By: Nikka / WolfDAO (X: @10xWolfdao)

The Great Convergence: Why Gold, Silver, and Bitcoin Crashed Together in 2026

The financial markets witnessed an unprecedented event in January 2026: a synchronized and dramatic collapse across what were traditionally considered disparate asset classes—gold, silver, and Bitcoin. This simultaneous downturn shattered conventional wisdom, challenging the long-held distinctions between safe-haven assets and speculative instruments. Far from being isolated incidents, these plunges revealed a profound shift in market dynamics: the pricing power of precious metals has decisively moved towards financialized markets, where they, alongside Bitcoin, are now predominantly driven by overarching macroeconomic factors such as U.S. dollar liquidity and real interest rates, and traded by the same institutional capital. Silver, with its inherent high leverage, acted as a volatility amplifier, leading all three assets to trigger cascading liquidations at critical liquidity inflection points. This era marks a stark divergence between the paper and physical markets for precious metals, while Bitcoin’s foundational narrative of decentralization finds itself increasingly diluted by institutional integration, placing significant strain on the broader crypto ecosystem.

An Unprecedented Synchronicity

January 30, 2026, will be etched into financial history. Gold, plummeting over 12% from its all-time high of $5,600 per ounce, recorded its most significant single-day drop in nearly four decades. Silver experienced an even more brutal descent, crashing 27% in a single day, followed by another 6.7% decline the next. Bitcoin, not immune, breached the $75,000 mark, dipping into the $70,000 range over the weekend, and ultimately falling below the critical $60,000 threshold within the week, fueling widespread market panic.

Such a confluence of events defies traditional financial understanding. Gold and silver have long been revered as safe-haven assets—bastions of stability, wealth preservation during crises, and low volatility. Bitcoin, conversely, has been labeled a speculative asset—a high-risk, high-reward instrument. Convention dictates that these assets should react to different stimuli, at different times, and for different reasons.

Yet, market reality has delivered a resounding message: this established classification system is fundamentally broken. At least in terms of pricing logic, precious metals and Bitcoin are increasingly being treated as a single, homogenous asset class.

The core issue isn’t that gold and silver have “lost their safety.” Rather, the very forces dictating their prices have undergone a radical transformation.

The Overlooked Paradigm Shift

The journey to understanding this shift begins with a crucial insight: the prices of gold and silver are no longer primarily dictated by traditional “safe-haven demand.”

