Ethena’s Unprecedented Capital Outflow: Is USDe Still Secure Amidst Market Turmoil?

By Azuma, Odaily Planet Daily

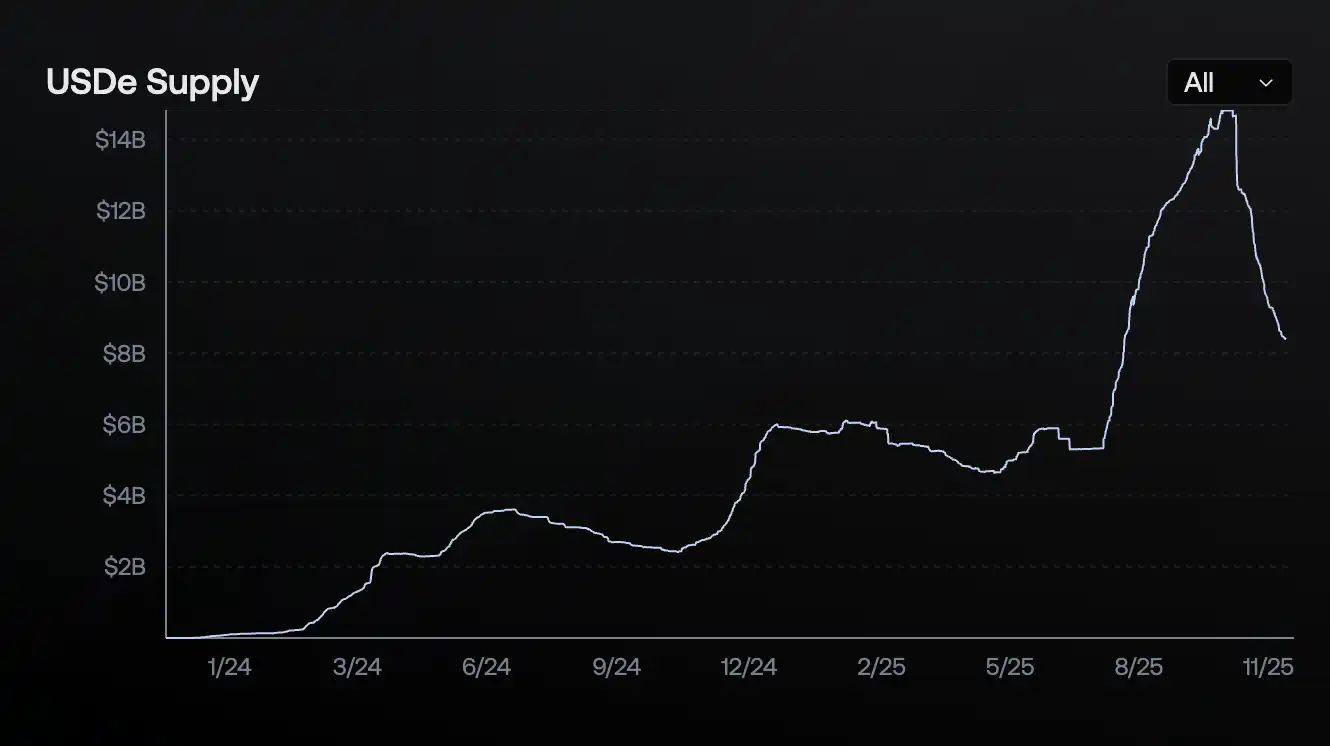

Ethena is currently navigating its most substantial period of capital outflow since its inception. On-chain data reveals a significant contraction in the supply of USDe, Ethena’s flagship stablecoin. Its circulating supply has receded to 8.395 billion, marking a staggering reduction of approximately 6.5 billion from its early October peak of nearly 14.8 billion. While not a complete halving, this decline is undeniably remarkable.

This outflow coincides with a tumultuous period for DeFi security, highlighted by the recent implosions of Stream Finance (xUSD) and Stable Labs (USDX) – two interest-bearing stablecoins that, much like Ethena, purported to employ a Delta-neutral model. Whispers suggest that their downfall may have been triggered by their neutral balances being forcibly disrupted by CEX’s (centralized exchange) ADL (Auto-Deleveraging) during the market’s brutal October 11 downturn. Adding to the unease is the lingering memory of USDe’s brief de-pegging incident on Binance around the same time. These events have collectively fueled a widespread wave of FUD (Fear, Uncertainty, and Doubt) surrounding Ethena.

