Cryptocurrency Market Faces $2 Billion Outflow Amidst Uncertainty and Whale Selling

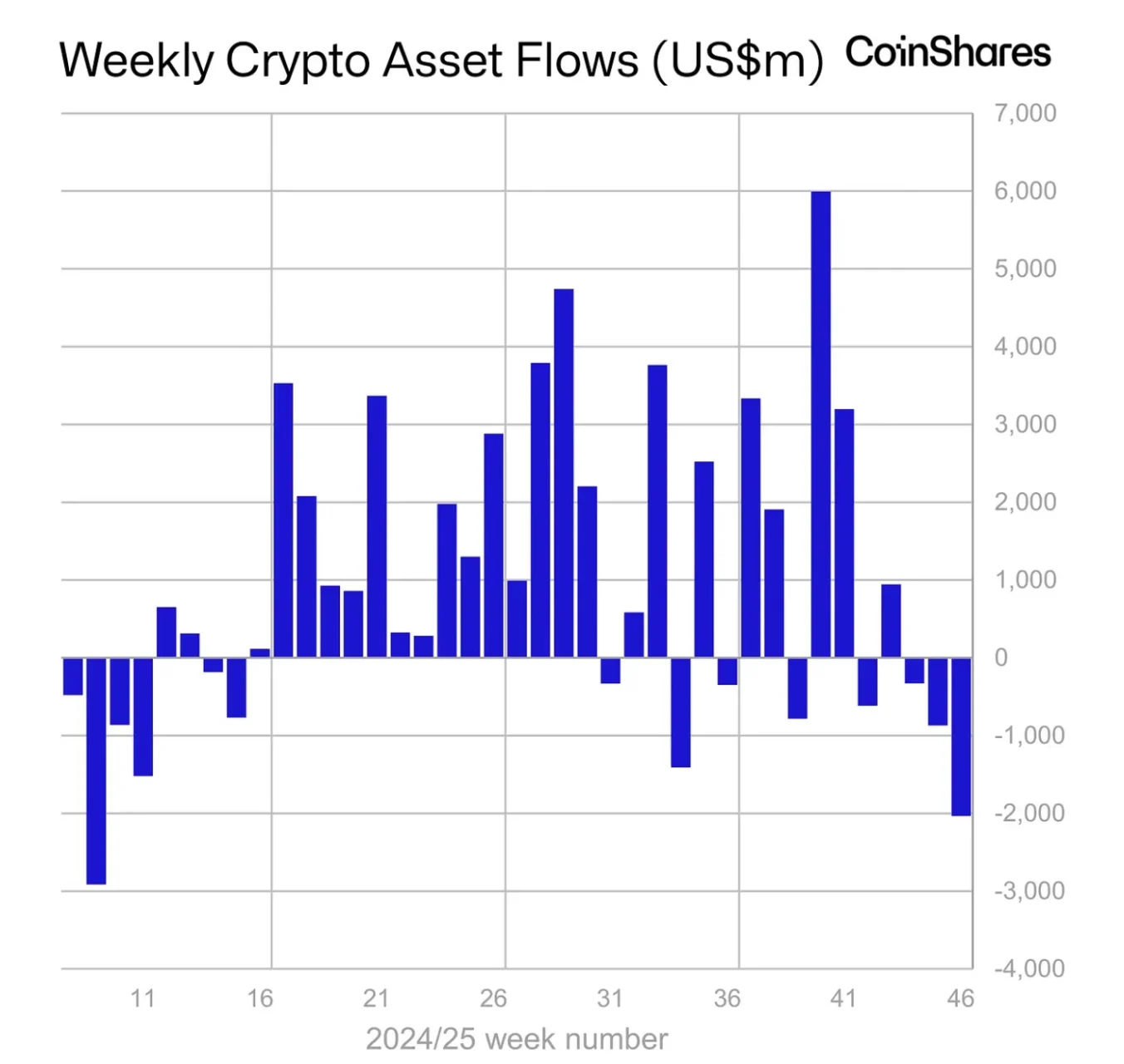

A recent report from digital asset management firm CoinShares reveals a significant downturn in the global cryptocurrency market, with investment products recording a substantial $2 billion in net outflows last week. This marks the largest withdrawal since February of this year, driven by prevailing monetary policy uncertainty and considerable selling pressure from large institutional investors, often referred to as “whales.”

This latest exodus extends a three-week streak of net outflows from cryptocurrency funds, accumulating a total loss of $3.2 billion. Consequently, the overall assets under management (AUM) have plummeted from $264 billion at the beginning of October to $191 billion, representing a nearly 30% contraction.

James Butterfill, Head of Research at CoinShares, highlighted the dual headwinds impacting market sentiment. He noted that the market is simultaneously contending with “waning interest rate cut expectations” and persistent supply pressure from major whale sell-offs. These combined factors have consistently eroded investor confidence, perpetuating a negative trend that began earlier this month.

Geographical Shifts: US Dominates Outflows, Germany Seizes Opportunity

Last week’s capital outflow was predominantly concentrated in the United States market, accounting for a staggering $1.97 billion – or 97% – of the global total. Switzerland and Hong Kong also experienced significant net outflows, recording $39.9 million and $12.3 million, respectively.

In stark contrast, German investors demonstrated a strategic “buy the dip” approach, injecting $13.2 million into cryptocurrency ETFs last week. The German market has a historical tendency to accumulate assets during price pullbacks, a characteristic that was once again evident in the recent market activity.

Despite the resolution of the US government shutdown crisis, broader market pressures persist. As previously reported by Blockcast, Bitcoin briefly dipped to $93,000 today (the 17th), reaching a nearly seven-month low. This underscores the cryptocurrency market’s continued vulnerability to global liquidity tightening and large-scale whale selling.

Asset-Specific Performance: Broad-Based Withdrawals

In terms of asset-specific capital flows, Bitcoin ETPs bore the brunt of the outflows, registering $1.38 billion in net withdrawals. This marks the third consecutive week of capital retreat for Bitcoin ETPs, representing approximately 2% of their total managed assets. Ethereum ETPs also saw substantial outflows of $689 million, accounting for about 4% of their total assets. Solana (SOL) and Ripple (XRP) experienced smaller, but notable, withdrawals of $8.3 million and $15.5 million, respectively.

Disclaimer: This article is for market information purposes only. All content and views are for reference only, do not constitute investment advice, and do not represent the views and positions of Blockcast. Investors should make their own decisions and trades. The author and Blockcast will not bear any responsibility for direct or indirect losses incurred by investors’ transactions.