense and disquieting. However, it is crucial to reiterate that our strategy is fundamentally long-term oriented, specifically designed to withstand short-term price volatility, even amidst extreme market conditions like the present.

Market Headwinds and a Forward-Looking Perspective

The earnings call occurred against a backdrop of significant turbulence in the cryptocurrency market. Bitcoin had seen an 8% decline within the preceding 24 hours, trading around $66,000. Concurrently, Strategy’s stock price experienced a notable downturn, falling over 17% on Thursday to $106.9, extending its six-month decline to 72%.

Despite the prevailing short-term market weakness, Michael Saylor urged investors to pivot their focus back to fundamental indicators, highlighting positive shifts in U.S. regulatory policy as a potential catalyst for future growth and stability.

Disclaimer: This article is provided for market information purposes only. All content and opinions are for reference only and do not constitute investment advice. It does not represent the views or positions of the author or the platform. Investors should exercise their own judgment and make independent trading decisions. The author and platform will not assume any responsibility for direct or indirect losses incurred by investors as a result of their transactions.