ECB Issues Stern Warning: Stablecoins Pose Significant Risk to Global Financial Stability

The European Central Bank (ECB) has issued a stark warning regarding stablecoins, unequivocally stating that these digital assets present a substantial “risk to financial stability.” In a recently published research article, the ECB highlighted concerns that stablecoins are inherently prone to de-pegging from their reference currencies and could trigger adverse effects across traditional financial markets in both the United States and Europe.

The ECB’s analysis underscores that stablecoins’ “inherent vulnerabilities” and their “high interconnectedness with the traditional financial system” are primary drivers of potential financial instability. The report specifically cautions that a loss of investor confidence in a stablecoin issuer’s ability to redeem assets could precipitate a de-pegging event or a crisis akin to a traditional bank run.

Even with major stablecoin issuers like Tether (USDT) and Circle (USDC) holding significant portfolios of US Treasury bonds, the ECB suggests that the risk of a run remains potent. Experts echo this concern, warning that a widespread stablecoin run would compel issuers to liquidate their US Treasury holdings to meet redemption demands. Such a sell-off could profoundly destabilize the colossal $25 trillion US Treasury market, sending ripples throughout the global financial system.

The ECB further delved into the contentious issue of interest-bearing stablecoins. While the European Union’s landmark Markets in Crypto-Assets (MiCA) regulation has already prohibited these products, the ECB warns they could still lead to “banking disintermediation,” where funds bypass traditional banking channels.

Echoing these sentiments, US banking institutions have also urged their government to implement similar prohibitions. They fear that interest-bearing stablecoins directly threaten their core deposit businesses, potentially leading to solvency issues and even replicating the financial fragilities observed during the 2008 financial crisis. Consequently, the US banking sector advocates for strict restrictive measures.

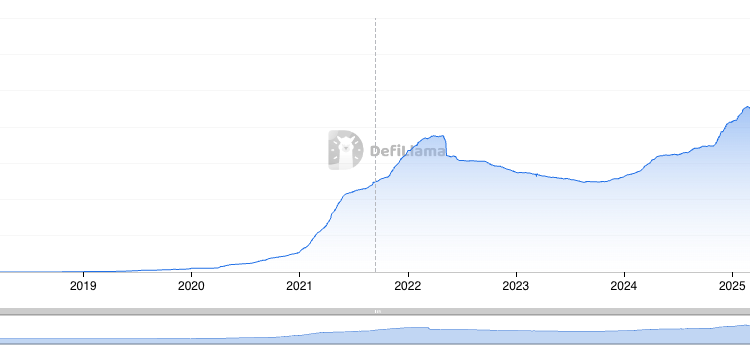

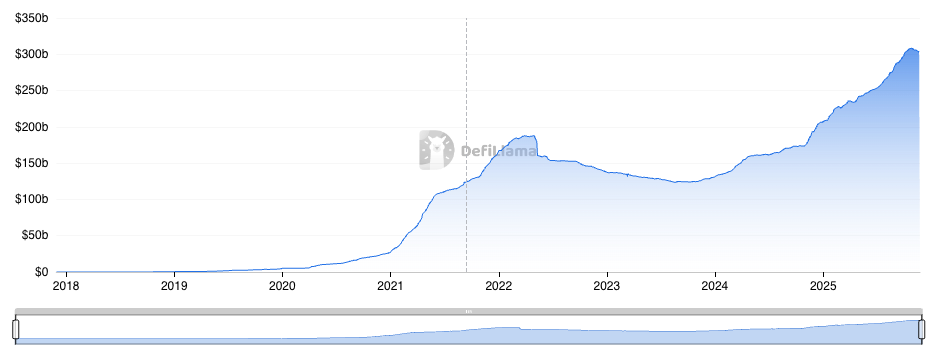

Despite these warnings, the sheer scale of the stablecoin market highlights its critical role. According to DeFiLlama data, the global stablecoin market surpassed $300 billion by early October. USDT and USDC collectively dominate, accounting for over 85% of this market. These two stablecoins have become indispensable sources of liquidity, serving as the lifeblood for the decentralized finance (DeFi) ecosystem and cryptocurrency exchanges worldwide.

Remarkably, while Europe and the traditional banking industry are united in their warnings about stablecoins’ potential impact on financial systems, the United States has charted a distinctly different policy course in recent months. Driven by the ambition to become a “global crypto capital,” particularly under the Trump administration’s influence, the US has shown a more accommodating stance towards digital assets.

However, this doesn’t mean a complete lack of regulation. The US passed the “GENIUS Act” in July this year, designed to bolster the oversight of “circulating stablecoins.” This legislation aims to mitigate risks associated with DeFi-dominated stablecoins and is anticipated to exert pressure on interest-bearing stablecoins, suggesting a nuanced approach to managing innovation while addressing potential systemic vulnerabilities.

Disclaimer: This article is for market information purposes only. All content and views are for reference only and do not constitute investment advice. They do not represent the views or positions of Blockcast. Investors should make their own decisions and trades. The author and Blockcast will not be held responsible for any direct or indirect losses incurred by investors’ transactions.