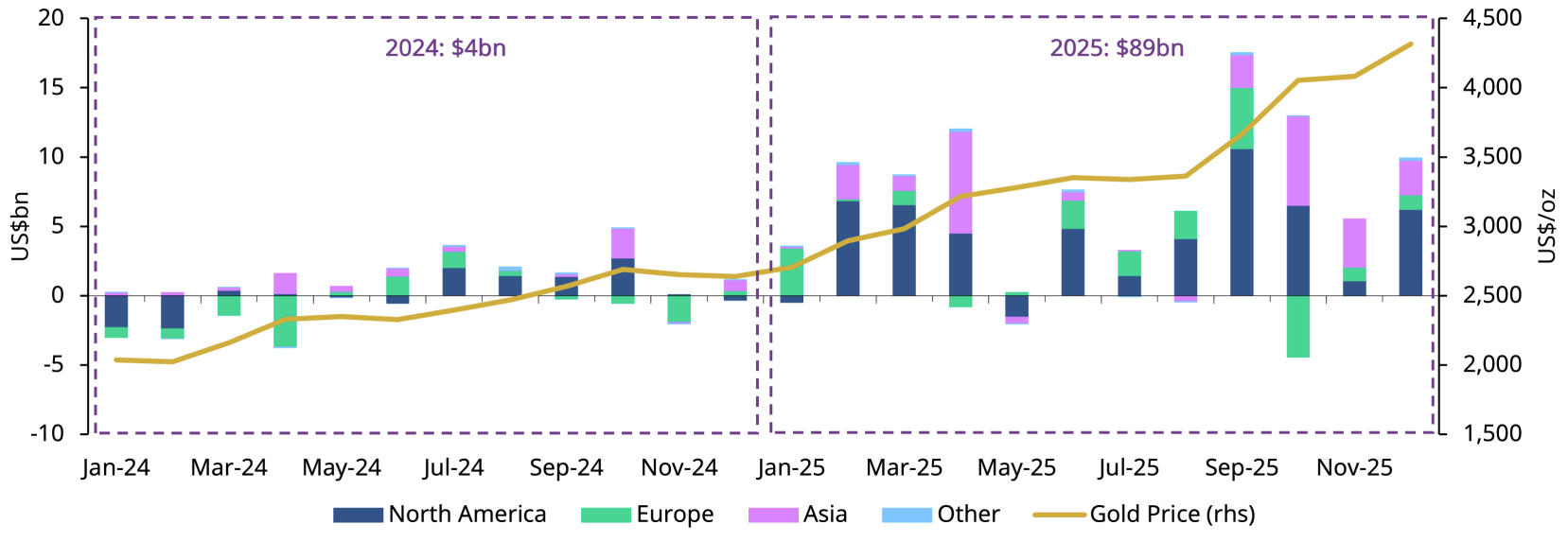

Source: gold.org

In 2025, global Gold ETF inflows reached an unprecedented $89 billion, effectively doubling assets under management to $559 billion. This surge propelled gold’s share of global financial assets from its 2010 nadir to a notable 2.8% by Q3 2025.

This 2.8% figure is more than just a statistic; it signifies a profound structural metamorphosis: the pricing authority for precious metals has migrated from physical demand to highly financialized markets.

Today, the vast majority of marginal price movements in gold and silver originate from a specific cohort of global macroeconomic capital: hedge funds, Commodity Trading Advisors (CTAs), systematic trend-following strategies, and institutional accounts engaging in cross-market allocations. These sophisticated players are not driven by the intrinsic “safe-haven” qualities of gold; their decisions hinge on three pivotal variables:

- U.S. Dollar Liquidity

- Real Interest Rates

- The Velocity of Shifting Risk Appetite

Research from JP Morgan substantiates this, indicating that fluctuations in U.S. Treasury yields can account for approximately 70% of quarterly gold price volatility. This underscores gold’s profound integration into macro-driven, systematic pricing models. When gold prices move, the impetus is no longer the seasonal demand for Indian weddings or the buying fervor of Chinese consumers, but rather the complex quantitative models and algorithmic trading systems of Wall Street.

The Same Macroeconomic Lever

This paradigm perfectly explains the recent synchronized, sharp fluctuations observed across gold, silver, and Bitcoin.

All three assets are concurrently exposed to the same overarching macroeconomic force: the dramatic and volatile shifts in global liquidity expectations.

When market sentiment leans towards anticipated interest rate cuts, a weakening U.S. dollar, and the dilution of monetary purchasing power, these three asset classes are acquired in unison. This isn’t because they are inherently “safe havens,” but because, within sophisticated quantitative models, they are categorized as “non-sovereign scarce assets.”

Conversely, when inflation proves persistent, interest rate expectations rebound, the U.S. dollar strengthens, or risk models trigger deleveraging events, these same assets are simultaneously offloaded. The rationale isn’t that they are suddenly “high risk,” but rather that they reside within the same institutional risk basket.

Therefore, price volatility is not a reflection of “changed asset attributes,” but rather the consequence of a homogenization among the participants and methodologies driving their pricing.

The events of January 30th serve as a compelling illustration. The market’s interpretation of a hawkish signal—following the nomination of Kevin Warsh as Federal Reserve Chairman—triggered a rebound in the U.S. dollar, immediately followed by:

- Gold plunging from $5,600 to below $4,900

- Silver plummeting from $120 to $75

- Bitcoin sliding from $88,000 to $81,000

Three distinct assets, at the exact same moment, moving in the same direction with identical ferocity. This is no mere coincidence; it is direct evidence that they are all priced within the framework of a unified trading system.

Silver: The Volatility Amplifier

Silver’s performance during this period is particularly telling, acting as a magnified reflection of the broader market trends.

Unlike gold, silver possesses a dual nature, serving as both a precious metal and an industrial commodity. This characteristic, combined with inherently higher leverage and more fragile liquidity, makes it a potent volatility amplifier. By late 2025, silver’s 30-day actual volatility had surged past 50%, while Bitcoin’s compressed into the 40% range—a significant and counterintuitive reversal.

The recent rapid ascent and subsequent sharp decline in silver prices were not driven by short-term structural shifts in its fundamentals, but rather by the concentrated entry and exit of large macroeconomic long positions. In January 2026, the Chicago Mercantile Exchange (CME) raised silver futures margin requirements from historical lows to 15-16.5%, effectively drawing a close to an era of low-cost “paper silver” speculation.

As prices fell, highly leveraged speculators, unable to meet these elevated margin requirements, were forced into liquidation. This triggered a cascading effect: further price declines leading to the mandatory closure of even more positions. This “margin trap” bears a striking resemblance to the strategy employed in 1980, which, by increasing margin requirements, successfully broke the Hunt Brothers’ infamous silver hoarding attempt.

This price action mirrors almost identically the behavior of Bitcoin around critical liquidity turning points, underscoring their shared susceptibility to leveraged unwinds.

