Following a week of intense volatility, Bitcoin (BTC) has tentatively stabilized near the $70,000 mark, establishing short-term support around $68,000 after rebounding from a low of $60,000. Ethereum (ETH) has also managed to reclaim the $2,000 threshold. However, this recovery appears fragile, as investor sentiment remains overwhelmingly negative in the wake of recent market turbulence. The crypto market stands poised for a potential retest of the critical $60,000 support level should any adverse news emerge. All eyes will therefore be on the upcoming US non-farm payrolls and unemployment figures, scheduled for release on Wednesday and Thursday, given that last week’s downturn was partly triggered by preliminary employment data.

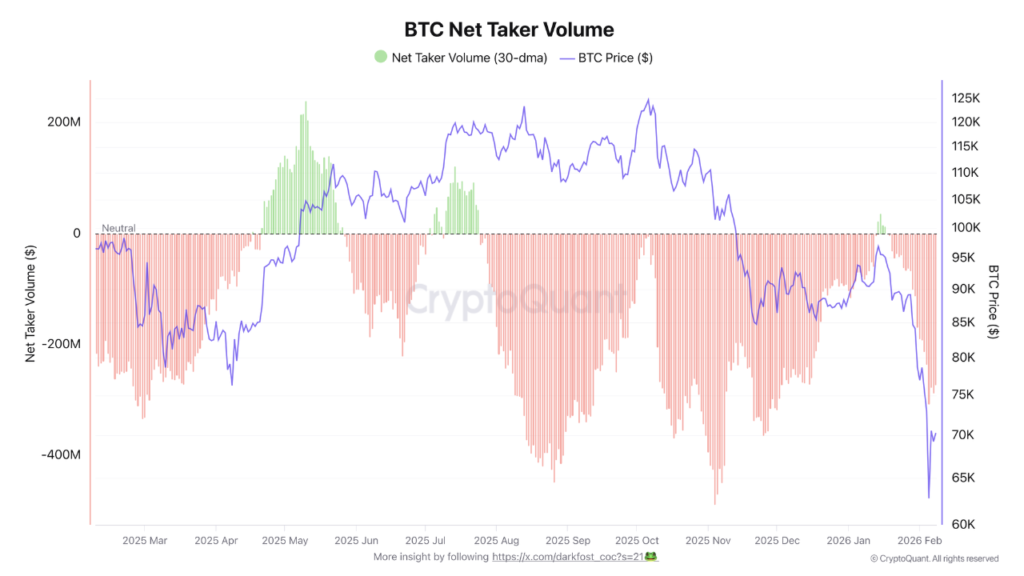

Beneath this surface-level stabilization, Bitcoin continues to grapple with significant selling pressure within the derivatives market. A deeper analysis reveals that the net taker volume, when averaged monthly, has once again plunged into negative territory. While buyers briefly asserted some control between November and January, contributing approximately $36 million, sellers have now decisively regained dominance. Today’s net taker volume underscores this shift, registering a substantial -$272 million. This negative trend is further corroborated by data from major exchanges like Binance, where the taker buy/sell ratio, a key indicator of market sentiment, has declined from 1 to 0.97 over the same period, signaling a clear tilt towards selling activity.

What is particularly concerning is the accelerating pace of this selling pressure, which necessitates a robust surge in spot demand to counteract its effects. With futures trading volume continuing to overshadow spot activity and ETF inflows, derivatives markets are dictating overall price movements. As investors navigate the current precarious market environment, closely monitoring crucial macroeconomic data points—including non-farm payrolls, unemployment rates, and the Consumer Price Index (CPI)—the crypto market faces considerable headwinds this week. The recent rebound, while welcome, remains inherently fragile, warranting continued vigilance from market participants.

Disclaimer: This article is intended solely for market information purposes. All content and views are provided for reference only and do not constitute investment advice. They do not represent the views or positions of BlockTempo. Investors should make their own informed decisions and execute trades at their own discretion. The author and BlockTempo shall not be held liable for any direct or indirect losses incurred by investors’ transactions.