Is USDe Still Safe? A Deep Dive into Ethena’s Resilience

Given Ethena’s considerable market footprint, any significant mishap could potentially trigger a black swan event on par with the Terra collapse. This naturally begs the crucial question: Is Ethena truly facing systemic issues? Is the capital outflow merely a flight to safety? And can investors confidently continue deploying funds into USDe and its associated strategies?

My personal assessment leans towards the following conclusion: Ethena’s core strategy appears to be functioning as intended. While the broader DeFi risk aversion has undoubtedly contributed to the capital exodus, it doesn’t represent the primary driver. USDe’s current security posture remains relatively robust, though I advise caution against the use of leveraged looping strategies.

My confidence in Ethena’s operational integrity stems from two key factors:

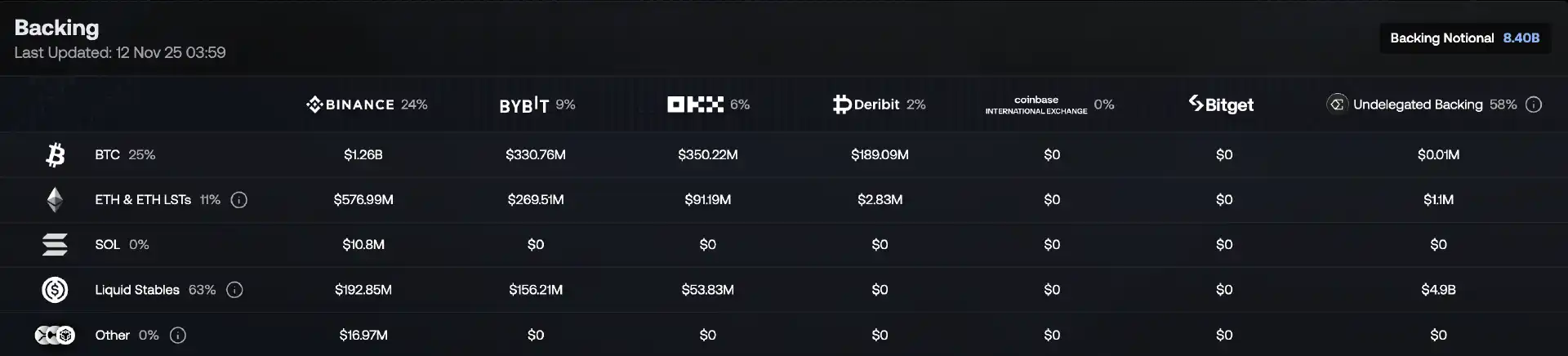

- Unparalleled Transparency: In stark contrast to many interest-bearing stablecoins that often lack clear disclosures regarding position structures, leverage multiples, hedging exchanges, or liquidation risk parameters, Ethena stands as an industry benchmark for transparency. Its official website provides direct, comprehensive access to critical information, including reserve details and proof, position distribution and allocation, and real-time earnings data.

- Robust ADL Mitigation: The aforementioned concern regarding ADL-induced neutral strategy imbalances is often overstated for Ethena. While rumors of ADL exemption agreements with certain exchanges persist (and remain unconfirmed), Ethena is inherently less susceptible to ADL impact even without such clauses. Its publicly disclosed strategy primarily utilizes BTC, ETH, and SOL as hedging assets. These major cryptocurrencies experienced comparatively minor fluctuations during the October 11 crash, and their respective counterparty capacities are significantly larger. ADL events are typically more prevalent in the volatile altcoin market, where liquidity is thinner and counterparty capacity is constrained. This explains why recent collapses have largely impacted less transparent protocols, whose strategies may have been overly aggressive or deviated significantly from a truly neutral stance.

The primary drivers behind Ethena’s recent capital outflow can also be distilled into two points:

- Shrinking Arbitrage Opportunities: As market sentiment cooled, particularly after October 11, the basis arbitrage opportunities between spot and futures markets diminished. This directly led to a reduction in both the protocol’s yield and sUSDe’s annualized yield (which, at the time of writing, had fallen to 4.64%). Consequently, USDe’s yield no longer offered a significant advantage over the base rates of mainstream lending platforms like Aave and Spark, prompting some capital to seek more attractive interest-bearing avenues.

- Heightened Risk Awareness and Yield Compression: Increased market awareness of the risks associated with leveraged looping, exacerbated by declining yields both off-chain (due to reduced CEX subsidies) and on-chain, led to a substantial unwinding of these strategies and subsequent fund withdrawals.

Based on this analysis, we conclude that Ethena and USDe continue to operate in a relatively stable state. While the recent capital outflow has, to some extent, exceeded expectations due to extreme market conditions and security incidents, its fundamental cause remains the reduced attractiveness stemming from shrinking arbitrage opportunities in a subdued market. This dynamic is intrinsically linked to Ethena’s design philosophy, which naturally experiences capital fluctuations.