The Paradox Unveiled: Safe Havens in Crisis

This new market reality sheds light on a seemingly contradictory phenomenon: assets traditionally considered safe havens plummeting precisely when systemic risk materializes.

The explanation is not that these assets have suddenly lost their intrinsic safe-haven properties. Instead, when systemic risk escalates to a certain threshold, the market’s immediate priority shifts from “long-term value preservation logic” to the urgent need for “cash” and “liquidity.”

During periods of surging volatility, liquidity often evaporates. Market makers reduce their quoted sizes, bid-ask spreads widen dramatically, and price gaps become common. In such an environment, all assets that are highly financialized, readily convertible to cash, and carry significant leverage exposure are simultaneously sold off—regardless of whether they are called gold, silver, or Bitcoin.

As Ole Hansen of Saxo Bank aptly states, “Volatility reinforces itself.” When prices experience violent fluctuations, the underlying market structure takes precedence over everything else. Within this self-reinforcing cycle, the “intrinsic attributes” of an asset become largely irrelevant.

A Tale of Two Markets: Paper vs. Physical

However, this financialized narrative doesn’t tell the entire story.

While the paper market experienced a dramatic collapse, the physical market for precious metals displayed contradictory signals. Following silver’s sharp decline, physical silver premiums in Shanghai and Dubai surged to an astonishing $20 above Western spot prices. Major silver miner Fresnillo revised its 2026 production guidance downwards to 42-46.5 million ounces, while industrial demand (from sectors like solar energy, electric vehicles, and semiconductors) continued its robust trajectory.

This stark divergence highlights a critical dichotomy:

- The Paper Market: Highly financialized, characterized by extreme volatility, and primarily driven by macroeconomic funds.

- The Physical Market: Defined by supply constraints, robust underlying demand, and relative stability.

A similar bifurcation is evident in the gold market. Central banks globally are projected to purchase 750-950 tons of gold in 2026, marking the third consecutive year of acquisitions exceeding 1,000 tons. The rationale for these “traditional” buyers—predominantly emerging market central banks—remains consistent: de-dollarization, reserve diversification, and long-term value storage. Crucially, these entities do not engage in short-term trading, do not employ leverage, and are therefore immune to margin call-induced liquidations.

This creates a distinctive two-tiered market structure:

- The Long-Term Floor: Central bank buying provides a continuous demand base, effectively setting a price floor for precious metals.

- Short-Term Volatility: Institutional investors and algorithmic trading systems dominate marginal pricing, generating periods of extreme volatility.

The Erosion of Crypto Narratives

A more profound consequence of these shifts is the escalating challenge to the foundational narrative system upon which the crypto market has long relied.

The “decentralized safe haven” narrative, once a cornerstone of Bitcoin’s appeal, is being increasingly diluted by its institutionalization. Bitcoin’s significant drops during periods of thin weekend liquidity are largely attributable to liquidations within leveraged trading and futures markets—mechanisms inherently tied to centralized finance. The purists who staunchly uphold “not your keys, not your coins” and genuinely control their private keys have, in terms of pricing power, been progressively marginalized.

The ramifications of this transformation extend far beyond Bitcoin, permeating the entire crypto ecosystem.

Altcoins Face Intensified Pressure: If even Bitcoin loses its unique value proposition, becoming just another “macro liquidity trading tool,” what fate awaits altcoins with weaker narratives and more precarious fundamentals? When institutional capital considers allocating to crypto assets, will it opt for the “tamed” and more liquid BTC, or will it venture into the higher-risk territories of Ethereum, Solana, or other public blockchains?

Ethereum’s concurrent 4% decline to $2,660, performing even weaker than Bitcoin, suggests a harsh reality: under prevailing macro risk models, capital tends to consolidate into “the crypto market’s gold” (BTC), while abandoning assets perceived as “the crypto market’s silver or copper.”

The Paradox of DeFi: Decentralized finance (DeFi) was once heralded as crypto’s most revolutionary innovation, promising trustless lending, trading, and other financial services free from traditional intermediaries. However, if the pricing of core underlying assets (BTC, ETH) is now overwhelmingly dictated by traditional financial markets, how much substantive “decentralization” remains within DeFi protocols?

One can certainly execute trades via decentralized protocols, but if the true price discovery occurs on Wall Street trading desks, Chicago’s futures markets, and within the servers running quantitative models, then this decentralization is, at best, merely superficial.

(This content is excerpted and reprinted with authorization from our partner PANews. Original Link | Source: WolfDAO)

Disclaimer: This article is provided for market information purposes only. All content and views are for reference only and do not constitute investment advice, nor do they represent the opinions and positions of BlockBeats. Investors should make their own decisions and trades. The author and BlockBeats will not bear any responsibility for any direct or indirect losses incurred by investors’ transactions.