Ethereum’s Ambitious Trajectory: Tom Lee’s $7,000 Target Amidst Market Skepticism

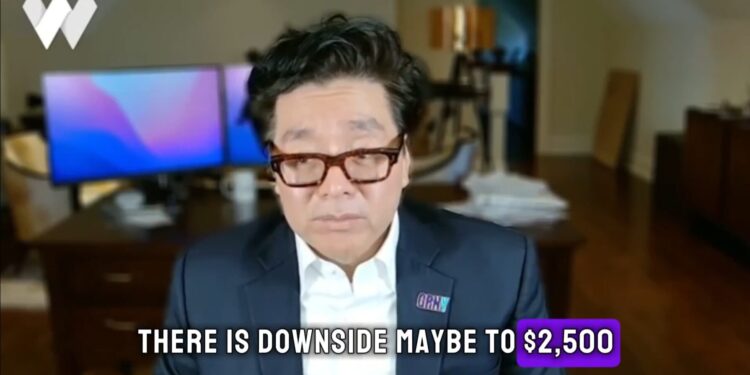

A prominent figure in the cryptocurrency space, Tom Lee, a managing partner at Fundstrat Global Advisors and a well-known Bitcoin bull, recently offered a compelling outlook on Ethereum (ETH). In a recent media interview, Lee projected a potential short-term dip for ETH to $2,500, but followed by a significant rebound to at least $7,000 by January 2026. This bold forecast has ignited discussions across the crypto community, prompting a closer look at the factors underpinning such an optimistic prediction.

The Bullish Case: A Super Cycle on the Horizon?

Lee’s confidence in Ethereum’s long-term potential is rooted in the belief that any immediate downturn would be merely a blip in a larger, impending “super cycle.” He articulated his perspective:

“Yes, I believe there’s still short-term downside, potentially to $2,500, but this decline is negligible compared to the super cycle currently brewing. We anticipate Ethereum could reach $7,000 – $9,000 by the end of January 2026, representing a massive rebound. This pattern is, in fact, typical of fourth-quarter market movements.”

A Reality Check: Historical Data and Narrative Gaps

While Lee’s bullish sentiment is noteworthy, a closer examination of historical data introduces a layer of skepticism regarding such an aggressive January target. Ethereum’s performance in January has shown a declining trend since 2022. Although 2023 saw a respectable 32% surge during the NFT craze, it paled in comparison to the explosive gains witnessed during the 2021 DeFi boom.

Considering ETH’s current trading price of approximately $2,900, even if it were to replicate the impressive 78% January growth of 2021, the price would only reach around $5,100. This figure falls significantly short of Lee’s projected $7,000-$9,000 range. The critical question then arises: what unprecedented factors or compelling new narratives could propel Ethereum to such unprecedented heights in the near future? Currently, such catalysts remain elusive.

Macroeconomic Influences and Future Catalysts

The broader cryptocurrency market, including Ethereum, appears to be grappling with a “narrative exhaustion.” With Bitcoin already achieving a level of recognition from major global leaders, including the US President, the market struggles to identify fresh, impactful narratives that could ignite another parabolic run. It could be argued that much of the “good news” has already been priced in.

Presently, a significant driver for the crypto market’s upward momentum is its correlation with the performance of the US stock market. Looking ahead, potential catalysts for a renewed surge in digital assets largely hinge on macroeconomic developments. The most anticipated events include the Federal Reserve’s potential interest rate cuts in December, ideally coupled with an announcement of quantitative easing policies for 2026. Such measures, designed to inject liquidity into the market, would be crucial for stimulating the crypto sector and pushing it towards new all-time highs. Without these significant macroeconomic tailwinds, sustaining a monumental rally remains a formidable challenge.

Disclaimer: This article is intended solely for market information purposes. All content and views expressed herein are for reference only and do not constitute investment advice. They do not represent the opinions or positions of BlockTempo. Investors are advised to make their own independent decisions and conduct their own transactions. The author and BlockTempo shall not be held responsible for any direct or indirect losses incurred by investors as a result of their trading activities.