The More Formidable Challenge: Scalability

Beyond the cyclical capital movements, a more profound challenge confronts Ethena: the scalability of its Delta-neutral model, which fundamentally relies on the perpetual futures market. This model appears to be approaching a critical bottleneck.

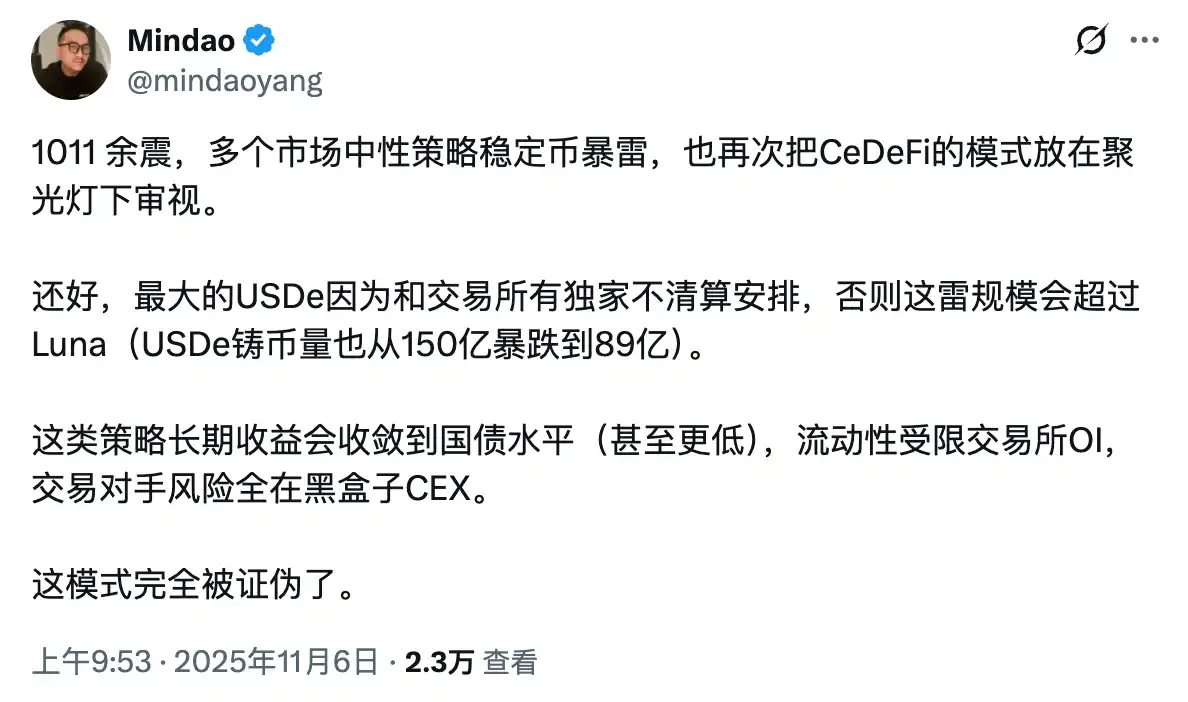

On November 6, DeFi luminary Mindao offered a pointed critique following recent neutral strategy stablecoin failures: “The long-term returns of such strategies will inevitably converge to (or even fall below) treasury bond levels. Liquidity is inherently constrained by exchange Open Interest (OI), and counterparty risk is entirely encapsulated within the opaque ‘black box’ of centralized exchanges. This model has been thoroughly disproven… it simply cannot scale, ultimately relegating these assets to niche status, incapable of competing effectively.”

This predicament can be likened to “The Truman Show.” Ethena initially thrived within a confined ecosystem, but this “small world” is inherently limited by the perpetual futures market’s position sizes, as well as the liquidity and infrastructure capabilities of trading platforms. In stark contrast, the giants Ethena aspires to challenge, such as USDT and USDC, operate within an unrestricted, vast external environment. This fundamental disparity in growth environments presents Ethena with its most significant, inherent challenge.

(The above content is an authorized excerpt and reproduction from our partner PANews. Original article link | Source: Odaily Planet Daily)

Disclaimer: This article is provided for market information purposes only. All content and views are for reference and informational purposes and do not constitute investment advice. They do not represent the opinions or positions of BlockBeats. Investors should exercise their own judgment and discretion in making investment decisions and conducting trades. The author and BlockBeats shall not be held liable for any direct or indirect losses incurred by investors as a result of their trading activities.